By Tony Sagami

|

Ha! Lots of you enjoyed my column last week about my high school hot rod, a 1968 Camaro SS. My guess is that a lot of aging baby boomers have fond memories about the cars we drove in our youth.

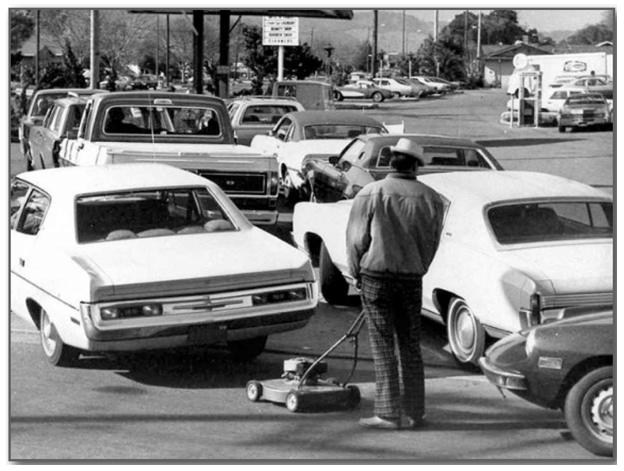

My loud, fast Camaro only got eight miles a gallon, so the rocketing gas prices during the 1973–74 OPEC oil embargo kept my gas-sucking car frequently parked in my father’s barn.

I couldn’t afford to fill it up … if I could even get gas.

Do you remember waiting on those long lines? And only according to the last digit of your license plate (even or odd)?

I recall those lines being hours long and being told to leave when the station ran out of gas.

Even more frustrating was that my vegetable-farmer father had an underground storage tank filled with gasoline.

You see, farmers and other key businesses were excepted from gasoline rationing … and my father got as much gas as he needed to run the farm.

But my father wouldn’t give me one drop out of the hundreds of gallons stored beneath our barn.

In my father’s moral world, everything was black-and-white … right or wrong.

“That gas is for the farm, Tony. Not for you to joyride around town. You need to wait in line like everybody else,” he said.

Looking back, I know that he was right. But at the time, I was mad as hell because I couldn’t take my cheerleader girlfriend out for a Saturday night date.

So, I waited in line like everybody else. Sometimes for hours.

And even when I did fill my tank, I had to pay a LOT more to do so.

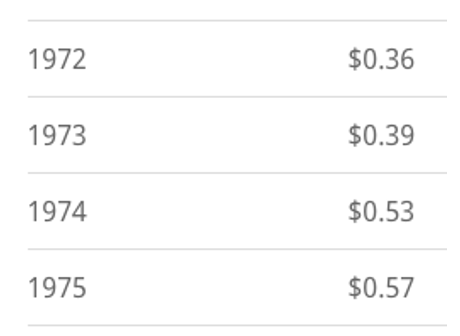

The national average cost for a gallon of gas was only 36 cents when I got my driver’s license in 1972, but it rose to 57 cents by the time I graduated high school.

And that — 57 cents a gallon — might sound ridiculously cheap today, but it was a 58% increase, and minimum hourly wage was only $1.60 at the time.

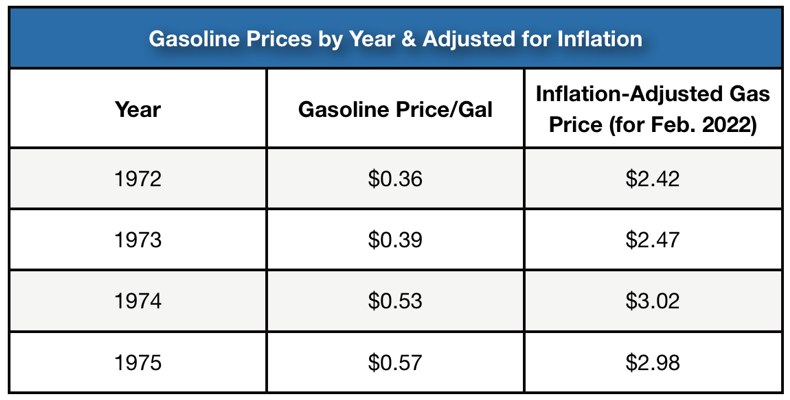

I wasn’t paying attention at the time, but gasoline wasn’t the thing that was going up in price.

Inflation had been running between 5% to 6% at the start of the 1970s but reached double digits in 1974.

Inflation got so bad that President Nixon introduced wage and price controls — which, along with OPEC oil embargo, severely reduced gas supplies and was why my Camaro’s fuel tank was frequently empty.

And then the Fed began to raise interest rates in 1977, which ultimately pushed the economy into a painful recession.

I don’t own that hot rod Camaro anymore (I sure wish I did), but today’s rising gas prices, hot inflation numbers and soon-to-increase interest rates could push our economy into a recession just like it did then.

What Should Investors Do?

Should you run for the hills and sell everything now?

Nobody knows for sure, but …

- I think what you should be doing is investing in assets that prosper during periods of high inflation and rising interest rates.

I’m talking about hard assets and natural resources: energy, industrial metals, timberland, precious metals and agricultural commodities.

Another great idea? Dr. Martin Weiss’s Weekend Windfalls strategy.

There’s never been an easier way to potentially make all the income you need — when you need it … especially in this historically low-rate world.

If you like to learn more, click here now.

As for playing the commodity rally, the Invesco DB Commodity Index Tracking Fund (DBC) looks very attractive.

It invests in futures contracts on several types of commodities like oil, gold, soybeans, aluminum, wheat, copper, corn, zinc, natural gas, sugar and silver.

Since the start of the year, when the stock bounced off its 50-day moving average, shares have been breaking out and are currently sitting at their 52-week high.

No matter what you choose, don’t get stuck on the side of the road because you didn’t fuel up your investment tank.

Best wishes,

Tony Sagami