Find ‘Silly Season’ Sanity in This Surprising Sector

|

| By Gavin Magor |

“Silly season” started a little early this year.

This is the term I use to describe the summer, when you can expect just about anything from the stock market.

It’s silly because equities seem to take on minds of their own, and investors can lose theirs if they aren’t careful.

And all it takes is a whisper to push the seasonally smaller-than-usual herd to buy or sell stocks.

A great example of this happened just last Wednesday, when stocks saw their worst sell-off since 2022.

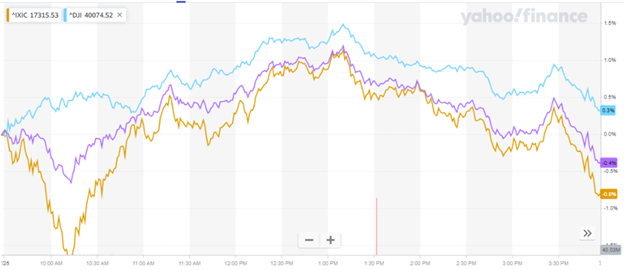

The next day, the tech-heavy Nasdaq experienced a 500-point differential during the day. It gained 1% by 1 p.m. Eastern, then lost most of that by the closing bell.

Here’s a chart showing Thursday’s erratic movement of the Nasdaq, the Dow Industrials and the S&P 500. That’s just one day!

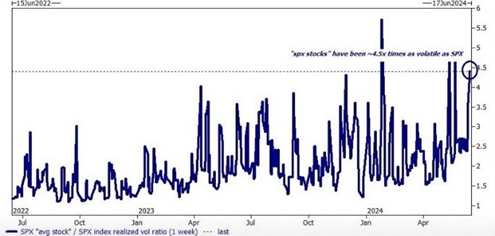

Here’s a longer-term snapshot of S&P 500 stock movement from June 2022-June 2024.

Both look a bit like when you get bad news while sitting for an EKG test, don’t you think?

Unfortunately, though, we can’t use a defibrillator to zap stocks into a more normal trading pattern.

Calming a volatile stock market isn’t that simple. After all, human emotions are what’s driving all of those ups and downs.

The zigs and zags are dependent on how investors react or don’t react to external market influences.

So, what can investors do now in the face of strong — and, I believe, rising — volatility?

Some great ideas in the face of volatility are to take profits on some of your more speculative plays, increase your cash position and possibly even consider adding some inverse ETFs.

This last option acts as a hedge and increases in value as the market goes down.

That said, I do remain cautiously optimistic … I just think we’re going to see lots of volatility. It will be a bumpy ride. But remember, pullbacks are normal, healthy and quite necessary.

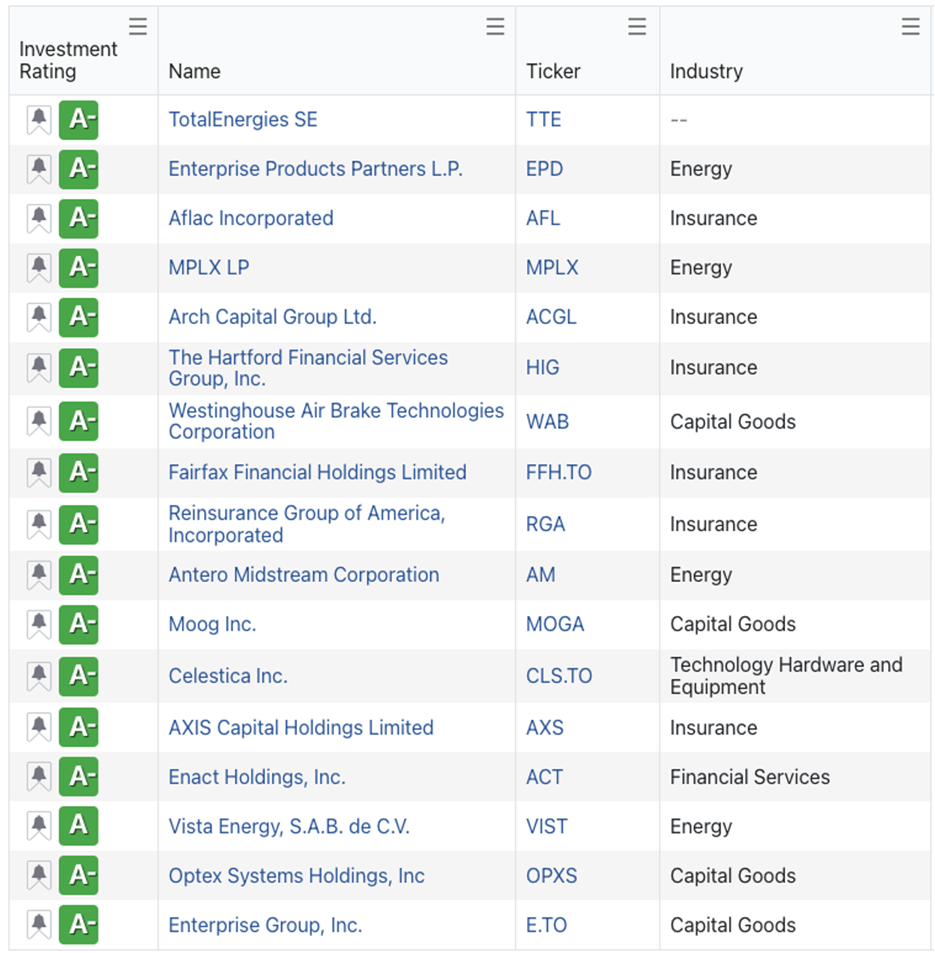

Another tremendous option is to consider highly rated Weiss stocks. Let’s check in with some of our “A”-rated names.

One common theme is plenty of names in the energy and insurance industries. That isn’t too surprising considering both industries are up this year.

And that is really the tip of the iceberg when it comes to our ratings.

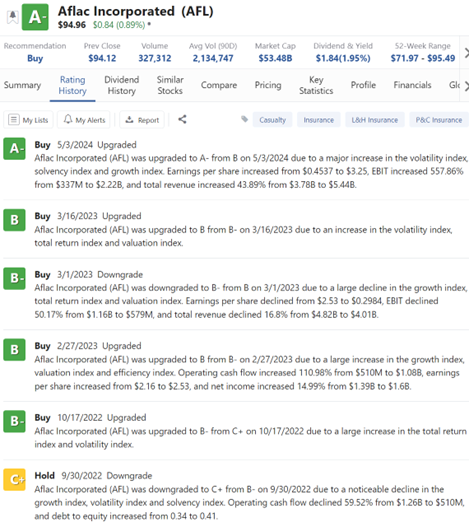

Say, for example, you wanted to take a close look at a strong play in the insurance industry: Aflac (AFL).

On its ratings page, you could see everything from where we rated it historically to an in-depth look at its financials.

As shown above, Aflac was upgraded into our “A” range after seeing a jump in profitability.

So, no matter what market forecast comes our way during silly season, you can unquestionably better prepare yourself with the Weiss Ratings financial compass by your side.

Cheers!

Gavin

P.S. Dr. Martin Weiss recently released an important presentation to protect your money before a possible election crisis. Former President Trump was shot. President Biden is out of the race. And the stakes couldn’t be higher. I urge you to check this out immediately.