|

| By Tony Sagami |

I may have spent more money on beer than food during my college days.

When I was in my early 20s, I considered money something to be spent … not something to save. It wasn’t until I hit 25 that I started to get serious about money.

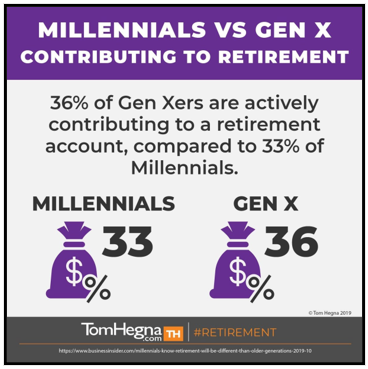

Contrary to what you might think, younger Americans in the workforce are saving more money than my generation ever did. According to a BlackRock study, Gen Z is saving an average of 14% of each paycheck for retirement.

Additionally, 36% of Gen Z workers faithfully contribute to a 401(k) plan.

Click here to see full-sized image.

That’s impressive, but Gen Z also has very unrealistic expectations about how much it’ll cost to fund a comfortable retirement. BlackRock found that one-third of Gen Z feels that $250,000 will be enough to comfortably retire on.

Fat chance. That’s a lot of money but woefully inadequate for 20+ years of retirement.

Here’s what I tell my Gen Z and millennial children:

The very best place to save money for retirement is inside a 401(k).

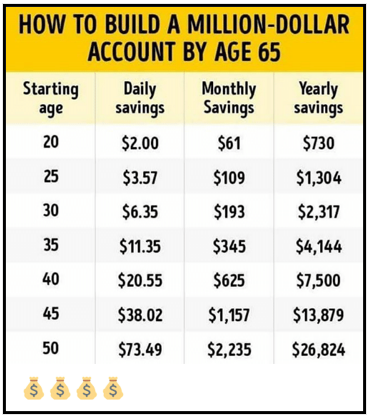

In fact, accumulating $1 million is pretty easy if you start young and faithfully contribute to your 401(k).

Click here to see full-sized image.

Not only does 401(k) money go in without taxation, but most companies will contribute 50 cents for every dollar you save, so up to 6%.

Your 6% plus the company’s 3% gets you to 9%.

If you save $5,000 a year — $3,333 of your money and $1,666 of your company’s match — for 30 years and earn an average of 10%, you’ll come close to accumulating $1 million.

And don’t forget the importance of making your savings work as hard as you do. The mainstream media wants you to believe that plowing your life savings into unmanaged index funds is your best strategy, but that ignores the financial damage that bear markets wreak on your 401(k).

My advice is to pack your 401(k) with low volatility, dividend-paying stocks.

Why? They’ve proven time and time again that they beat the pants off the S&P 500 and do so with lower volatility.

Those are exactly the type of stocks that I recommend in my Disruptors & Dominators service, where members are currently sitting on open gains of around 47%, 44% and 28%!

More money with less risk is the best way to build a million-dollar 401(k) portfolio.

That million-dollar 401(k) nest egg combined with Social Security will set you up for a comfortable retirement.

By the way, the annual increase for Social Security retirement benefits is about to get a big boost. Starting in 2023, the cost-of-living adjustment will increase Social Security payments by 8%-10%.

The annual Social Security inflation increase has reached 10%+ only twice in the past: 14.3%+ in 1980 and 11.2%+ in 1981.

That big increase is both good and bad. The reason for the big increase is because inflation has skyrocketed. The costs for food, shelter, energy and medical care have also skyrocketed.

But if you’re a good saver, you’ll accumulate enough money to overcome higher prices and live a comfortable retirement.

Unlike my college days, I’ve been a good saver so I can afford all the beer I want. But these days, I’m more likely to drink a cup of milk than a bottle of beer.

All the best,

Tony

P.S. If you’re interested in another way of growing your wealth before you retire, click here to see how members of my trading service, Disruptors & Dominators, are doing it.