|

| By Sean Brodrick |

Looking at gold now is like staring into the eyes of a bull. This big beast is not blinking, and it looks ready to charge.

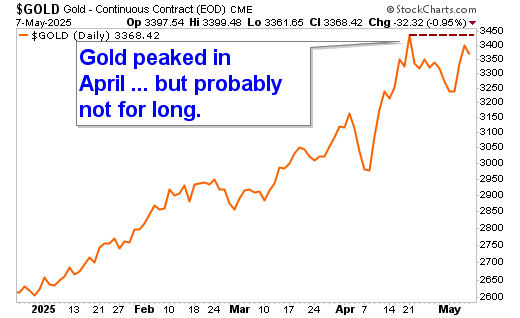

Let’s look at a chart of the yellow metal, and I’ll show you why.

Since gold peaked under $3,500 on April 8, traders have waited for the inevitable pullback. We’re not getting much of one. In an ordinary market, gold should pull back to test first support around $3,150.

In fact, I was expecting a monthlong consolidation process before gold finally broke out again. Ordinarily, I believe that’s what we could expect. But these may not be ordinary times.

Here are three reasons why …

Persistent Uncertainty. When I spoke at the Weiss Investment Summit in Boca last week, my watchword was “uncertainty.”

Tariffs and trade wars have everyone nervous, sending the U.S. dollar lower and gold higher.

Now add in real-world shooting matches between Pakistan and India, the Houthi rebels launching Iranian-made missiles at Israel and the never-ending knockdown, drag-out struggle in Ukraine, and you can see why countries the world over are rushing to load up on the ultimate safe haven — gold.

Strong Central Bank Demand. Goldman Sachs reported in February that central bank demand surged to 108 metric tonnes in December, five times the pre-2022 average.

The purchases continue, with Poland next door to the hornet’s nest in Ukraine, adding another 48.58 tonnes in the first quarter. Uzbekistan, China, India, Kazakhstan, Turkey, the Czech Republic and Qatar all added to their gold hoards in Q1.

Gold Shrugs Off Federal Reserve Stubbornness. Last Wednesday, the U.S. Federal Reserve maintained its benchmark federal funds rate at 4.25%-4.5%, not giving the market the cut it hoped for.

Moreover, the Fed only hinted at two cuts in 2025, saying it is keeping a “wait and see” attitude in case inflationary forces linger.

That bad news should have sent gold sliding much lower. While the yellow metal ended down for the day, it wasn’t by much.

Gold is resilient in the face of the Fed not moving on rates. That is a big change from the past … when the Fed did not give the rate cuts it wanted, it would send gold cratering.

Clearly, gold is bullish.

Look, I would love for gold to pull back — perhaps even dip below $2,900 an ounce. And maybe it will.

But everything I’m seeing points to a feisty, even furious gold market that is pawing at the dirt like a raging bull, ready to run higher.

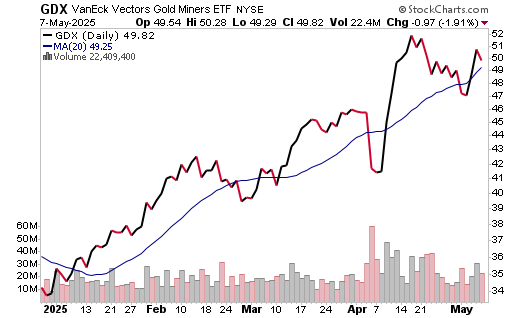

An easy way to play this is to buy the VanEck Gold Miners ETF (GDX). That’s because gold miners are leveraged to the underlying metal — as gold goes higher, their profit margins widen like the Grand Canyon. And the GDX holds a basket of the best gold miners.

I’ve recommended the GDX repeatedly – in May, in February, heck, I’ve recommended the GDX in this cycle as far back as March 20, 2023.

If you’d bought the GDX back then, you’d be up 67%. But you know what? This profit party is just getting started.

I fully expect gold to surge above $3,500, $4,000 … even $6,900 an ounce, as I explained in January.

Just imagine what that kind of price move is going to do to the GDX.

You can see that the GDX keeps tagging its 20-day moving average and using that as a launch pad. The GDX just tagged the 20-day again.

Get busy or get left in the dust. This gold bull isn’t blinking. It’s ready to charge!

All the best,

Sean

P.S. You could drill down into this ETF to find some specific miners that could do better than the rest. But a word of warning: You’ll need to tread carefully. This will help.