How to Cut Uncle Sam Out of The Retirement Picture Forever

|

| By Nilus Mattive |

“Dad, do you think taxation is theft?”

The question came out of the blue from my soon-to-be-16-year-old daughter, presumably because of the financial literacy course she’s been taking at school.

It didn’t take long for me to answer in the affirmative.

After all, I don’t want to give my money to some of the intended purposes.

But if I don’t, I could ultimately end up staring down the barrel of a gun until I pay up.

In fact, as Business Insider recently reported, the government has been advertising 360 different openings in all 50 states for IRS agents that are legally able to carry handguns and willing to "use force up to and including the use of deadly force."

Those special agents are mostly dedicated to financial crimes, terrorism, money laundering and other similar activities.

Still, even a regular person could find themselves getting hauled away to jail at gunpoint if they don’t pay their taxes.

Now perhaps you enjoy giving Uncle Sam — and possibly several different layers of state and local governments — a portion of every dollar that you earn …

Another portion of every dollar you spend …

And maybe even a third portion of the dollars that you end up gifting to someone else down the line.

Maybe you simply consider it your responsibility for living in the U.S. Or maybe you just don’t want to get shot or go to jail.

Whatever your personal outlook, that’s totally fine. However, financially speaking, I still think it makes sense to …

Minimize Your Tax Bill Using

Whatever Legal Means Available

I’m talking about a special type of retirement account that 99% of Americans are ignoring right now … one that can give you two huge advantages:

1. It allows you to invest in a wide range of "off-Wall Street" assets, including gold bullion, private companies, physical real estate and even Bitcoin (BTC).

2. It can greatly reduce the drag of taxes by exempting all your future gains from federal taxes forever.

Some of the wealthiest Americans have used this very same type of account to create massive — and untouchable — fortunes.

Protects Your Money From Taxes &

Invest in “Off-Wall Street” Investments

These investments are disallowed by regular brokerage firms. So it makes sense even if you completely trust the government and just want to enjoy the very widest range of investment choices with the very lowest future tax burden.

It starts witha retirement account that cuts Uncle Sam out of the picture forever.

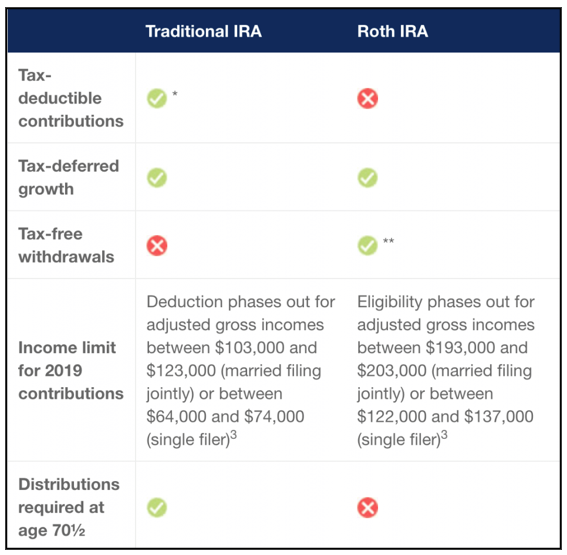

Most people have heard of individual retirement accounts. However, the most common type — so-called traditional IRAs — only defer taxes until a later date.

That’s because the money you contribute hasn’t been taxed yet. It works the same way as your typical 401(k) plan.

The IRS lets you put money into these accounts before taxes are levied. They also let the money continue to rack up investment gains without requiring you to pay annual taxes on gains. Then, they tax both the original contributions and any investment returns when the money is withdrawn.

In short, traditional IRAs are a good deal but maybe not a great deal … especially if your primary goal is racking up spectacular gains and keeping as much money as possible.

Enter another type of IRA, which was made possible because of important changes to the tax code in 1997. The first of those changes was spearheaded by Delaware Senator William V. Roth, Jr., who wanted to create a new type of IRA that could be funded with after-tax money then grow tax-free from that point forward.

The idea ended up getting approved as part of the Taxpayer Relief Act of 1997, and we now know these accounts as Roth IRAs, which have some distinct advantages over traditional IRAs.

Click here to see full-sized image.

For starters, because you contribute money that has already been taxed, your original investment — and all of the future gains — will never be taxed again as long as you are at least 59.5 years old, and the account has been held for a minimum of five years.

In addition, there are no required minimum distributions with Roth IRAs. In contrast, traditional IRAs require you to begin taking money out once you reach retirement age. Because of changes made as part of the SECURE Act, that age is now 72 for anyone who turns 70 on July 1, 2019, or later. Previously, the age was 70.5.

Also, should you withdraw your money from a Roth IRA before age 59.5, you’ll only owe a 10% early withdrawal penalty and regular taxes on any gains. All of the money taken out of a traditional IRA under that same circumstance is subject to the penalty and taxation.

Meanwhile, both traditional IRAs and Roth IRAs can be funded until Tax Day of the following year. For example, you can make contributions for the current tax year (2023) up until April 15, 2024.

They also have annual contribution limits. For 2023, that limit is $6,500 across all types of IRAs plus an extra $1,000 “catch-up” contribution for people aged 50+. Roth IRA contributions phase out once your modified adjusted gross income hits a certain level. For 2023, the phaseouts begin at $153,000 for single filers and $228,000 for joint filers.

Regular IRAs, on the other hand, have no income restriction for contributions, though the tax deductibility can be affected by your MAGI and whether or not you’re covered by a retirement plan at work.

If you’re worried about those last two points, the contribution limits and/or the income caps, don’t be. Under the current laws, there’s a workaround available to all of us …

I recently explained to my members of my service, Safe Money Report, what that workaround is … how it takes advantage of off-Wall Street investments … and how you can fund a Roth IRA through the “backdoor.”

Interested in learning more? Just click here.

Best wishes,

Nilus