|

| By Sean Brodrick |

Gold is screaming a warning. Are you listening?

The message is loud and clear: Something is deeply wrong in the U.S. financial system.

The metal has been grinding higher day after day, torching every other asset class in sight.

Stocks? Stumbling.

Bonds? Weak.

Crypto? Crushed.

But gold keeps powering to new records — even topping a 45-year inflation-adjusted high.

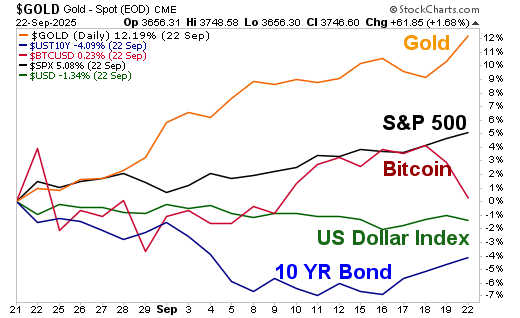

A one-month chart tells the story. Gold has left everything else in the dust.

Even 10-year U.S. Treasuries — the classic safe haven — have slumped over the past month, despite a recent bounce.

Bitcoin, often touted as “digital gold,” has just suffered its largest liquidation wave since March, along with the rest of the crypto space.

More than $1.5 billion in bullish crypto bets vanished in a single day on Monday, sending many tokens into a tailspin.

Meanwhile, gold shines brighter than ever.

My biggest fear: This price action is telling us something massive is going wrong with the U.S.

Fear in the System

What could it be?

We don’t know yet. But history gives us clues.

Emerging markets have seen this kind of move before — currencies debased and capital stampeding into precious metals as faith in leadership crumbles.

It’s just that Americans haven’t seen it in dollars … until now.

If you want to play the guessing game, start with Washington. The people steering the economy inspire little confidence.

Stephen Miran — President Trump’s new Fed appointee, and the bannerman for the President’s fiscal policies — is banging the drum for rate cuts.

He’s doing this even though core inflation is stuck at 3.1%, well above the Fed’s 2% target.

He dissented at the last FOMC meeting, demanding a half-point cut. And he says he wants three more just like it before the end of the year.

Fed Governor Michelle Bowman also sounds dovish, warning the Fed may already be “behind the curve” as the labor market softens.

Unemployment is at 4.3%, but job growth has flattened.

She may have a point, and in any case, she argues that aggressive cuts are needed now.

Markets see this and draw their own conclusion: More cuts with inflation still hot equals even more inflation.

Add in tariffs choking the economy, and you’ve got stagflation — the toxic mix of stagnation plus inflation.

Debt Spiral

Stagflation would make it impossible to tame America’s debt monster. The numbers are already terrifying.

The U.S. national debt now stands at around $37.5 trillion, 123% of the country's GDP.

This year’s deficit is running near $2 trillion, up $92 billion from last year.

Projections indicate that annual deficits will swell to $2.6 trillion by 2035.

That path pushes debt-to-GDP into uncharted waters.

Every dollar borrowed costs more, thanks to rising interest expenses.

Social Security and Medicare are ballooning.

And tariff revenues aren’t covering the shortfall as hoped.

So, the market is making a simple bet …

The dollar may no longer be the ultimate store of value.

Gold is.

Gold’s Breakout Year

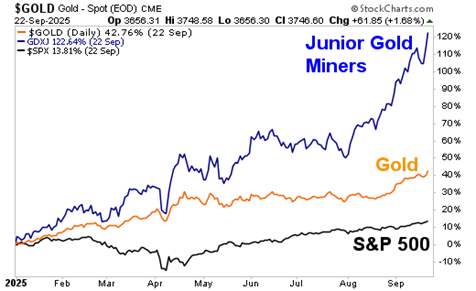

Gold is up an astonishing 42.7% in 2025 — its best year since 1979. Back then, it soared 133%.

Could we see another move like that? Don’t rule it out.

Goldman Sachs warns that if Fed independence is compromised, and just 1% of the $27 trillion Treasury market rotates into gold, prices could explode to $5,000 per ounce.

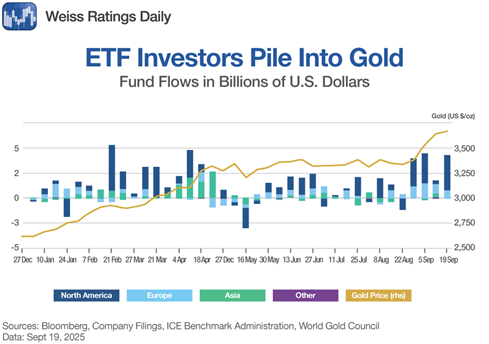

And the flows are already here.

Global gold ETFs saw inflows of over $4 billion last week, the largest surge in more than three years.

Year-to-date, net inflows are $57 billion — equal to 561 metric tonnes.

Central banks aren’t sitting this one out either.

Buying continues at a record pace, and China is angling to become the custodian of foreign sovereign gold reserves through the Shanghai Gold Exchange.

That could expand Beijing’s influence in global bullion trade — and deal another blow to U.S. dollar dominance.

Miners: Massive Leverage to Gold

You could buy physical bullion. Or you could go where the real torque is: Gold miners.

Here’s why …

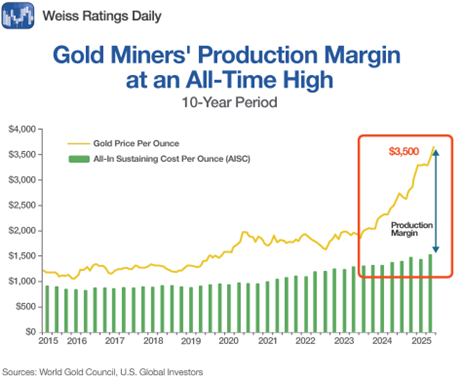

The average all-in sustaining cost (AISC) for major producers sits around $1,500 per ounce.

With spot gold blasting through $3,700, miners are reporting record profits.

Every dollar above all-in costs goes to the bottom line.

And unlike past cycles, miners are showing discipline.

The better companies are avoiding reckless spending sprees and moving fast on smart acquisitions.

Management teams are primarily focused on generating free cash flow, paying dividends and executing buybacks.

The Warning & the Opportunity

Make no mistake: Gold’s relentless rise is flashing red lights about the U.S. economy.

It says investors no longer trust policymakers to protect the dollar, keep inflation in check or rein in debt.

Hedge fund billionaire Ray Dalio recommends that gold should comprise 10-15% of every portfolio.

He’s calling U.S. debt plaque clogging an artery — with a financial heart attack looming.

So, listen to what gold is screaming.

Hedge your bets.

Own bullion if you want safety.

However, if you want to reap the upside, own the miners.

The easiest way in? Buy the VanEck Junior Gold Miners ETF (GDXJ).

It gives you diversified exposure to several names.

Year-to-date, you can see the S&P 500 is up 13.8% (good), gold is up 42.7% (better) and the GDXJ is up a whopping 122.6%! Wow!

The best part — I think there’s a lot more to come from where that came from.

Gold is screaming, and it may be warning us of danger ahead.

But if you view that scream as a signal rather than a threat, for savvy investors, it’s opening the door to generational profit potential.

All the best,

Sean

P.S. The GDXJ is a great one-stop shop for leverage to gold’s rally. But it isn’t the absolute best way to maximize your gains from it.

For those, you’ll need individual miners leveraged for gains not seen since 1979.

I urge you to watch this to see the ones I’m recommending right now.