|

| By Gavin Magor |

Unexpected upsets. Buzzer beaters. Cinderella stories … it’s all what makes March Madness great and highly entertaining.

It’s often called the “Big Dance” … and this year nearly every game has been exciting.

Over the past few weeks, 68 elite NCAA division one basketball teams have played highly entertaining — and usually very close — games in the annual March Madness tournament.

This past weekend was the Final Four. And tonight, the two last standing teams are competing in the National Championship game.

And as a fan of the tournament (I know I’m not alone!), it got me thinking … who are the four top performers in the Weiss Stock Ratings over the past year for our current “Buy”-rated stocks?

For starters, to even have a “Buy” Weiss Rating, a stock needs to have a very impressive track record with limited amounts of risk. Certainly, past performance is just an indication, but we view our “Buy” ratings to deliver strong performance relative to risk in the future.

And all of this information is available on our Weiss Stock Ratings website.

Past Year of Success for These “Buy”-Rated Names

Looking at the track record of our “Buy”-rated names is very important to do.

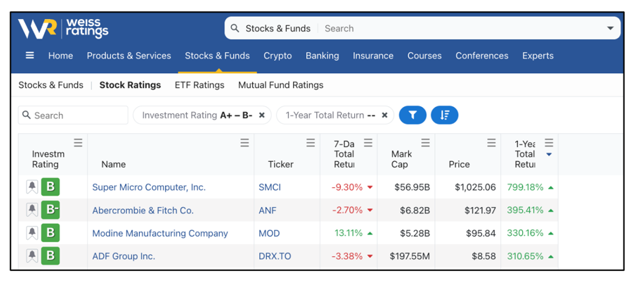

After simply filtering for Investment Rating of “A” through “B-” and one-year Total Return, here’s what populated for the top four performers:

You may be surprised to not see Nvidia (NVDA) on this list because we do have it rated as a “Buy.” NVDA is 10th on the list, with a 240% return as of this writing.

Super Micro Computer (SMCI) is the top performer with a blistering 799% return over the past year, with 222% of that return coming since early January.

The company is one of the largest producers of high-performance servers. And it’s benefitting highly from the AI-market craze.

The other three names, Abercrombie & Fitch (ANF), Modine Manufacturing (MOD) and ADF Group (DRX.TO) are all up well over 300%. I encourage you to take a further look at them.

Getting Technical with the Weiss “Buy” Ratings

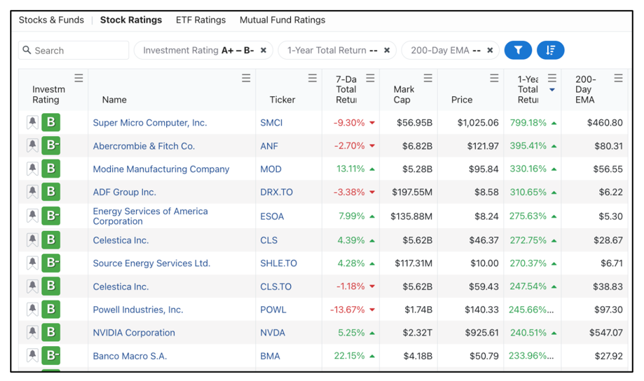

Another amazing feature of our Weiss Stock Ratings page is our “200 Day Exponential Moving Average” feature.

Using the same parameters as above, I included the 200-Day EMA tab under “Exponential Moving Averages.”

Here’s what populated:

Exponential moving average is a type of technical indicator that tells investors where the price of a stock has been over a period of time.

In the above example, I used 200 days. Other popular time periods are 20- and 50-day moving averages.

It helps traders and analysts see when a stock is overbought or oversold.

Unsurprisingly, the above stocks are trading above their 200-day moving averages, but we still view them as “Buys.”

Always Check Past Ratings

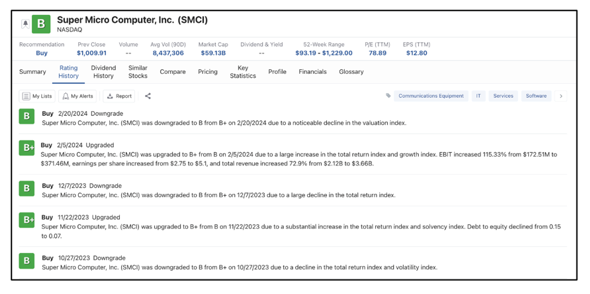

Another important aspect of the Weiss Ratings is to check past ratings for each name. For example, for SMCI, we can see that earnings played a role in several of its last upgrades:

On Feb. 5, shortly after SMCI’s latest earnings report was released on Jan. 29, we further upgraded the stock as its EBIT, EPS and total revenue increased.

Here at Weiss Ratings, we do the hard work and the judging to make it easier for investors.

Whilst your bracket for March Madness may be busted, we’re doing all we can to make sure your portfolio is anything but.

There is certainly plenty of “madness” in the markets. But if you’re using the Weiss Ratings, you’ll have better chances of keeping your portfolio out of foul trouble.

Cheers!

Gavin

P.S. You may not have known that names like Abercrombie & Fitch and Modine Manufacturing would be among the top four performers of late. But that’s often the case … relatively unknown or out-of-the-mainstream companies often do lead in returns.

The same is certainly true in cryptocurrencies. In fact, our expert crypto analyst Juan Villaverde just recommended three that could lead that market over the next year. Check it out here.