|

| By Nilus Mattive |

Back in high school, I worked as a line cook at a large pizza restaurant.

For minimum wage, which was $4.25 an hour, I prepped salads … made sandwiches … boiled pounds of pasta and applied an array of sauces …

And much to my chagrin on Wednesday wing nights, I dropped basket after basket of poultry parts into a deep fryer for hours on end.

Every once in a while, a server came back to berate us when an order got messed up or something else wasn’t done correctly.

But they never once shared their tips.

Hey, maybe I still have a little resentment from that time in my life. But for years now, I’ve been thinking that tipping in America is getting out of hand.

And I’m not alone.

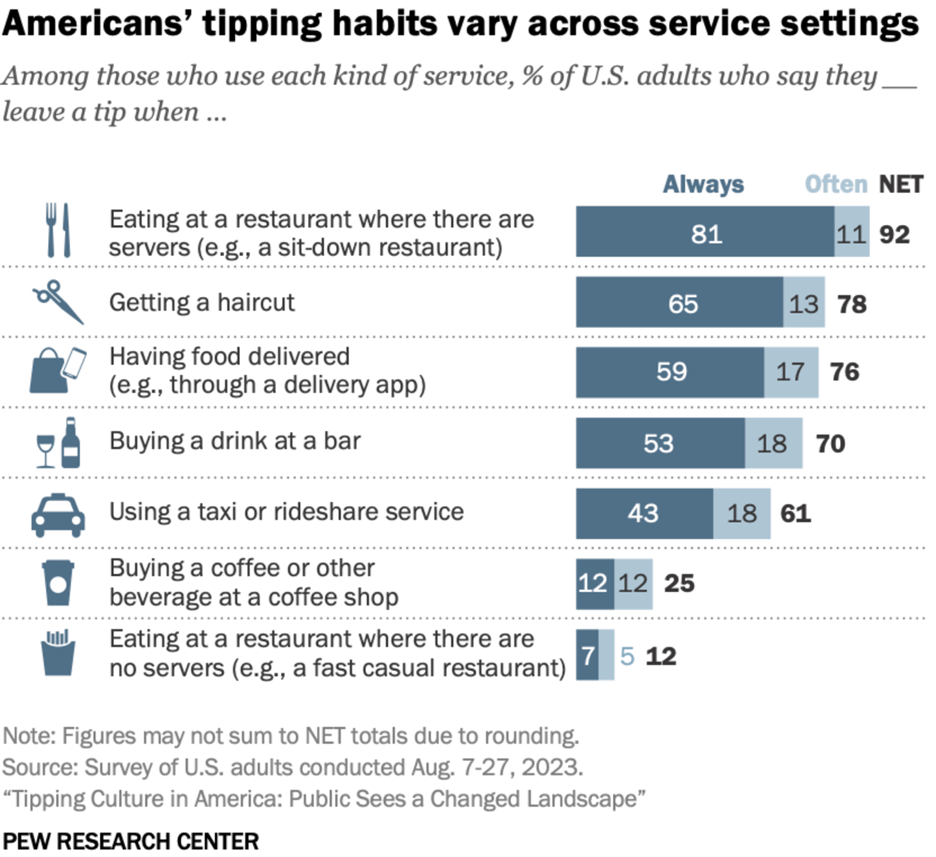

According to a survey Pew Research did toward the end of 2023, 72% of U.S. adults said tipping is expected in more places now than it was just five years earlier. A large majority remain confused about when or how much to actually give.

I’ll be the first to say this isn’t just a polarizing topic, it’s also a relatively minor one in the grand scheme of personal finance and money matters.

Still, it touches on a lot of larger themes I think worth talking about … especially now that the Big Beautiful Bill is aiming to exempt at least some tip income from taxation.

A Brief History of Tipping in America

I travel quite a lot, and it’s always eye opening to see how tipping works in other countries.

In places like El Salvador or Barbados, a gratuity isn’t really expected at informal places. But fancier restaurants will add a 10% service charge onto the bill.

In Italy, you might see a service charge on the bill, but that’s more like a seating fee and not a gratuity.

The latter isn’t really expected, but a couple euro is considered a nice gesture for exceptional service.

Even at a fine dining establishment, a server would be surprised if you left more than 5% or 10% of the total bill.

And in Japan? Tipping is generally frowned upon.

You might be surprised to learn that it used to be the same way in the United States.

As this article from the Richmond Fed explains:

“In the early history of the United States, however, tipping remained uncommon and was subject to intense criticism.

“The practice of giving vails in England was wrapped up in long-standing European class distinctions between the tipper (wealthy aristocrats) and the recipients (servants).

“Many Americans viewed this practice as antithetical to the country's founding egalitarian principles.”

That changed over time for a couple of different reasons.

Initially, when hotels still included meals and served them family style, tipping was used to bribe servers into getting more food and/or faster service.

Later, it really gained steam as Prohibition cut into restaurants’ profits. More establishments realized tipping could help them keep wages lower.

And despite a back and forth — which included several states temporarily outlawing tipping altogether — it’s been this way ever since.

What’s more, tip percentages have also doubled!

Up until the middle of the 20th century, a 10% tip was considered standard.

By the time I was chopping romaine professionally, the customary tip for good service in a full sit-down restaurant was 15%.

If things were exceptional, a generous person might go to 18% or 20%. Many certainly left far less.

The only time tipping was ever automatically applied to any type of check was for a large table of guests — maybe eight or more.

Meanwhile, if you went to a coffee shop, an ice cream parlor or the local hot dog counter … you probably weren’t being asked for anything.

Maybe there was a jar with a cleverly written note. You’d throw the change — or even a dollar — in there.

The New Normal

These days, it seems like a 20% tip has become the new norm …

It is often applied — or at least aggressively suggested — not just at full-service restaurants but anywhere a food or drink product is being purchased …

Plus, I have seen plenty of additional add-ons creeping in over the last several years, too — everything from mandatory service charges that are applied separately from regular gratuity to an option imploring me to “buy the kitchen a round of beers.”

If only the latter was a thing back when I was in school!

A lot of this “tipflation” — particularly the dreaded iPad screens daring us to be stingy in front of a line of people — started during the pandemic through a confluence of new checkout systems and a feeling of solidarity with a suffering restaurant industry.

But just like the rise of tipping itself during Prohibition, it never went away.

Instead, it simply continued to spiral out of control … along with the massive uptick in inflation.

Which brings up an interesting point:

Many American workers haven’t gotten nearly enough in pay raises to keep pace with the jump in costs over the last five years.

However, because tips represent a percentage of the bill, that income always — and AUTOMATICALLY — keeps pace with rising costs.

The fact that the percentage being tipped has essentially doubled over the last century only amplifies that built-in inflation protection.

Can you imagine all of America’s salaried workers automatically getting raises every time as their employers’ revenues went up?

Yet now the Big, Beautiful Bill wants to exempt at least some tip income from federal taxation.

Why? Because a lot of tip income goes unreported in the first place?

Other than codifying what was previously simple tax fraud, there’s no logical explanation at all.

Even the arguments related to minimum wages — which are adjusted downward in some states for employees receiving tips — don’t really hold water.

Heck, here in California, workers receive at least $16.50 an hour whether they receive tips on top of that or not.

Now look at it this way …

Picking Winners & Losers

You’re a line cook at a restaurant. In the very best case, you make the same official wage as the servers. In most cases, you probably make less … even before tips.

Yet you will pay full federal income taxes on all the money you earn, while the bulk of their income will be exempt.

Want to take things a step further?

Let’s say it’s your day off and you go out to eat at a similar restaurant.

Since you’re in the industry, you tip generously.

By default, you’re paying with money that has been reduced substantially through taxation while the person receiving it — who probably earns more than you — gets to keep it all.

This is yet another glaring example of the government picking winners and losers.

And for the majority of Americans who were already feeling a massive round of tip fatigue, it adds insult to injury.

Their buying power has gone down because their earnings have not kept pace with soaring prices.

Yet they’ve been asked to give more and more, first under the guise of temporary goodwill gestures, and now out of greed on the part of certain businesses that don’t want to bear the costs of operating like everyone else.

Worse, we’re starting to see this trend move deeper into other corners of the service industry.

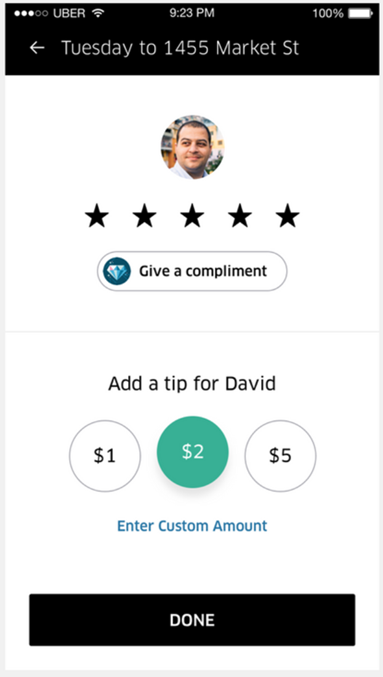

Take the push to tip on rideshare apps like Lyft and Uber.

Sure, back when I lived in New York City, you might throw the cabbie a buck or two for getting you somewhere especially quickly … or stopping for you in the first place.

But now we have previously agreed-upon contracts with exact routes mapped out in advance … ETAs down to the minute … and prices spelled out quite clearly.

Why are we supposed to be tipping for that?

Or, to come at it from another angle, why AREN’T we tipping airline pilots for landing our planes smoothly or getting us to our final destinations on time?

Speaking of planes, why aren’t we tipping the flight attendants on those planes for bringing our bags of pretzels and cups of water?

Don’t forget that most tips are made on after-tax amounts, too!

The more rocks you turn over, the less it makes sense.

My New Game Plan

I won’t hold my breath for any state to make tipping illegal again or for restaurants to simply pay their service staff normal wages …

I don’t expect our society to come to clear rules of engagement on what has become a rat’s nest of etiquette and guilt-tripping …

And despite the unfairness inherent in the idea, I figure at least some version of the new federal exemption for tip income will probably get passed this summer.

However, I’m going back to 15% as my baseline tip for full-service restaurants from here on out.

If that tax-exempt income is now going up yet another 20% relative to my still-taxed income, then it’s only reasonable to true up the difference from my side.

Ironically, doing so would still only bring the result back to an inflation-adjusted version of what it was back when I was getting yelled at for burning chicken wings.

As far as tipping for anything else? Other than a buck added for exceptionally fast or friendly counter service, it’s going to be a hard pass from here on out.

I suspect many of you will have strong opinions on this subject as well as my proposed solution … by all means, feel free to send them my way here.

If I get enough feedback, I’ll consider a follow-up article that highlights some of the best stories and points on both sides of the topic.

Best wishes,

Nilus Mattive

P.S.Tipping isn’t the only thing that seems crazy right now. Doesn’t everything around you feel a bit … chaotic?

You aren’t alone if you feel that way. Dr. Martin Weiss just laid out why we are now in an “Age of Chaos.”

He and I also lay out six easy steps you can take to protect yourself here.