Head North for the Holidays: Why You Should Bet on Canada

|

| By Sean Brodrick |

There is a boom going on in North America. I’m talking about Canadian stocks.

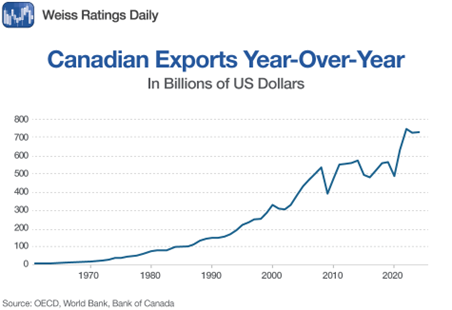

While that country’s GDP growth remains modest — 1.1% to 1.3% for the year — its exports are surging, and that is propelling Canadian stocks higher.

Look at how Canadian exports are ramping up!

This is waking up the sleepy Canadian stock market.

I believe betting on Canada is one of the smartest moves you can make for the end of this year and beyond!

Let’s start with some stats.

Here’s a chart showing the change in Canada’s top exports year over year.

Most of Canada’s top export commodities saw growth from 2024 to 2025, with particularly strong increases in precious metals, wheat and meat exports.

For investors hunting commodity-backed growth, Canada is quietly shaping up as one of the most compelling macro stories for 2026.

Where’s the Beef? In Canada, Obviously

The biggest shockwave came from protein.

Canadian beef and poultry exports blasted more than 75% higher year over year.

That’s a stunning turnaround powered by recovering herds and sharply improved feed conditions.

Compare that with the Western U.S., where nearly half the national herd remains under drought stress and ranchers choke on high feed costs.

Result: Canada is exporting aggressively into a supply-tight global market just as U.S. producers remain stuck in reverse.

Wheat: A Global Buyer Pivot

Wheat was another standout.

Canadian exports jumped more than 25% as the prairies swung back to bumper conditions, letting Canada reap market share across Asia, North Africa and Latin America.

With Russia and Ukraine still facing export disruptions, buyers from Cairo to Shanghai shifted to Canadian grain.

America’s tariff stand-off with China pushed that country to import more Canadian grain, too.

Precious Metals Shine!

As gold and silver prices move higher, the value of Canada’s precious metals exports is way up.

In fact, they surged nearly 38% in value, helped along by a weaker U.S. dollar and continued central-bank stockpiling.

Canada’s mining complex is built for moments like this, with its steady output, world-class refining capacity and honest government. That’s a sweet spot.

The bottom line is that Canada’s export engine is outperforming that of most advanced economies.

And that strength is showing up across commodities, from agriculture to railroads, ports and resource-heavy manufacturers.

Energy: The 2026 Comeback Story

And there’s more good news coming. Low prices dragged Canada’s energy exports in 2025.

The sector is lining up for a strong rebound. Export Development Canada expects nominal energy-export revenues to grow 4.9% in 2026.

Oil sands and thermal output are set to climb 4% to 5% as producers like Canadian Natural Resources push expansions.

LNG Canada will finally reach full export capacity, opening the spigot to Asia and unlocking a long-awaited phase of natural gas growth.

New pipelines and marine infrastructure are giving Canadian crude more direct access to U.S. refiners and to emerging Asian buyers.

How You Can Play It

You can buy individual stocks. And my subscribers are already raking it in on individual names.

Or you can buy a basket of the best Canadian stocks: iShares MSCI Canada ETF (EWC).

It has a Weiss Rating of “C,” an expense ratio of 0.50% and it’s plenty liquid.

The EWC moved sideways throughout October and November.

It’s building up what I call an “energy band” for a big move.

And I believe that move is much higher. My target for a breakout is $65.

So, treat yourself this holiday season.

Stuff your portfolio with an ETF riding global megatrends for potential megawealth — in agricultural products, precious metals and energy.

All the best,

Sean