Forget Altman … This Is the Complete AI Investment to Buy Now

|

| By Jon Markman |

The company behind ChatGPT is in turmoil.

In the span of a week, its chief executive officer was fired, rehired … and virtually all of the employees threatened to quit.

AI development at OpenAI may be moving too quickly, according to accounts from the board of directors. It is a wake-up call for investors. AI is going to shake up everything.

And I have the best way to play it …

Why Everyone Is Watching ChatGPT

ChatGPT has been a sensation since December 2022, when the first public version of the AI chatbot began rolling out to end users.

Unlike traditional computing, generative AI actually generates answers to user queries by applying algorithms to large language models. Old school computing is little more than gloried data retrieval.

This may seem like an inconsequential difference. It is not. Models that generate answers are thinking, for lack of better terminology.

Ethicists worry that generative AI models trained with voluminous datasets — ChatGPT has 220 billion parameters — will progress exponentially and uncontrollably. They warn that it is only a matter of time before one of these models achieves artificial general intelligence, the holy grail of computing.

AGI is the point where the intelligence of a computer supersedes the smartest humans.

These fears may be the root cause of the decision last week by the OpenAI board to fire Sam Altman, the company’s CEO.

The Firing and Hiring … AND Hiring of Altman

Ilya Sutskever, chief scientist at OpenAI, was part of a group that grew concerned about AGI at OpenAI. Reuters reported that a group of company researchers wrote a letter to the board in early November that warned a powerful new AI had been discovered. They feared this AI posed a potential threat to humanity.

On Nov. 17, Greg Brockman, an OpenAI cofounder, wrote that the board reached out to Sam Altman on the previous day via Google Meet. Members informed him that he was being fired due to a series of inconsistent statements. This is when the whirlwind of turmoil started.

Within days, Microsoft (MSFT) agreed to hire Altman to head a new AI development project. And 747 of the 770 staff at OpenAI threatened to quit if Altman was not reinstated.

Keep in mind that Altman was negotiating with private investors to sell OpenAI shares at a $86 billion valuation. That transaction would have made many of the 770 staff wealthy.

OpenAI was created in 2015 as a nonprofit. Its mission then was to develop AI that would benefit humanity. Sam Altman created a for-profit arm in 2018 … and quickly scored Microsoft as a large investor.

The software giant has since invested $13 billion for a 49% stake in the for-profit business.

Unfortunately for Altman and Microsoft, that business is nestled under the umbrella of the nonprofit company. This is how Altman was blindsided.

Altman was rehired late last week, with the help of a flip-flop from Sutskever. The chief scientist wrote that he regretted his role in the firing. And two of the board members who voted to oust Altman were replaced with Larry Summers, the former secretary of commerce, and Brett Taylor, the former chairman of Twitter.

The Complete AI Investment to Buy Now

There are some key takeaways for investors.

Money matters, obviously. Altman has become a golden goose at OpenAI. He is attracting capital and big names from the world of finance. There is no constituency to kill the source of this wealth.

However, the biggest hot take is that AI is a legitimate investable trend that is likely to spark a new wave of hype and enthusiasm.

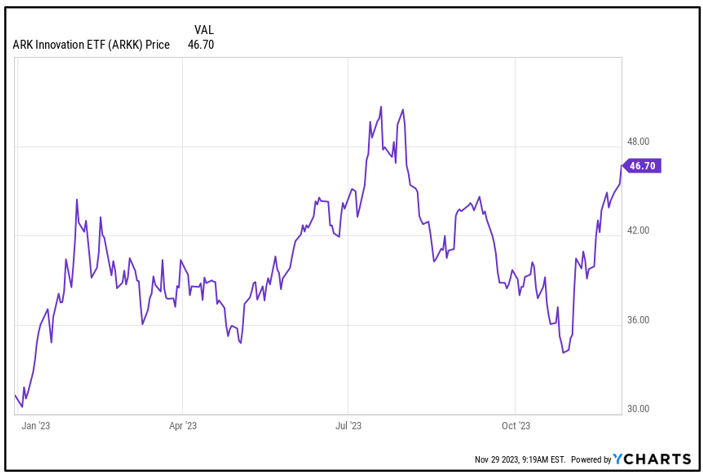

And unless you have the time to separate the wheat from the chaff, there’s one investment you can make to play this unstoppable wave: the Ark Innovation (ARKK) exchange traded fund.

Ark is a collection of emergent technology firms. Many of these stories, such as Tesla (TSLA) and Block (SQ), have been early adopters of AI.

More importantly, the $44 billion fund has the kind of name recognition to lure investors.

Ark Innovation shares are up 12.3% in 2023. Still, they are far cheaper than their 2021 high of $127.40. It’s certainly not out of the question that they’ll get back there again.

All the best,

Jon D. Markman

P.S. Of course, there are other, better ways to play this AI megatrend. In fact, we recently hosted an AI Town Hall event, where I name the #1 AI stock for 2024 to buy now. Click here to check it out.