|

| By Gavin Magor |

Today’s the last day of Q3. And so, before we start the new fiscal quarter and new chapter for the market, I want to take a look at our newly upgraded Weiss “A” names.

Or, as it turns out, name — singular …

After a few easy clicks, I was able to filter for stocks within our “A+” through “A-” range … and then select “Recently Upgraded.”

Here’s what populated:

It’s an intriguing energy company called Energy Transfer (ET).

A Giant Pipeline of Income

Energy Transfer is a midstream energy company that operates a vast network of pipelines, terminals and processing facilities in the United States.

It gathers, transports and stores crude oil, natural gas and natural gas liquids in North America.

This stock has been on my radar for a while now, primarily because we have been rating it as a “Buy” going back to April 18, 2022.

Since then, shares are up 39%. That doesn’t include its very meaty dividend — currently yielding 7.9%.

Let’s take a gander at its five-year chart:

Major reasons for its most recent upgrades include higher profitability and larger earnings per share (EPS). Those increased from 32 cents a share to 35 cents a share in its latest earnings report.

Its balance sheet paints a story too. The stock unquestionably has stable cash flows, is flush with cash and still trades at a relatively modest 13 times earnings.

Fundamentally, you can’t ask for much more. But I want to use this opportunity to show you some of the incredible features that our Ratings site has on the technical side.

Getting Technical with the Weiss Ratings

After “Pricing” and then “Technical Chart,” I was able to see many of ET’s important technical features.

Right away, we can see that ET’s price history has been stable and steadily growing:

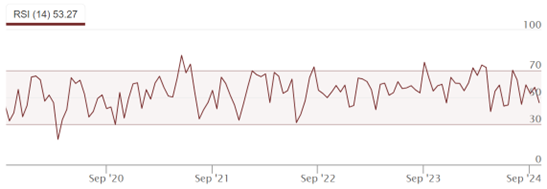

Right under the price history chart, we can see its RSI, which stands for “Relative Strength Index.”

The RSI is one of my favorite momentum indicators. Essentially, the RSI measures the speed and magnitude of a stock’s recent price change to detect if a stock is priced fairly.

For many important technical features, I encourage you to utilize our amazing technical features.

You can always check it out at our Weiss Ratings screener page.

That’s it for today. Have a great week … and Q4!

Cheers!

Gavin Magor

P.S. Energy Transfer’s 7.9% dividend yield is rare. In fact, I only know of one place that can do any better — The Great Income Solution Summit.

Tomorrow, you’ll have a chance to grab a seat to see it for yourself. So, keep an eye on your inbox for your invitation.