|

| By Jon Markman |

Tesla is at the middle of another firestorm, and for once it has nothing to do with Elon Musk.

The electric vehicle maker is under fire from Dan O'Dowd, a software developer who has taken issue with Tesla (TSLA)’s full self-driving capability system. O’Dowd claims FSD is fundamentally unsafe.

Investors should use the weakness to buy Tesla shares. I’ll explain why in a minute.

You see, O'Dowd is the founder of Green Hills Software, a company that develops operating systems software and programming tools used in nearly everything like desktop printers, high-precision military aircraft and vehicle autonomous driving systems.

O'Dowd claims that when companies absolutely need their software applications to work without fail, they depend on Green Hills because it is undeniably the best foundation to build upon.

It's a heck of a claim that has detracted from his criticism of Tesla software.

The Green Hills chief executive has been embroiled in a year-long attack on FSD, the Level 2 autonomy software being developed by Tesla.

O'Dowd even paid for a Super Bowl advertisement in February to disparage FSD as dangerous. One demonstration showed Tesla vehicles with FSD running down cardboard cutouts of children.

The Real FSD Story

To be clear, O'Dowd is deliberately mischaracterizing FSD.

FSD is in beta. It is not capable of full autonomy, and Tesla makes no such claim. Users enrolled in its FSD program are instructed to remain alert and ready to take over at any time.

This is an important distinction that is almost always ignored by the media. They're focused on the name and are missing the point that FSD requires attentive humans.

In fact, journalists are burying the lede.

The Tesla FSD story is about a major public company using AI to rapidly build a functioning autonomous vehicle platform.

Tesla has a fleet of approximately 400,000 FSD vehicles now logging one million miles everyday in the U.S. and Canada. More countries will come online later this year.

This data is being methodically analyzed at Tesla and used to train its computer vision AI algorithms.

Dojo Changes the Narrative

In July, the company will begin to process that data on Dojo, a supercomputer built from the ground up for computer vision. Elon Musk claims Dojo can compute millions of terabytes of video data in real time, collected from Tesla's fleet.

Dojo is a game changer, and Dan O'Dowd is going to hate it.

The supercomputer is exactly the kind of mind-bending development that investors love. Its structure is unique. Dojo uses bespoke silicon and a data science process called training titles to extract only the most pertinent information from the FSD data deluge, leading to new processing benchmarks.

Dojo might be a big new competitive advantage for Tesla, and it could become an industry standard, licensed to other automakers. Last month, Musk tweeted an announcement to share the Tesla supercharger network and potentially license its FSD technology with the rest of the industry.

We don't know when or if Dojo is going to lead to true FSD on Tesla vehicles. We do know that it is a great AI success story, and it will absolutely sell in the current environment. in short, this is good news for Tesla shareholders.

Meanwhile, several YouTube video bloggers are posting impressive FSD outcomes.

Whole Mars Catalog and Dirty Tesla have entire channels dedicated to rides taken under the guidance of FSD, including failures.

How to Play the FSD Hate

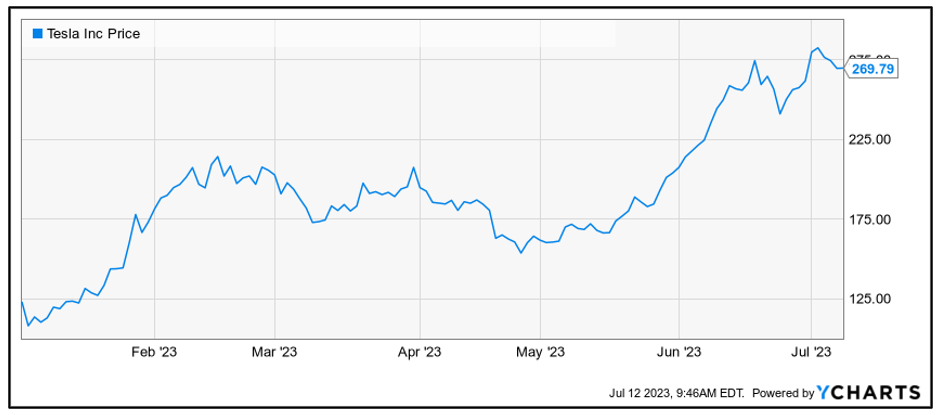

Tesla shares have been on a tear during 2023, rising by 113%.

Click here to see full-sized image.

Earlier this month, the company reported that Q2 deliveries swelled to 466,140 units. Production during the quarter reached 479,700 vehicles. Each metric rose greater than 80% year over year.

Any controversy that shines a light on FSD and the impressive AI strides made at Tesla is bullish for the stock price. Too often investors don't consider Tesla to be an AI-centric business.

Tesla shares trade at 53.8 times forward earnings and 8.9 times its sales. Although this is not cheap by the standard of regular automotive companies, Tesla is in a league of its own.

Investors should consider buying Tesla on any pullback to $210, the rising 50-day moving average.

That’s all for today. I’ll be back with more soon.

All the best,

Jon D. Markman