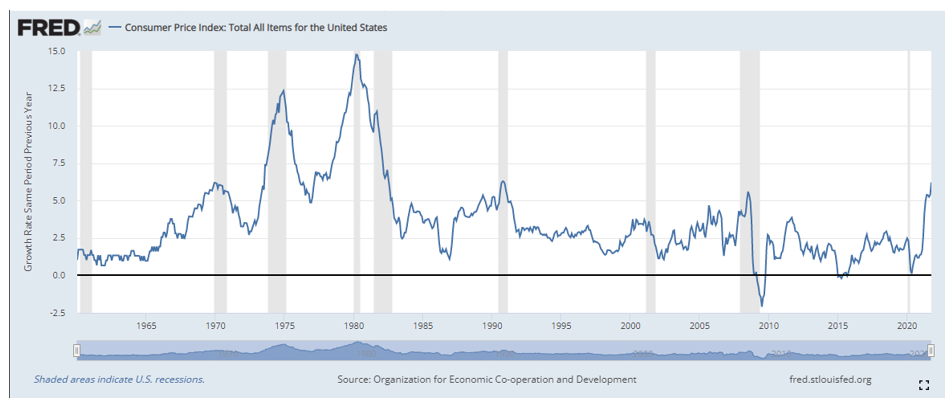

Scary inflation numbers are not new to 2021. It seems like every month is a little worse than the last.

In November, we saw the highest inflation growth year over year since 1982.

Gas prices for the same month were 50% more than November of 2020. McDonald’s (NYSE: MCD) explained that labor and supply costs are the driver behind menu prices increasing nearly 6%.

- Consumers everywhere are feeling the hurt on their pocketbook.

I read all the articles. I noticed the increase in grocery items. But it really hit me when I went to grab wrapping paper last week at Dollar Tree.

I arrived at the cashier with three rolls of wrapping paper and a package of clear tape.

The total was $5.30.

I was dumbfounded trying to dig an additional $1.06 out of my bag, because I hadn’t noticed the new signs ...

The familiar green and yellow signs were different this time.

Because — after 35 years of solid brand identity — the Dollar Tree (Nasdaq: DLTR) had finally increased their prices.

The chain’s been around since 1986 when retail veterans Doug Perry, Macon Brock and Ray Compton stumbled across a store called Everything’s A Dollar. The trio liked the concept and thought that they could do it better.

So, they opened five stores under the name “Only $1.00.” Obviously, Everything’s A Dollar was not so receptive to the competition and sued the chain, which then changed its name to the current Dollar Tree.

In his 2017 autobiography, the late Macon Brock explained:

I viewed the dollar-only concept as sacred. It was everything. Without it, we’d be just another discount retailer. Ditch the dollar, I believed, and we’d surrender our niche.

It was, in fact, a nice long run for the company selling everything from pantry staples and party supplies to toys and holiday decorations for the low, low price of just $1.

Even as recently as August, Dollar Tree chief executive Michael Witynski reiterated that “This dollar price point is going to be more important than ever. $1 is going to look good.”

Well, in less than four months, he was singing a different tune.

- The company denies that the increase is due to inflation or short-term market conditions.

Instead, it says the price increase will allow the reintroduction of items that it had to phase out … and that hiking prices will help the company increase its profit margins in a time of high merchandise costs, including freight and wage increases.

You say tomato, I say to-mah-to.

The company has also been working on an initiative known as Dollar Tree Plus, testing products at the $3 and $5 price points at some stores.

It’s even expanded this to include items at the $10 price point in a section called Five Beyond. (Really, guys? You didn’t learn from the Everything’s A Dollar experience.)

Maybe this will help the company in the long term … or maybe this will alienate all its customers. Only time will tell.

The truth is: The Weiss Ratings haven’t been impressed with the Dollar Tree for quite a while now.

The company hasn’t been able to hold onto a “Buy” rating since before September 2015. Sure, the company’s bounced momentarily into the “Buy” range, but it’s been consistently chugging along in the “Hold” range. It even dropped a few times into “Sell” territory. And right now, it’s sitting at a solid “C.”

- Remember the Weiss Safety Rating is an unbiased rating.

It doesn’t take into consideration anything that the CEO says. It doesn’t take into consideration what was in the latest press release. And it doesn’t get distracted by management’s attempt to spin numbers in quarterly earnings releases.

It’s based on numbers and math. And the result is what it is.

Shares of DLTR are up 26.7% so far year to date.

Consumers turned to the Dollar Tree for stable prices in tough times. Investors saw the momentum.

But the chart illustrates exactly when the company started talking about the price change — there was a drop, and I think we’ll be seeing a sideways trend for at least a few quarters as stores implement the change.

What About Other Discount Retailers?

Five Below (Nasdaq: FIVE) is currently rated a C+. Although known for selling products for $5 or below, in recent years, the company added phone chargers, cases and other electronics items above that threshold. Five Below has around 1,050 stores across 38 states.

Over the past two years, it’s seen the “Buy” range many more times than Dollar Tree has, despite being downgraded to its “Hold” status at the beginning of December.

The downgrade was due to a major decline in growth index, total return index and solvency index. Operating cash flow, earnings per share (EPS) and earnings before interest and taxes (EBIT) all saw declines.

Shares are down 17% over the past 90 days, but still up 12% year to date.

Dollar General (NYSE: DG), on the other hand, remains a “Buy.” It was one of the companies that kept hitting our top lists even during the worst of the pandemic.

- Since 2014, the company has only dropped into the “Hold” range three times … for a grand total of 214 days.

Unlike the other two concepts, DG doesn’t base its brand identity around a specific price point. It sells a bigger variety of food products, including brand names.

It has everything from kitchen supplies to cookware to small appliances. There’s apparel for the whole family, automotive supplies, toys and holiday items. Some even carry beer and wine.

Its brand is simply a discount retailer, and it currently has 17,683 stores across 46 states.

Shares are down 6.9% over the past 90 days, but up 5% year to date. And unlike DLTR and FIVE …

- DG pays a dividend of $1.62 per year.

Maybe Dollar General has a point by offering more products at a variety of price points. But can Dollar Tree succeed at doing something similar? Is its brand too closely tied to that $1 price point?

The dollar-and-a-quarter tree doesn’t roll off the tongue quite as easily.

I’m going to go ahead and add the Dollar Tree to my Weiss Ratings watchlist.

I want to make sure I keep following this one. But for now, I wouldn’t add it to your portfolio.

Best,

Kelly Green