|

| By Sean Brodrick |

Wondering why gold is swooning today … and what that means about the gold boom I’ve been predicting?

Here’s what’s happening.

Yesterday, gold hit a new all-time high of $4,381.21 per ounce. That move was fueled by the usual suspects:

- Market fears about trade friction,

- dovish Federal Reserve expectations and

- sustained central bank gold buying.

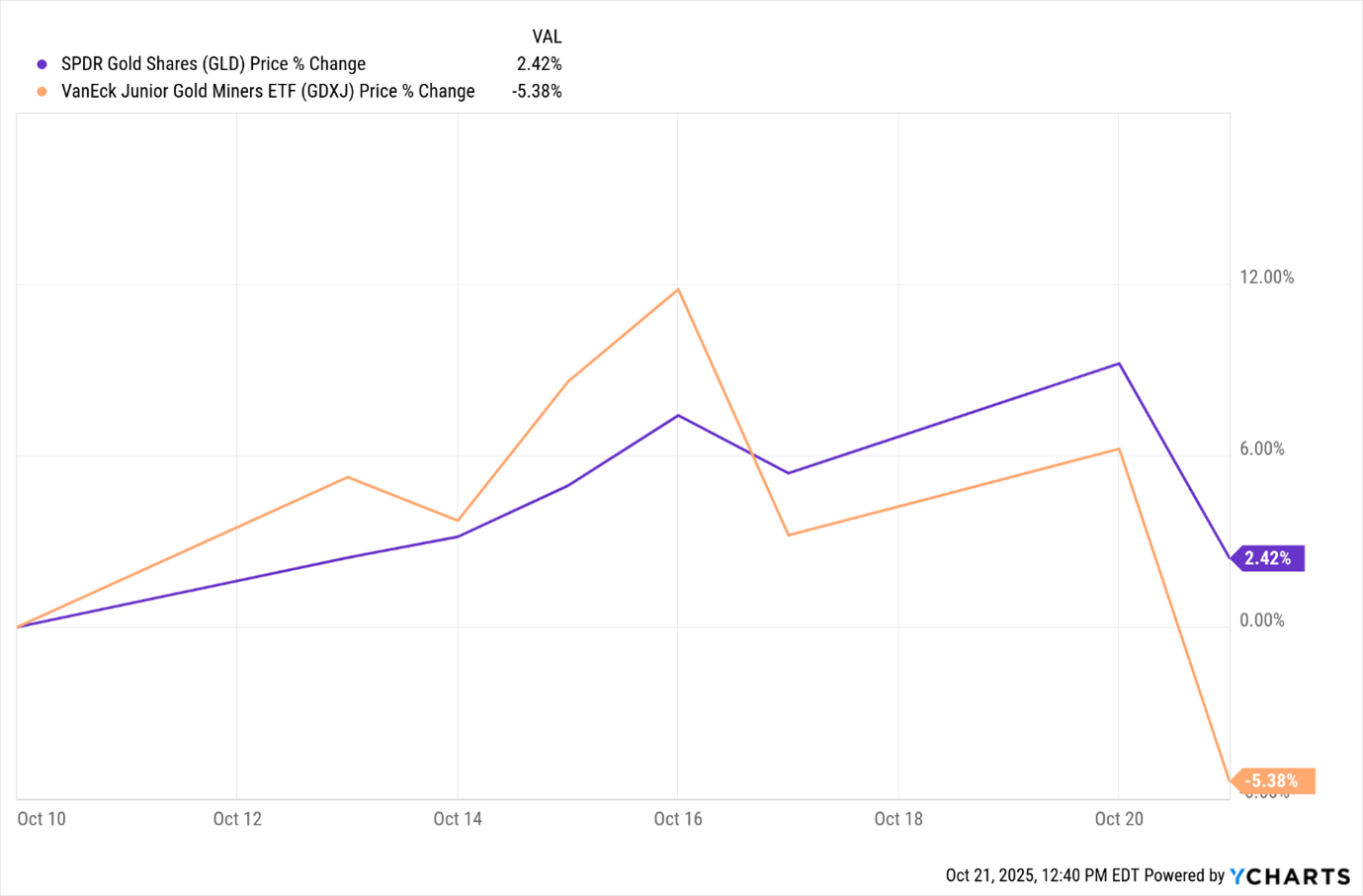

However, Monday’s surge came after a plunge on Friday …

And now, that’s been followed by a plunge in gold prices Tuesday.

Shell-shocked investors might be left wondering what’s going on.

It’s simple: Gold has run far and fast. And now, traders are banking gold gains.

Now, that’s something we did in in my Resource Trader and Supercycle Investor publications recently.

That said, I only recommended that my subscribers take half-gains. To move their original investment capital to the sidelines.

In other words, we still have plenty of skin still left in the gold game.

But it’s nice to bank some gains while you have them.

And it appears that other investors are doing the same today.

If you are worried about gold’s swoon … and wondering what to do now, whether that’s to sell, too … listen up.

New highs are not a sign of a market top. So, put that fear aside.

That said, there is some risk in gold.

The biggest risk, hands-down, is not having any skin in the game.

Another risk is that the daily price swings in gold (and silver) have turned extreme. So, we could see more of this choppy, highly volatile trading for the foreseeable future.

If this swoon-before-the-boom time lasts for a while, it could drive away speculative bulls and bears in the gold and silver futures markets.

Profit-taking isn’t the only catalyst for the past three days’ worth of swoons and booms.

The CME Group raised margin requirements on gold and silver futures right before the Friday session.

To be clear, there’s nothing suspicious about that. As gold booms higher, margin requirements must go up.

So, maybe gold will get a well-deserved rest for a bit.

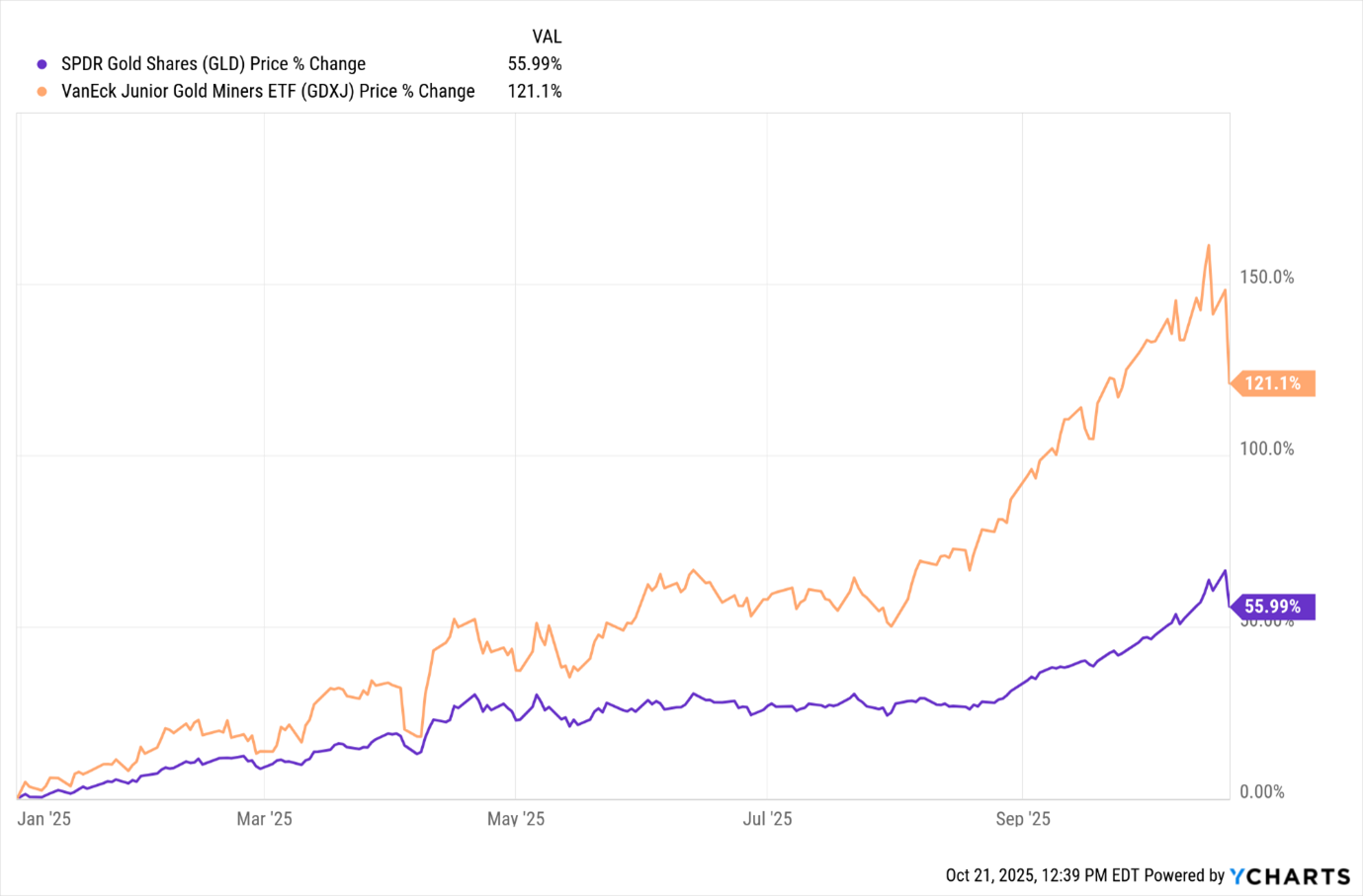

Regular readers will know that I like trading gold. But I really love trading gold miners.

So, these alternating gold swoons and booms could weigh on gold miner shares. That’s because they’re leveraged to the underlying metal.

However, gold miner earnings start rolling out Thursday, Oct. 23.

The world’s biggest gold miner, Newmont Mining (NEM), will kick off gold miners’ reporting season after that day’s closing bell.

What will I be watching?

Well, I expect that Newmont’s earnings will be interesting. But it’s Newmont’s forecast that I’m most eager to see.

That’s because rising gold prices are turning select miners into cash machines. Even if gold pulls back, miners will continue to rake in the bucks.

I’ll have two new ideas for you tomorrow morning (Wednesday) in Weiss Ratings Daily. That issue should land in your inbox shortly after 7 a.m. Eastern.

Even if gold and miners perk up between now and then, you’ll want to consider buying one or both stocks at current prices.

For now, don’t worry. Nothing moves in a straight line, and a correction is a normal and necessary part of any bull market.

If you must do something, make a shopping list. That’s what I’m doing for the Resource Trader and Supercycle Investor portfolios right now.

Best wishes,

Sean Brodrick