Editor’s note: Investing has always been about following the money — hedge funds, retail investors, insiders, etc. But in today’s market, that means finding out what those in power are investing in.

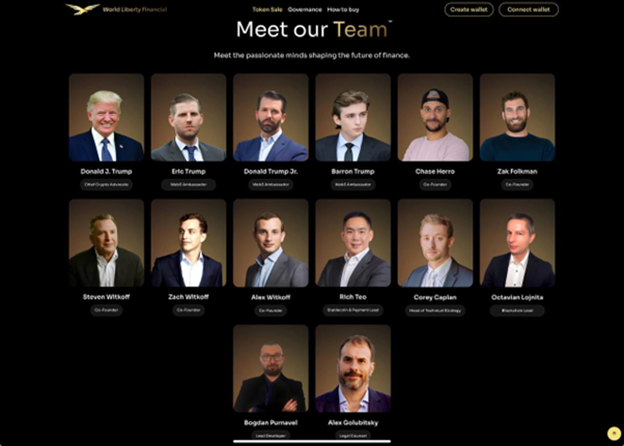

Dr. Bruce Ng — our resident DeFi expert — did just that. Just take a look at this “team” to see what we mean:

But our good doctor went one step further. He found what this team is investing in.

And it happens to control the crossroads between traditional finance (TradFI) and decentralized finance (DeFi).

Read about this opportunity below …

|

| By Bruce Ng |

World Liberty Financial aims to reinforce the dominance of the U.S. dollar within the DeFi ecosystem through the promotion of dollar-backed stablecoins.

To do that, World Liberty Financial plans to integrate DeFi capabilities into its offerings. This could open access to DeFi to a sea of new users.

But World Liberty has gained most of its attention in the past year due to its association with President Trump and his family.

While not officially on the board, Trump and several family members hold advisory positions. And they hold WLFI tokens.

My colleague Mark Gough took a deep dive into World Liberty Financial … and the barriers that keep most U.S.-based retail investors from investing in it.

He also suggested an alternative way to benefit: Target the same coins World Liberty invests in.

As Mark put it, “If Trump’s affiliated wallets begin accumulating specific assets, for example, those tokens may experience increased demand as the market reacts. As an investor, this could create a unique perspective on potential investment opportunities.”

That’s definitely one way to follow the money!

And it’s how I noticed a notable new addition to World Liberty’s portfolio.

Movement Aims to Shake Up Ethereum

Movement (MOVE) is a Layer-2 solution aimed at enhancing scalability and security for the Ethereumnetwork. The network promises high transaction speeds — up to 160,000 transactions per second — and low gas fees to stand out as competitor in the crowded Ethereum L2 space.

The MOVE token is used for governance, staking and as a native asset for decentralized applications on its network.

And on Jan. 28 and Feb. 14 — marked by the yellow circles below — World Liberty Financial added 4.16 million tokens amounting to $2.3 million at the current market price.

This immediately caught my attention for two big reasons.

First because, as Marija Matić revealed last Monday, most large buyers are adding mostly crypto blue chips to their portfolios.

In this market, the comparative stability the larger crypto projects offer is very appealing.

Second because the Layer-2 narrative has massively underperformed this sector. In 2024, only one Ethereum Layer-2 coin finished the year in positive territory.

As you can see, even projects like Arbitrum (ARB) — which saw an impressive performance last bull cycle — was down significantly over the year.

Clearly though, the World Liberty Financial team must believe MOVE will outperform not just its L2 competition … but the broad market in a meaningful way.

So, that brings me to the big question: What do they know that we don’t?

To me, there are three factors that stand out about this new project that give us a big clue.

MOVE: What Makes It Stand Out

Factor 1: Speed and Scalability

Movement allows developers to create application-specific rollups — which help improve speed and scalability — tailored to each app’s unique requirements.

We can see this potential as Movement boasts a top throughput of 160,000 TPS. That could be huge if realized. At the moment, however, this figure has not been battle-tested under real world conditions.

Factor 2: Security

Security is paramount when dealing with high value financial transactions. And Movement has created a network with security built-in from the ground up.

The Move programming language was initially developed by Meta (META). Yes, as in the social media giant. And one of the fundamental elements of this language is that it prioritizes security and resource safety.

Factor 3: Real Utility

While some projects stick to crypto-native use cases, Movement actively targets real-world use cases like payments, gaming and logistics. This makes it attractive for mainstream adoption.

By combining these three strengths, we can see a clearer picture.

The Main Reason Why I Think

World Liberty Bought MOVE

If Movement’s strengths are scalability, security and real-world utility, then it is perfectly positioned to run high frequency and high valued financial transactions.

That is the gold standard for financial DeFi applications. Like the kind World Liberty hopes to incorporate.

And with its latest investment, I believe World Liberty Financial will back and endorse Movement to run institutional financial transactions.

That would break MOVE out of just the L2 narrative … to benefit from both the institutional DeFi and real-world asset sectors.

With the backing of World Liberty Financial and the Trump administration, Movement stands a good chance of becoming the top L2 for institutional financial transactions.

Of course, nothing is set in stone yet. Movement is still a new project, which means thorough research will be needed to determine if it’s right for your investment strategy.

That said, I do believe this is one exciting project that investors should keep on their watchlist.

Best,

Dr. Bruce Ng

P.S. Investing in smaller, newer crypto projects like MOVE comes with greater risk exposure thanks to their volatility.

But it also comes with the chance to target incredible gains thanks to their outsized growth potential. Overlooked coins have already posted gains of 64x … 206x … and 245x greater than Bitcoin, and we haven’t even seen altcoin season yet.

And earlier this week, my colleague Juan Villaverde revealed the “backdoor” buying method he uses to maximize his potential gains on these cryptos even more.