|

| By Gavin Magor |

Ah, come on, it’s pretty cool.

On Friday, the S&P 500 made history when it reached another millennium at the solid number of 6,000.

There is no other way to put it: The market has been blasting off this year … and is up 26% as of writing.

The market had an especially strong week last week as the U.S. presidential election was decisively decided … and we got no surprises from the Federal Reserve’s announcement.

In my opinion, the market’s primary rocket fuel was the election being decided so swiftly.

The market loves any certainty it can get. And seeing a decisive win, no matter which candidate, was all the fuel it needed for blast off.

I’ve been ready and continue to be cautiously optimistic based on the latest market data.

Of course, my premium Weiss Intelligence Portfolio Members are up much higher than the broad market.

However, if you’ve been reading my previous Weiss Ratings Daily columns, I’m sure you have had the chance to make some quite profitable trades as well.

And that’s primarily because I tend to write about the incredible power of the Weiss Ratings.

That continues today, as I want to take a look at all of our current “Buy”-rated stocks that have performed the best over the past 90 days.

Because, by the looks of it, there are some incredible profit opportunities for you.

Unwinding Weiss Winners

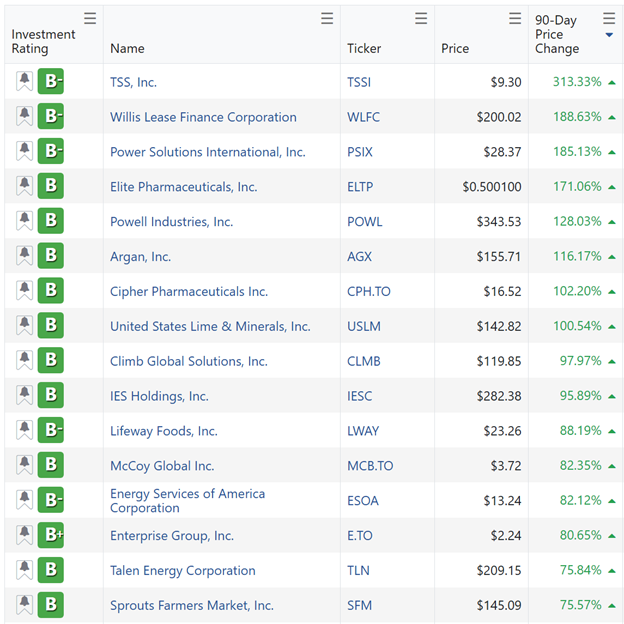

After a few very easy filters on the Weiss Stock Ratings site for stocks in the “A” to “B-” range — and sorted by past 90-day performance — I was able to find many stocks that have absolutely crushed this strong market.

Here are the results for what populated:

Those are 16 names that have a performance of 75% or more.

Be sure to explore all of our “Buy”-rated names.

But I’d like to focus on the last one today — Sprouts Farmers Market (SFM).

Consider Harnessing Healthy Profits

Sprouts Farmers Market has been within our “Buy” ratings since May 17, 2023. It is a special grocery store focused on fresh and organic products.

There is a very good chance of even more growth potential thanks to things like an expanding market for healthy food options, store expansions and e-commerce growth.

The company is fairly unique for the fact that it sells fresh produce, bulk foods and organic goods all together in its stores.

By the looks of it, the only thing healthier than the foods it sells is its financials.

Let’s take a look at its price history, which reflects the success of Sprouts’ business:

Its performance over the past few years absolutely trounces the broad market … and most stocks.

It’s clearly a profitable business and has strong cash flow growth.

It does appear to be on the expensive side, trading at 40 times earnings.

However, paying up for that growth potential with this healthy name may be the smart move.

If you’re looking for some consumer staples exposure in your portfolio, or even just for a high-growth name, be sure to research this one.

No matter how high this market continues to climb, you can aim to outperform with the boost of the Weiss Ratings research.

Now that a major Federal Reserve decision is behind us and election season is over, we can return a majority of our focus back to corporate earnings.

As always, we will be on top of it. And we will always be ready to do the heavy lifting so you don’t have to.

Lastly, with today being Veteran’s Day in the U.S. and Remembrance Day in the U.K., I want to use this opportunity to send a sincere thank you to any of our readers who are veterans and to remember those that gave the ultimate sacrifice. We WILL remember them.

Cheers!

Gavin Magor