|

| By Sean Brodrick |

There’s an old saying that “America is the land of second chances.”

Well, if you missed your first chance at the artificial intelligence supercycle, you’re getting a second chance right now. Nothing moves in a straight line, not even AI.

Earnings season brought pullbacks in a bunch of stocks and funds that were priced for perfection. The big trend is still higher, which means this is your buying opportunity.

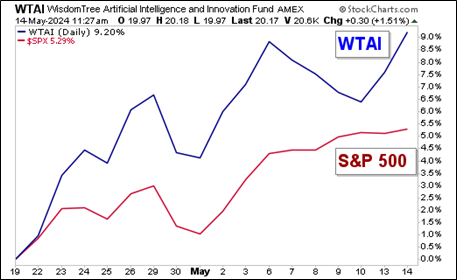

Let me show you what I mean. Here’s a chart of the WisdomTree Artificial Intelligence and Innovation Fund (WTAI), a fund that tracks a basket of stocks focused on AI software, semiconductors, hardware and AI innovation.

You can see that it tumbled hard this earnings season — more than 15% from its February peak.

Then, in April, it started rallying. It’s now approaching the 50-day moving average, which many technical analysts see as the dividing line between bullish and bearish movements. I believe WTAI is going to push above the 50-day, and then be off to the races.

Why did AI stocks sell off? Because so much money piled into those stocks, they were priced for perfection. And forecasts that were once sky-high were pared back a bit. But even with more realistic expectations, the outlook for AI is extraordinary.

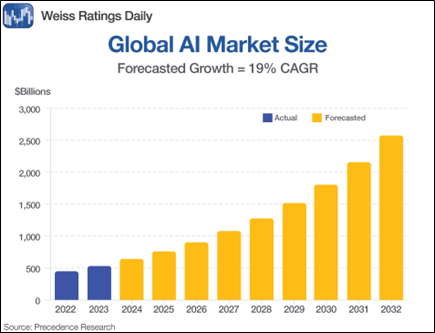

There are various forecasts for AI growth. Most of them have come down a bit, but here’s one example from Precedence Research …

That sure looks like red-hot growth. In fact, Precedence is forecasting a 19% compound annual growth rate (CAGR) in spending on artificial intelligence through 2032.

The AI supercycle is real, and after a sell-off, there are many great stocks that look like real opportunities.

And heck, the next move in stocks leveraged to artificial intelligence could deliver life-changing wealth to people who act fast. Because AI is going to supercharge the next tech supercycle.

The technology supercycle is the most powerful cycle in human history. It’s unlocking a $13 trillion opportunity, and you can get your own piece of it.

We’ve seen previous tech supercycles before. Past tech supercycles were sparked by electricity, the steam engine that kicked off the Industrial Revolution and the internet.

This new tech supercycle — led by AI — will see a wave of innovation so intense and transformative it has the potential to reshape human existence.

And we’re already seeing this new AI-led tech supercycle pay off. For example …

- Google's DeepMind built a tool that discovered a whopping 2.2 million new materials. And 380,000 of them are stable enough for research, a feat that analysts say equals “800 years' worth of knowledge.”

- Generative AI is also speeding up drug research, coming up with new drugs like abaucin to treat antibiotic-resistant bacteria. According to Grand View Research, the global AI drug discovery market is expected to grow at a CAGR of 29.6% through 2030.

- And AI is also making its way onto the battlefield. We’ve learned in Ukraine that a $400 drone can kill a $2 million tank. Now imagine a swarm of drones controlled by AI. That can tip the scales of battle enormously.

In this tech supercycle, the power of AI is going to deliver potential gains much faster.

According to the McKinsey Global Institute, AI is going to be adopted in some capacity by 70% of companies by 2030. And it’s going to contribute $13 trillion in new economic growth globally. That’s nearly half the size of the entire U.S. economy.

The last tech supercycle lasted for more than a decade. This upcoming AI trend could deliver the bulk of its gains in the first five years.

How Can You Ride This Supercycle?

We’re already playing this massive new trend in Supercycle Investor. If you’re doing this on your own, be very careful. Buying the wrong stock can take your portfolio to the cleaners.

One easy way to do it is to buy a fund like the one I mentioned earlier, the WisdomTree Artificial Intelligence and Innovation Fund. It has an expense ratio of 0.45%. And since it bottomed in April, it’s turned in nearly double the performance of the S&P 500, as this performance chart shows …

To be sure, an ETF won’t get you the truly massive returns we’re targeting in individual AI stocks. But at least you won’t miss the boat. 2024 is going to be a great year for select AI stocks.

I hope you’ll ride this rally for all it’s worth. Your second chance is here. Don’t miss it.

That’s all for today. I’ll be back with more soon.

All the best,

Sean

P.S. AI is also rapidly changing how big money in the market is made. In fact, I urge you to watch this presentation on one particular AI system that Dr. Martin Weiss calls his “legacy’s crowning achievement.”