|

| By Chris Coney |

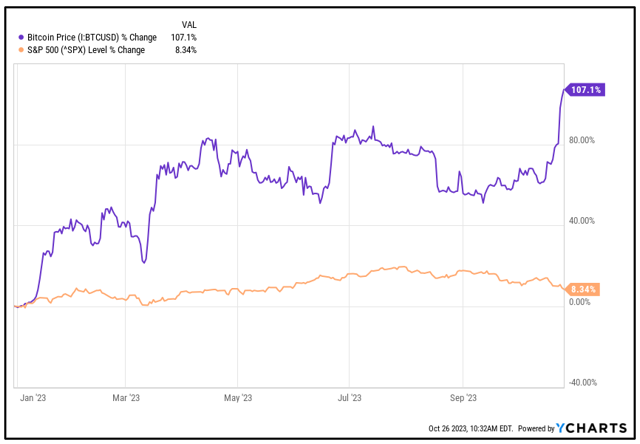

Editor’s Note: While it’s been another down week in the stock market, our friends in crypto have had a wild ride. Today, we have an expert crypto educator and analyst — Chris Coney — to discuss what such a rapid rally can do to an investor’s mind. And, this lesson applies to everything, not just cryptocurrencies. Here’s Chris …

For the average crypto investor, greed is somewhat of a paradox.

This is because it often ends up achieving the exact opposite of its intention.

The motive behind greed is to get more, but the outcome is often that you end up with less.

Crypto bull markets are a good example of this, especially if we are talking about new investors who have never been invested in crypto during a bull run.

If you haven’t yet been invested in the market during any previous crypto bull runs, then you are at the highest risk since you have yet to experience the unheard-of rates to which asset prices can climb.

If you are coming into crypto investing for the first time, there are only two places you could have come from.

One is traditional asset investing and the other is no investing at all (cryptos are your first foray into investing).

In either case, your mind will be calibrated to a certain expectation.

For example, in traditional stock market investing there is an expectation that the market will give an average return of around 7% a year over the long run.

That is a baseline around which other asset price appreciation can be measured.

It is also what people refer to when they say an investment “beat the market.”

That just means the returns were above the average.

From Yearly, to Monthly, to Daily

I love a question Bob Proctor used to throw at people:

“How would you like to turn your annual income into a monthly income?”

That question would often break people's brains for the same reasons we have been discussing here: Their minds were not calibrated to think at that scale.

If someone is calibrated to seeing the relationship between time and money as $100,000 = one year’s earnings, that means one month’s earnings = $8,333.33.

Bob Proctor's question proposes the thought that one month’s earnings could equal $100,000.

That would often defy someone's comprehension even though objectively, it is entirely possible.

Mapping that over to markets now, if traditional market investors are calibrated to expect the market to go up on average by 7% per year, what happens when a market goes up by 7% in a month?

Or better yet, what if (like in crypto) the market goes up by 7% in a day?

In crypto, it is common for a single asset to go up by more than 7% in a day let alone the whole market.

Why This Is Relevant

The most important aspect of this whole idea is what happens when an investor experiences something that falls outside of their comprehension (such as a market going up 7% in a day versus a year).

When that happens, the investor finds themselves in a situation where they have no mental strategy for dealing with it.

At that point, irrationality takes over and greed moves in.

My theory is that investors recalibrate too quickly.

When they have their first ever “7% in a day” experience, it not only breaks their rational mind ... it causes them to completely swing in the opposite direction.

They go from “more than 7% in a year isn’t possible” to “if I can get 7% in a day, why not 20% in a day?”

And thus, greed takes over.

I’d say greed is an irrational state of mind.

Blindsided by gains an investor has never seen before, they have no mental strategy for dealing with it, and thus greed becomes the default.

The net result of this is that they don’t know when to quit — i.e., they find it incredibly difficult to sell.

Even if they invested at the start of a crypto bull run, made 21% in the first month and then sold, they would have made 3x their stock market returns.

If that was the only investment they made that year, they’d come out with an annual return of 21%, pretty spectacular based on their mental calibration.

Everyone Should Start with Bitcoin

It is my current and long-standing belief that there is a certain order to crypto asset investing.

The first step in that sequence is Bitcoin (BTC, “A-”).

In my personal opinion, no one should be touching any other crypto asset if they have not yet established a foundational position in Bitcoin.

I would say Bitcoin is the lowest-risk asset within the high-risk sector that is crypto.

As I have been alluding to in this article, crypto market returns are already orders of magnitude larger than every other asset class.

Click here to see full-sized image.

So, even if all someone does is invest in the asset with the poorest returns, they’re still going to be light-years ahead of where they would be otherwise.

And that is why it all comes down to checking your greed.

Coming out of a crypto bull market with, say, a 50% gain on a Bitcoin investment, is far better than gambling on riskier cryptocurrencies and losing everything.

These same principles are universal. You can stumble into a huge gain from an unexpectedly good earnings report or a world-changing product announcement.

Greed is something we all must keep in check. And with crypto, it can be tested frequently.

But until then, it’s me, Chris Coney, saying bye for now.

P.S. Whether you are new to crypto investing or not, there’s a breaking story that could change the game. Check out this presentation to front run a shocking decision from the Biden Administration on crypto.