|

| By Jim Nelson |

We just closed the books on a very successful 2025 Weiss Investment Summit last night.

Today our whole team is meeting to share what we learned from our attendees so that our 2026 event is even bigger and better than this one was!

Normally, we’d wait till we’re all back at our desks to give you a rundown about what your experts are saying.

But this year, the primary message from this intimate gathering is too important to delay.

You see, the whole event kicked off with a warning — and a major piece of advice — from Dr. Martin Weiss himself.

No matter what your politics are. No matter where you live, how much wealth you have, or the steps you still need to take along your wealth-building journey, one thing is clear ...

We are living in an Age of Chaos.

It’s not the first time Dr. Weiss has seen this.

He told Monday’s amazing crowd of enthusiastic Weiss members that, when the Dot-Com Crash and Great Financial Crisis hit investors, his life’s work was invaluable.

Weiss Ratings helped people of all financial backgrounds and investment chops navigate each with precision for profits.

When tech stocks collapsed to pennies — and many to zero — Weiss Ratings was the first to recommend the ones that would come out stronger.

Think Apple (AAPL). Weiss called it a “Buy” when it was trading at around $10. Through many years of innovation and stock splits, that “Buy” rating could have produced a 30,000%+ profit for anyone who acted.

Then during the Housing Crisis and the fallout from that, Weiss successfully helped members steer clear of the banks that were in trouble before anyone else had any clue.

Dr. Weiss’ story is too long to detail here. But he talked about how his father helped investors navigate the Great Depression and how, together, they started Weiss Ratings in the midst of the stagflation of the 1970s to help a new generation of investors.

The one unifying theme from all these events is how he recommends investors shape their portfolios to come out ahead.

Diversification is the key. And that, so far, has been the centerpiece of the 2025 Summit.

And what your experts are helping members do is find what to diversify into … and how to allocate assets.

We understand that not everyone could make the trip to Boca Raton. But this message is too important to keep just among those here with us.

Fortunately, you already have plenty of resources on the subject. Most notably, your Safe Money expert Nilus Mattive has written extensively on the subject.

While we wrap up this fantastic event, one filled with actionable strategies across a wide range of asset classes, we urge you to refresh on the crucial subject at the center of it.

The best place to start is the aptly named article “If You Aren’t Diversifying, You’re in Big Trouble.”

We sent you this on March 17 — weeks ahead of “Liberation Day.”

In it, Nilus gave you plenty of ways to add layer after layer of safety to your portfolio.

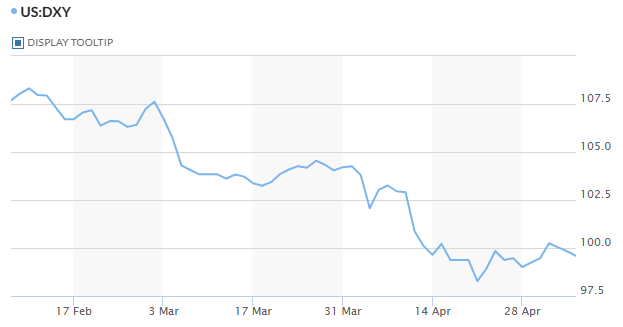

Then, a week later, Nilus told you that it was “Time to Decouple from the Dollar.”

With the way the dollar has fallen so fast and furiously against other currencies, we’d say that was spot on.

Does that mean it’s too late to act?

Absolutely not.

As Nilus himself said, “The best time to start diversifying was back when I first told you to.

“The next best time is right now.”

So, while we wrap up down here, this is a great opportunity to catch up on any articles you might have missed … or to just refresh yourself on them.

You can find all of your archives here.

As you can see, this is an important solution for this Age of Chaos. And you don’t want to ignore it.

Until next time …

Jim Nelson

Managing Editor, Weiss Ratings Daily