|

| By Gavin Magor |

Word of warning: Banks are playing with fire, and your hard-earned money is at risk of going up in flames.

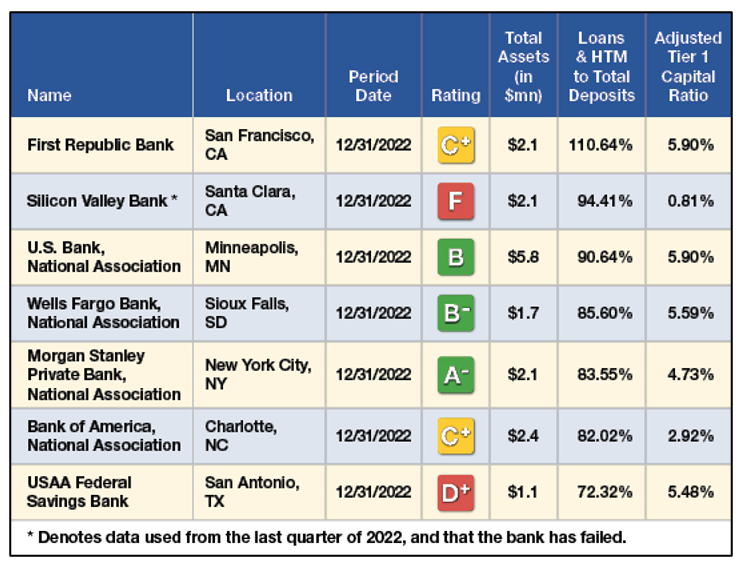

Not all banks are offenders, of course. But it could be problematic if yours is among the seven Weiss Ratings is raising concerns about.

Let’s just say we’ve identified the group as not being as fiscally prudent with deposits as they should or could be, putting assets at higher risk.

That’s because some banks act more like investment firms than custodians of funds and do so with little oversight and monitoring.

Sounds to me like they’re putting themselves first and the safety of customers’ money second. Should be the other way around, don’t you think?

Click here to see full-sized image.

Maybe you aren’t even aware that when you make deposits to a bank, the cash doesn’t just sit in a physical vault with armed guards protecting it. It’s either loaned out, invested in securities or added to reserves.

As we learned from Silicon Valley Bank’s collapse, owning a high ratio of utilized (invested or loaned out) bank deposits to total bank deposits is a …

Big Red Flag

An even bigger red flag is when a bank also has a high ratio of total risk-weighted assets to total capital and disclosed reserves.

Also referred to as the tier 1 capital ratio, this is one of the most used and recognized ratios introduced and used by regulators (minimum of 6% is required).

At Weiss Ratings, though, we want to be more prudent when using the ratio. That’s because we believe the standard equation for the tier 1 capital ratio leaves out an important element: unrealized losses.

Banks aren’t required to include them on their balance sheets and often don’t show up in traditional reporting, so we added unrealized losses and gains in held-to-maturity assets into the calculation.

And our “tweaked” ratios showed that at the end of 2022, Silicon Valley Bank had an adjusted tier 1 capital ratio of almost 0%. In other words, the bank had no ability to absorb any sudden losses. Of course, that played out when customers withdrew deposits at lightning speeds, thanks to social media.

Additionally, most of their deposits were tied to either loans or HTMs — specifically, investments in long-term U.S. Treasurys that fell in value when the Federal Reserve began raising rates after a decade of loose money.

Those two metrics are huge indicators of risk, but they aren’t the only ones. That’s why it’s important to look at the bigger picture and not judge a bank through such a narrow lens. We want to be discerning but fair.

Another institution we’re keeping an eye on, First Republic Bank (FRC), actually leveraged and utilized more than 100% of its deposits. And its adjusted Tier 1 Capital Ratio is close to 6%, but that’s not strong enough for us not to be concerned about the higher risk they carry in terms of potential duration gap and sudden losses.

Another special case is Morgan Stanley Private Bank, National Association. Our main concern for them is the slightly high utilization of deposits with just less than 84% of loans and HTM to total deposits, and a slightly low adjusted tier 1 capital ratio (4.7%). For those reasons, we need to keep an eye on this bank, as well.

These seven banks aren’t the only ones with assets sitting in long-term bond investments that have lost considerable value since interest rates began to rise. In fact, trillions of dollars are in the subpar bonds.

Look for the Signs

& Protect Yourself

Many banks seem pretty confident, dare I say arrogant, that they won’t suffer the same fate as SVB. I say that for two reasons.

One is because the only time a bank will need to cover 100% of deposits is IF something unexpected happens in the markets, economy or geopolitically to cause rapid-fire, widespread withdrawals from the banking system.

That’s like saying I’m too lazy to put the gas can in the garage, so I’m just going to store it in my kitchen. Then, somehow a spark shoots from one of the burners on the stove and the gas starts a fire. You wouldn’t have burned down your house IF it weren’t for the spark.

But it’s probably best not to put the gas can in the kitchen in the first place.

It’s not that much different when banks hold a lopsided number of devalued assets. They know they shouldn’t, but are willing to take the risk — again, with your money — that nothing will blow up in their faces.

Dismissing the “what if” isn’t OK. It’s borderline negligent if you ask me.

The second reason for some banks’ pseudo-confidence is because the U.S. government came to the rescue of all SVB’s customers — those under and over the $250,000 threshold insured by the FDIC.

Banks, the bigger ones especially, just figure if push comes to shove, they won’t be allowed to fail. If they do, we could see a contagion that causes a collapse of the entire banking system that would devastate an already-weakening economy.

It’s like they’re protected by impenetrable suits of armor and regulators have yet to hold them accountable and reveal their vulnerability. But IF they did …

Look, I don’t know what’s going to happen from here. No one does. But I do believe recession is very much in the cards. And if that occurs, people will lose jobs and it will only be a matter of time before we see widespread defaults in mortgages, auto loans and credit cards.

That’s when the you-know-what will really hit the fan. It’ll be too late at that point.

Now is the time to start asking questions to determine if your bank is at risk on the basis of assets and losses sitting on their books. You should frequently check Weiss’s Bank Ratings page — based on accurate, unbiased research — to see if we’ve raised any red flags about your bank.

Thanks to the government, the consequences for SVB customers went no further than the inconvenience of not being able to access their funds for a period of time.

If banks continue to get away with risky practices, and if something triggers a systemic collapse, you can bet my bottom dollar that customers will be more than inconvenienced.

Banks may be willing to take chances with your money and ignore the “what ifs,” but you shouldn’t. Do your research, look for the signs and ask the important questions to protect yourself.

Until next time,

Gavin Magor

P.S. According to my friend, colleague and Weiss Ratings Startup Investing Specialist Chris Graebe, the recent banking panic is already driving promising companies to equity crowdfunding, an alternative funding that allows regular, nonaccredited investors to invest in early, pre-IPO companies. This presents a huge opportunity for Weiss Members. Click here to learn more about how to claim an early stake in a well-vetted startup.