|

| By Gavin Magor |

Whilst the U.S. is on the edge of its seat for the election tomorrow, investors need to hear a siren, a trumpet or perhaps a clock tower bell.

History says don’t be spooked.

In fact, I expect the recent Halloween holiday to have been spookier than what we’ll see in coming weeks from an investment standpoint.

In fact, another major event is taking place. That’s on Wednesday at the start of the Federal Reserve’s next FOMC meeting, where it is widely anticipated they will announce another rate cut.

Right now, we’ve seen solid corporate earnings and nothing overly concerning within the markets.

Make no mistake, I expect volatility. But I remain cautiously optimistic. And the general trend appears to be up.

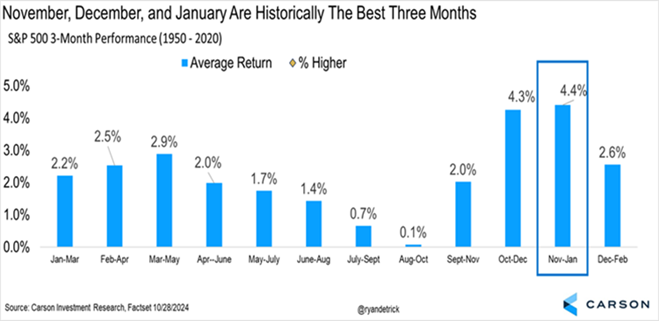

Again, history never repeats … but it often sings to a similar tune. And seasonality trends are also in investor’s favor with November to January being a strong time of year for the market:

So, although we all have our election uncertainties, history says don’t panic from an investment standpoint.

Continue to add strong plays to your portfolio. And it may even be a good time to consider adding some ETFs to your portfolio to take advantage of seasonal strength.

In fact, my premium Weiss Intelligence Portfolio Members are handily beating the broad market’s performance this year. And they have ETFs bolstering their portfolios.

It’s only fair that I keep which ones private. But I can tell you to be sure to explore our Weiss Ratings ETF screener page.

“EZ” ETF Investing with the Weiss Ratings

After a few easy clicks over on the Weiss Ratings website, I was able to find all of our ETFs rated in between “A” and “B.” I then sorted them by volume.

Take a look:

Above are the top six ETFs that are populated based on trading volume.

Let’s take a closer look at the top name, the Energy Select Sector SPDR (XLE).

I would argue that XLE is one of the best ETFs to target if you are looking for energy exposure for your portfolio.

After clicking on its name, we can see everything easily on its screener page.

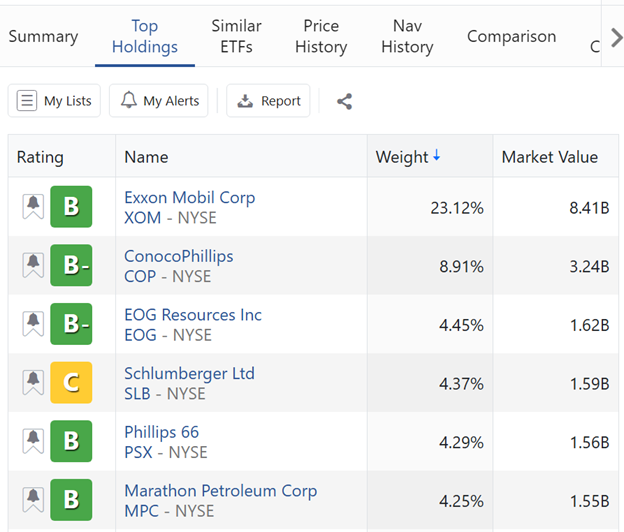

Here are XLE’s top components:

I’m sure you are familiar with several of these names, especially Marathon Petroleum (MPC) and Exxon Mobil (XOM).

But that’s not it. Within our ETF research, you can even target other sectors’ ETFs if that’s the exposure you are looking for.

Here at Weiss Ratings, we like to think of it as doing all the hard work for you … so that your investment research is as easy as possible.

But we also have some incredible hands-on investment strategies as well. And some of my fellow editors have put together some amazing investment plans.

In fact, my crypto expert colleague, Juan Villaverde, has recently announced that tomorrow will trigger a remarkable event.

A Titanic Time for This Timing Model

Juan’s Crypto Timing Model has pinpointed tomorrow as the start of a major crypto bull run. And it has very little to do with the U.S. election.

His timing model is three-for-three in pinpointing this signal in the past. He has recorded gains of 16X, 20X and even 93X.

That’s a 100% success rate. And I would hate for you to miss out on this golden crypto opportunity.

For more information, be sure to click here now.

So, no matter the outcome tomorrow, stay the course … trust the Weiss Ratings … and you will surely be one step ahead of the pack.

Cheers!

Gavin