|

| By Nilus Mattive |

As I descended the escalator, the past 24 hours of travel quickly faded away.

Gone were the delayed flights … the bus rides between terminals … and an entire night spent (sort of) sleeping on the floor of the Singapore airport with nothing but an eye pillow to block out the fluorescent lights overhead.

Yes, I was in yet another airport.

But the escalator was taking me down to Cathay Pacific’s first-class lounge, The Pier — one of the top airport lounges in the world.

After checking in, I went to the dining area, where I enjoyed a full tasting menu, as well as additional à la carte menu items like wagyu steak.

Next, I took a hot shower in a private bathroom that rivals what you’d find in an upscale hotel …

And eventually, I made my way to the business-class section of the lounge for a custom tea tasting.

There was also a library, full open bar and spa, offering complimentary services like 15-minute neck and back massages.

All this was completely free because I currently hold Emerald Status with the Oneworld Alliance frequent flier program.

But I’m not telling you this to brag ...

I’m telling you this to prove just how valuable credit card rewards programs can be.

Because, sure, I travel frequently.

However, most of the perks I enjoy are directly related to my judicious use of credit cards far more than how many miles I fly in any given year.

Now, before I go any further, let me say this …

The very best investment anyone can make is paying off existing credit card balances as quickly as possible.

The average interest rate on credit card debt is about 25% right now.

In other words, paying off that balance is like getting a risk-free return of 25%.

And considering the effects of compounding, letting unpaid balances sit for long periods of time is financial suicide.

What if you or someone you know has a current balance that can’t be paid off immediately?

I suggest calling the credit card issuer and trying to negotiate a better rate.

Or move the balance to a friendlier lender with a better interest rate.

There are usually 0% intro APR offers floating out there at any given time.

Just watch out for balance transfer fees, teaser rates and the like.

I only recommend using credit cards as a more convenient form of cash.

That means borrowing what I can afford to pay back immediately and paying off my balances in full and on time every single month.

As long as you do this, it doesn’t even matter what your interest rate is.

Nor does it matter if the company charges ridiculous fees for late payments.

These days, I even have all my credit cards scheduled for automatic “full amount due” payments just to make sure I don’t forget to meet a deadline.

What about annual fees?

There are plenty of great credit cards that don’t charge them, which is obviously preferable in most situations.

However, I’m willing to pay an annual fee on certain cards … as long as they provide benefits that are worth the yearly cost.

For example, I have a Marriott rewards card with a $650 annual fee.

But every year, I get back $300 in credits for using my card at restaurants …

A free night certificate worth roughly $731 …

Automatic platinum elite status with Marriot’s loyalty program …

Plus, several additional benefits.

So, my $650 annual fee is an “investment” that easily returns double back to me.

Indeed, as a responsible borrower, I love making credit card reward programs work for me!

Annual benefits associated with different cards are just the beginning.

Earning points or cash back for every dollar I spend makes using my cards far better than paying cash, too.

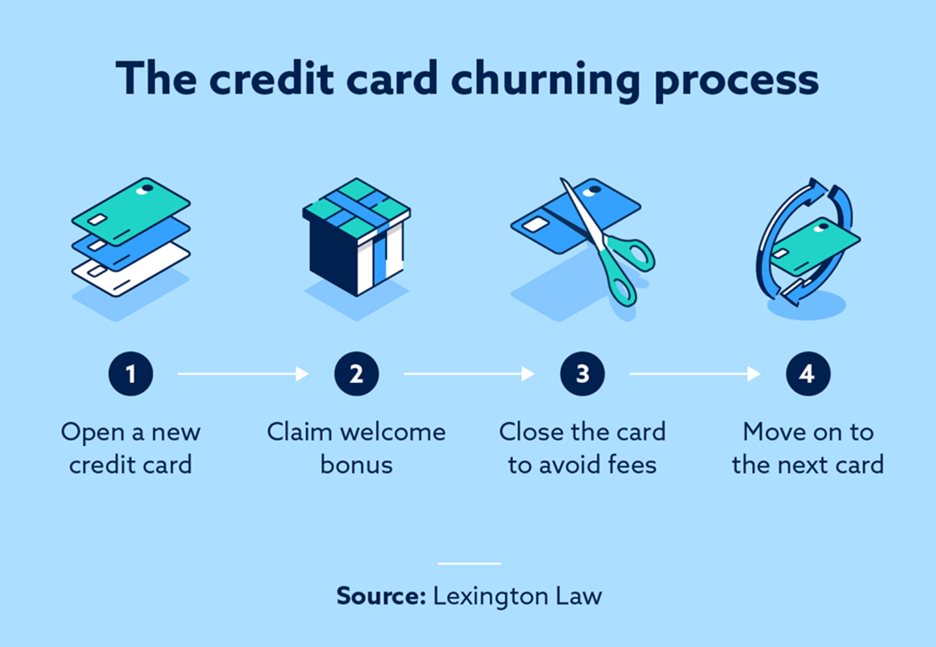

And what many people fail to realize is that the biggest windfalls come from signing up for different credit cards — and those offers change all the time.

For example, I once signed up for two Southwest Rapid Rewards Visa cards in the same year and got 100,000 Rapid Reward miles in the process.

That was good enough for four or five free round trip domestic flights.

Even better was that I only needed to earn a modest number of additional miles to get a coveted companion pass …

Which allowed me to take a companion on every flight for the rest of that calendar year PLUS the next onefor free (other than mandatory taxes).

And yes, the companion pass even applies to free travel you book with miles!

Does something like this interest you?

Then I have good news … Southwest is currently running a similar sign-up promotion through Sept. 17.

Only you can decide which particular programs and strategies make the most sense for your goals.

But the overall point is simple:

It’s relatively easy to squeeze extra benefits out of the money you’re spending.

All it takes is a little planning and discipline.

Just pay attention to all the different bonuses out there … how they interact with individual reward program rules … and then use that information to your advantage.

Do a quick search, and you’ll find plenty of websites that provide in-depth profiles on various card offers and rewards programs.

Some popular ones include www.nerdwallet.com, www.millionmilesecrets.com and www.thepointsguy.com.

Personally, I’m flying on American Airlines a lot more these days and working on keeping my high status with them, as well as their Oneworld partners.

After all, I’d much rather spend my layovers getting free massages than sleeping on floors.

Best wishes,

Nilus Mattive

P.S. While these are my favorite personal finance hacks, they aren’t even close to the first steps I recommend everyone take to protect their wealth.

Dr. Martin Weiss and I came up with six steps you need to take first to navigate today’s dangerous times in the market and in life.