|

| By Sean Brodrick |

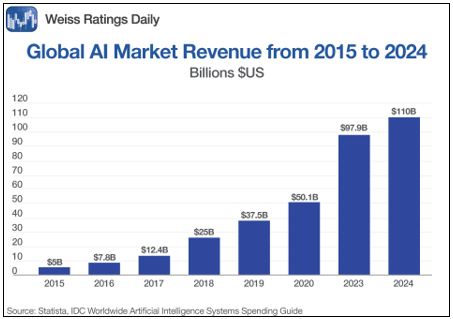

According to the IDC's Worldwide Artificial Intelligence Spending Guide, global spending on artificial intelligence is growing fast.

In fact, a market that was worth $5 billion in 2015, and $50.1 billion in 2020, should reach more than $110 billion in 2024. That’s a compound annual growth rate of 20.1% between the 2019-2024 period.

That’s a heck of a trend. But it’s only the tip of the iceberg. It’s the tip of a tech supercycle that’s starting now, being led higher by AI. Frankly, I believe IDC is being too conservative in its estimate of the AI market.

Now, there are other forecasts of AI market growth. And I’ll explore some of those in future articles. But ask yourself this question: “What if IDC is right?”

If IDC is right, then the opportunities for profit are truly extraordinary, as long as you buy the right stocks.

Why Is the AI Revolution Happening Now?

The amount of computer processing needed for AI is huge. HUGE! So, the dream of an AI-driven world was not possible even a decade ago. There simply wasn’t enough computing power available, and it was relatively expensive.

Chips advanced, and costs plummeted. Along with that, companies and governments started collecting data — lots of data. Big Data is at the heart of AI’s power. AI can take enormous amounts of data and process it to reveal answers and solutions that used to take human researchers years to accomplish.

Now add in machine learning — AI’s ability to learn about something without being explicitly programmed. Suddenly, you don’t need programmers. ANYONE can use AI.

If you hate corporations and governments getting all in your business, then AI will make you uncomfortable. I know I’m already leery when I talk to my wife about potential vacations, and suddenly, all we see are tourism ads. Our phones are listening!

On the other hand, as an investor, you can appreciate why companies and governments will spend billions and billions of dollars getting AI right. The advantages are massive.

You probably know AI from the pretty (and sometimes weird) pictures it makes. But it can be used for so much more. There are many ways to use AI. Let me tell you about three that I think will lead the pack …

Research Breakthroughs: In the fields of medicine, aerospace, new materials and transportation, AI can make intuitive leaps that have eluded human researchers for years. We’re going to see a steady stream of “miracles” roll out of the lab and into our lives. Companies will spend billions of dollars accomplishing this.

Defense applications: Drones are transforming the battlefield. You’ve probably seen videos of drones in Ukraine dropping bombs on soldiers and tanks. Well, AI-equipped drones are downright terrifying. AI can transform a drone into a relentless hellhound of destruction.

And it’s not just drones. AI is coming to tanks, submarines, fighter jets and more. AI lowers costs and saves soldiers’ lives. Governments around the world, led by the U.S. and China, are pouring money into AI weaponry now.

Efficiency: AI will be able to evaluate existing businesses and see how they can accomplish their production, customer service and long-term goals faster — all while using less energy and materials to do it. So, AI will be a great tool for businesses to streamline operations and enhance customer satisfaction.

To be sure, AI can be used for good … but it can also be used for bad. Governments are racing to put in some kind of guidelines. We’ll have to see how that works out.

In the meantime, we can invest with an eye on potentially huge payoffs. I’m recommending stocks leveraged to AI, as well as options, to my Supercycle Investor Members.

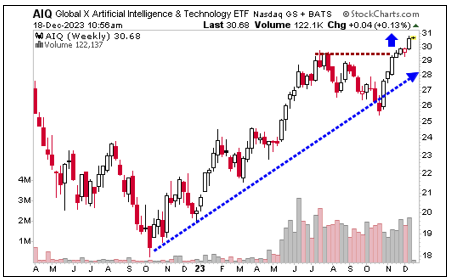

If you’re doing this on your own, you can look at one of the AI funds, like the Global X Artificial Intelligence & Technology ETF (AIQ).

It has a Weiss Rating of “C,” and an expense ratio of 0.68%. And it’s up 52% so far this year. Here’s a look at the weekly chart of AIQ …

You can see that AIQ is enjoying a great run. It just broke out to the upside, and I strongly believe there are higher prices ahead.

ETFs lower the risk, but also lower the potential reward. For hit-it-out-of-the-ballpark potential, you’ll have to buy individual stocks. This tech supercycle is just getting into gear, and AI will lead the way higher.

I’m already showing readers how to take advantage. Make sure you get your piece of what could be life-changing wealth. You can click here to see my latest presentation on exactly that.

That’s all for today. I’ll be back with more soon.

All the best,

Sean