|

| By Gavin Magor |

Sure, it’s coming down, but it’s sticking around like a bad head cold.

Most things I’ve been hearing from the pundits about inflation recently have been misguiding.

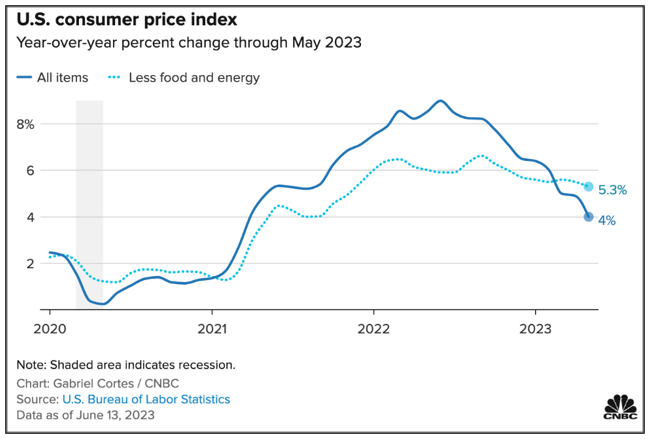

This week, both the Consumer Price Index and the Producer Price Index reports for May 2023 were released, and the good news was that the rate of inflation is continuing to decrease.

The CPI came in at 4% for May, but here’s the thing, that’s an increase of 4% of inflation on a year-over-year basis, so while yes, it is increasing at a slower rate than the scorching hot number of 8.6% in May 2022, it’s 4% on top of that number.

It’s essentially a compounded number, and I probably don’t have to tell most people reading this that everyday prices are still very high and taking a toll on household budgets.

So, make no mistake, inflation is still quite hot, and the Fed has a lot more work to do to get to their target of 2%.

And they know this. That’s why, despite their first interest rate hike pause after 15 straight months of increases, Fed Chair Jerome Powell stressed a hawkish tone by saying more hikes are coming, and that he doesn’t anticipate there being any rate cuts until “a couple years out.”

This economy needs more cooling, but in the meantime, investors need to act because there is strength in the stock market.

At Weiss, we are here to help all investors make important decisions. And if you’re not already familiar with them, our Weiss Stock Ratings have a strong bias toward safety.

Strong and safe names are the ones I target not only at all times, but especially in more uncertain times like these. Sure, like anyone, I want to outperform the market, but I also want to make sure I have the peace of mind knowing there are strong and safe stocks in my portfolio.

One great way to combat sticky inflation is with highly rated and high dividend-paying stocks, which can easily be found on the Weiss Ratings site.

Defend Your Portfolio with Dividends

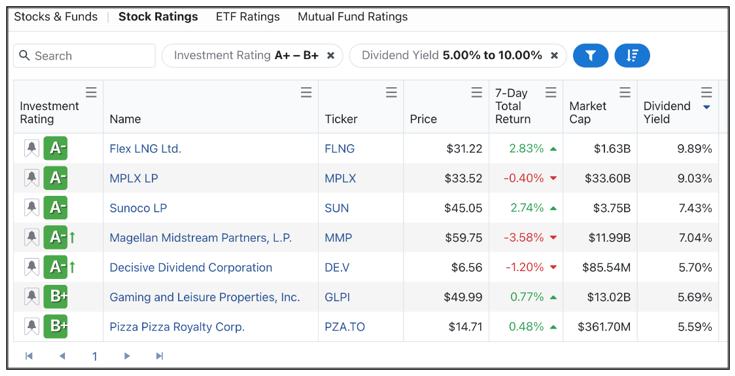

Today, I used two criteria to find highly rated stocks that pay a nice dividend yield in the 5% to 10% range.

First, I selected stocks with ratings of “B+” to “A-”, and then selected a dividend yield range of 5%–10%. Here’s what populated:

Out of the 12,932 stocks we rate, my criteria was narrowed down to seven stocks.

At first glance, it’s clear that at least several of these names are in the energy sector. In times of high inflation, energy stocks tend to outperform other industries.

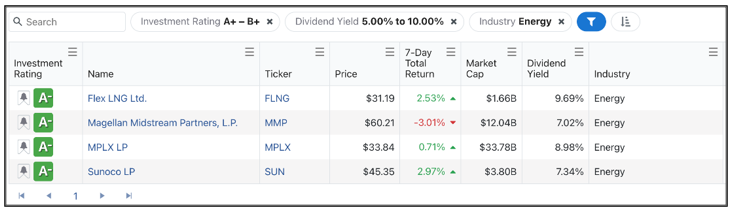

So, say for example, I want to further narrow my selection, I can hit the “Energy” filter, so I only see the stocks that are in that sector:

And coincidentally, all of these names — Flex LNG (FLNG), Magellan Midstream Partners (MMP), MPLX (MPLX) and Sunoco (SUN) — are rated “A-.”

Highly rated, strong dividend payers and in the energy sector. These stocks check all three major boxes that I was targeting, and they certainly have my attention. And if there’s an open spot or two in your portfolio, they should have your attention, too.

I haven’t even scratched the surface of all the incredible (and yes, free!) tools that are on the Weiss Ratings site, available for all investors to use.

Immerse yourself, learn and not only see ratings for stocks, but also for banks, mutual funds, insurance companies and a lot more all on the Weiss Ratings site.

I lead a global team of research analysts and data scientists, and I constantly preach to my analysts that we’re living in a new, faster-paced world and being on top of the latest trends is crucial.

From Benjamin Graham to the everyday common man, we should all be lifelong learners, especially when it comes to our investment decisions.

Cheers!

Gavin Magor

P.S. Just weeks from now, the Fed will roll out a new digital platform that gives unelected officials the power to spy on your financial transactions. Worse yet, they’ll now have the power to potentially seize your money at will. That’s why Dr. Martin Weiss has called for an Emergency Summit to Protect Your Money from Imminent Government Attacks. Click here for more while there’s still time.