Is the tide turning for the crypto market? Just like in the equities markets, assets have been rallying since hitting lows in June.

In this segment, I speak with Crypto Analyst Alex Benfield about how investors can find high returns in this bear market — a winning strategy that the Weiss Crypto team may carry over into the next bull run — and the landmark event happening in a few weeks that's set to transform the crypto landscape and usher in a new wave of money into the space.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): The tide could be turning forcrypto.

Alex Benfield: Most of the market — especially Bitcoin (BTC) and Ethereum (ETH) — have been rallying pretty hard since their June lows.

JB: We are seeing a correlation right now between the equities markets and the crypto markets and that could be seen as a good thing or a bad thing.

AB: Originally, people had invested in crypto as a kind of hedge or a different asset class from equities. So, in that sense, a strong correlation could be seen as a negative thing.

But when they're both rallying, it could be seen as a positive development. We have seen a massive rally in equities, as well.

JB (narration): Crypto Analyst Alex Benfield is a contributor to Weiss Crypto Daily and Weiss Crypto Portfolio, working alongside Senior Crypto Analyst and cycles expert, Juan Villaverde.

Alex says the macroeconomic backdrop has affected crypto assets for nearly a year.

AB: And we're waiting on a pivot from the Federal Reserve.

When they start cutting rates, that's likely when investors are going to feel more confident about moving back into risk assets, like Bitcoin, like cryptocurrencies.

And there's a lot of money on the sidelines right now, so perhaps that Fed pivot might just be the starting gun for money to move back into risk assets and for the show to go on again.

JB (narration): A driving force for the market at this very moment? The upcoming Ethereum Merge, slated for mid-September.

It'll be a major software upgrade for the blockchain.

JB: Let's talk about what's happening with ETH. This is really a landmark event for the crypto market.

AB: Absolutely, this has got to be one of the biggest events in crypto history.

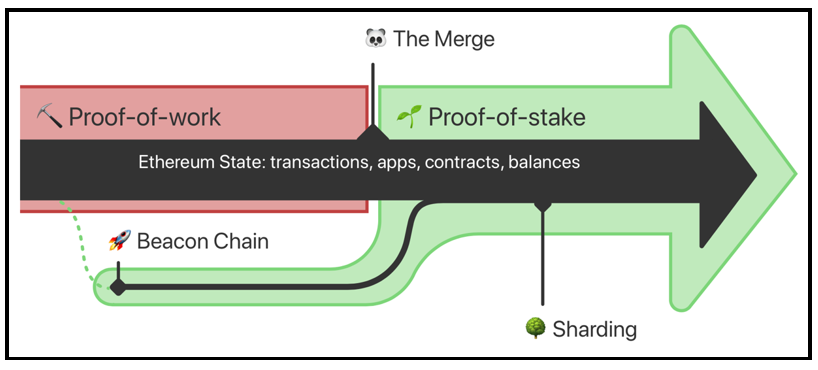

This will be the first time a blockchain has transitioned from proof-of-work to proof-of-stake, while the blockchain is still going.

JB (narration): These consensus mechanisms are very different, and debate continues over which is more secure and decentralized.

A proof-of-stake network, which Ethereum is moving to, will make scaling solutions in the future easier.

It's also more energy efficient, minimizing the heavy use of electricity needed for mining.

AB: So, one potential net positive for Ethereum on this move is that Ethereum may be seen as an ESG-compliant blockchain.

And there are a lot of funds and pools of money that can only allocate their funds toward assets, commodities, investments that are ESG-compliant.

JB (narration): ESG stands for environmental, social and governance criteria. It's a set of standards used to screen investments.

AB: Bitcoin is not ESG-compliant. Most funds are only interested in Bitcoin or Ethereum, as Ethereum is the biggest cryptocurrency outside of Bitcoin.

So, these funds that couldn't previously invest in Bitcoin or Ethereum because neither were ESG-compliant, may now have the ability to invest in Ethereum as it is potentially going to be ESG-compliant after The Merge.

So, it's possible that we'll see a large influx of money from these funds into crypto after The Merge.

JB (narration): During this bear market, Weiss Crypto Portfolio has been using the ProShares Bitcoin Strategy ETF (BITO).

It's a Bitcoin futures exchange-traded fund and functions a lot like standard futures contracts for commodities or stocks.

It allows investors to bet on the price trajectory of an asset.

JB: Talk about BITO and how it became included in the portfolio.

AB: This was Juan's brilliant idea on how to take action in the market. Obviously, we saw a slowdown in crypto prices and realized that we needed to find returns somewhere else.

By trading the BITO options, Juan is basically hedging the price of Bitcoin down during this bear market. If the price goes down, he's collecting a premium.

He's selling puts on the way down. Basically, we're just averaging down our cost of Bitcoin in this bear market, so if we end up having to buy a put, it's no problem because we're long-term bullish on Bitcoin.

And it's been a great way to earn interest on these positions and stock up a bit on our long BITO, essentially our long Bitcoin.

Long term, we are bullish on Bitcoin, so we have no problem buying it at lower prices.

JB (narration): Bitcoin and Ethereum are two blue-chip cryptocurrencies. And Alex says they're here to stay.

AB: There would have to be something extremely bad to happen to this space for either one of these blockchains not to succeed.

I think that the opportunity that both Bitcoin and Ethereum provide for investors is something that they're just not going to get anywhere else.

And we're in an age where governments are attempting to crack down on financial privacy, collect more financial data … we've seen governments cut off people and countries from the central banking system.

At some point, people are going to realize that the only escape route here is cryptocurrencies, and the two safest cryptocurrencies to invest in are Bitcoin and Ethereum.

JB (narration): So, when momentum in the market takes hold, keep that long-term outlook in mind.

JB: Crypto Analyst Alex Benfield, it's a pleasure to get your insights. Thank you so much for making time.

AB: Thank you for having me.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings