|

| By Jon Markman |

Knowing what to avoid when it comes to technology investing is possibly even more important than knowing what’s coming down the road.

And innovation for the sake of innovation doesn’t always produce winning investments.

Today, I want to share a story I’ve already given to members of my Disruptors & Dominators service to illustrate this point.

Let’s get right into it …

Disruption is difficult.

Don’t be fooled by investment bankers and corporate marketing doublespeak. Radical change requires foresight.

Innovators must recognize the vulnerability of the status quo, and they must be willing to go all in to bring new products to market.

This is simply not part of the culture at most large enterprises. Executives at legacy firms will resist disruptive innovation, even in the face of an existential crisis.

Investors must be selective. They need to identify legitimate secular trends … and find the businesses in the best position to win.

The story of Mary Barra could be a Hallmark TV movie. Hometown girl Barra began working at General Motors (GM) in 1980 as an 18-year-old co-op student.

After graduating with a degree in electrical engineering, she spent the next three decades working her way up the corporate ladder.

She became vice president of global manufacturing engineering in 2008. Only one year later, she was the vice president of global human resources. Two years after that, she was vice president of global product development — a position that gave her oversight of the design and determination of the number of automotive platforms at the Detroit, Michigan-based automotive giant.

Finally, in January 2014, Barra became chief executive officer.

Barra’s rise to the top of GM is astonishing, inspiring and frightening all at the same time. All the major decisions now run through her corner office. Unfortunately, Barra has been really bad at her job.

GM under her reign is a complete mess.

Along Came Musk

The downfall started with automotive innovator Elon Musk when Barra was settling into her global manufacturing engineering gig.

Musk had the bright idea in 2008 to disrupt the automotive sector with electric vehicles … an endeavor that instantly made him the butt of industry jokes.

Nobody wanted EVs, said automotive execs, including Barra. EVs were underpowered, annoying and simply were not trucks. The North American automotive sector was being pushed toward trucks that were easier to build … and far more profitable.

The problem for the 100-year-old industry is that Musk didn’t build an underpowered EV.

His first battery-powered vehicle looked like a Lotus supercar. The second, the Model S, released in 2012. It became MotorTrend magazine’s 2013 “Car of the Year.” The fourth incarnation, the Model Y, a small sport utility vehicle, jumped to the best-selling car in the world only four years after its release in 2020.

Uh-oh.

Musk disrupted the entire automotive sector with EVs that are fast … and fun to drive. They are also cheaper to manufacture.

Musk had a really big idea that created a secular trend, which tapped into consumers’ desire for an eco-friendly vehicle that didn’t feel like a tiny car wrapped around a sewing machine.

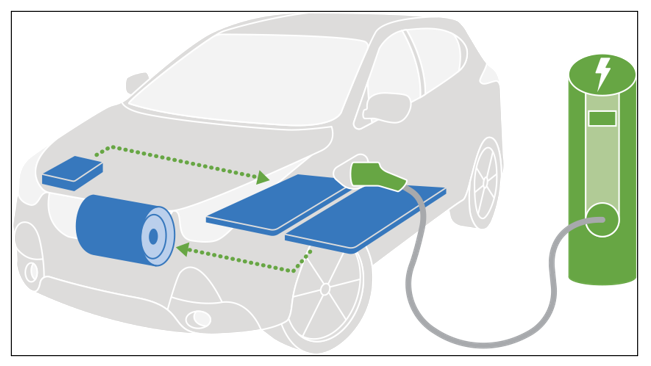

EVs run on a skateboard platform. Their drivetrain is essentially four wheels, a battery pack and motors … negating the need for hundreds of smaller suppliers for engine, transmission and other mechanical parts. Cutting out those suppliers makes EVs easier to manufacture, cutting down on labor costs.

So, in 2021, Barra planned to disrupt GM’s 110-year automotive business with EVs.

She began telling investment bankers that by 2025, GM would become the world’s biggest EV company. This goal was ambitious given that at the time, the company was manufacturing a subcompact Chevy EV that tended to catch fire.

Despite this reality, investors embraced her even more ambitious plan to transition the entire GM fleet to EVs by 2030.

Investment strategists added GM shares to their focus list of best ideas. And President Joe Biden praised Barra for leading the transition to sustainable transportation.

The Tesla (TSLA) experiment was said to be in jeopardy. Real competition was coming from companies that understood how to make vehicles, or so the narrative let on.

Except the EV experiment at GM has been an abysmalfailure. The company is now curtailing plans to expand EV production and build new battery factories, even as EV adoption accelerates globally.

The Cadillac Lyriq, a stylish SUV designed to take on the Model Y, sold only 9,000 units in 2023. And those flammable subcompact Chevy Bolts are still catching fire.

After investing billions and making bold promises of disruption, Barra’s EV dream now seems to involve creating fear, uncertainty and doubt. She now claims the technology is simply not ready for the mainstream.

The moral of the GM electric vehicle debacle is that innovation does not automatically mean disruption. GM provides a painful lesson on that score for a legacy industrial company.

All the best,

Jon D. Markman

P.S. There are other disruptions out there that ARE easier to spot. AI is obviously a breakthrough akin to the internet or personal computers. But the best ways to play it are not through the major trillion-dollar tech giants. Check out this presentation to see how to best take advantage of this $200 trillion “Superproject.”