|

| By Gavin Magor |

When it comes to investing, I’m a data-first type of decision-maker.

So, I always start with Weiss Ratings.

And I recently found one slice of data there that I just had to share with you today.

You see, right now is the perfect time to utilize one amazing Weiss Ratings Plus tool that lets you look at where stocks are headquartered.

Recently, the stock market has seen lots of geopolitically driven volatility.

But just like any challenge, there too, comes opportunity … for smart investors.

With all that’s happening in the world — new governments, trade wars and actual wars — you can target specific countries and regions to stay ahead.

Here’s how if you are a member of Weiss Ratings Plus …

First, start with the Stock Ratings Analyst section of the membership:

Then, simply filter for “Country.”

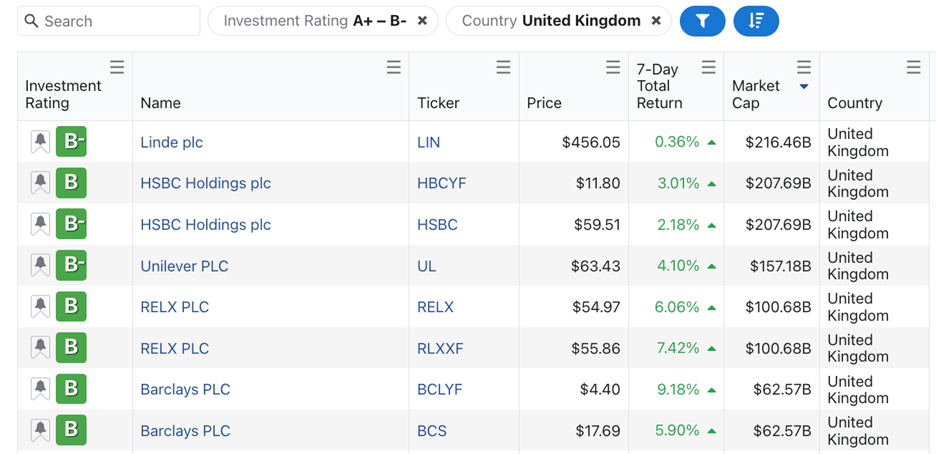

Let’s look at our “Buy”-rated stocks domiciled in the United Kingdom.

And no, I’m not intentionally looking at these to reminisce on my motherland (although I will).

There are a number of reasons investors could potentially benefit from these names.

You see, there are a number of “Buy”-rated stocks domiciled there at the moment … and there are some advantageous foreign exchange reasons investors could potentially benefit.

For example, the British pound gaining strength on the U.S. Dollar. It currently takes $1.35 dollars to buy each pound sterling. That’s up from just $1.22 back in January.

Additionally, some may argue that the U.K.’s political environment is a bit more stable at the moment than other countries.

Trust me, I am very familiar with the U.K. since I am originally from there. And it looks like it’s entering a relatively conflict-free period.

So, again, some may call me biased. But I am bullish on the U.K.’s economy over the next decade.

These are other reasons why investors may want to target stocks in a particular country.

Another example is India, which may be poised to capture more manufacturing from China depending on geopolitical decisions in coming years. But that discussion is an entirely different article.

Today, we’ll stick with the U.K.

Here are the stocks from the U.K. with a “Buy” rating and a market capitalization greater than $60 billion:

Above, you see some dual listings. That is due to the fact that some stocks are listed on multiple exchanges.

The company I want to emphasize today is Linde (LIN).

Not only is it a great stock … it is also the largest of the names above.

What’s more, it has been within our “Buy” range since Dec. 8, 2022.

Linde is an industrial gas company that operates globally in 80 countries. It dominates its markets and has a large client base.

This has resulted in lots of pricing power and solid financial strength.

This stable business model is well reflected in its chart:

This isn’t the kind of stock that will sell newspapers or dominate headlines.

But it’s stable and is up 37% since our last “buy” upgrade, excluding dividends.

So, if you’re looking at some geopolitically leveraged plays within our “Buy” ratings, Linde is a great one to research.

There are many other ways to look abroad for gains and additional wealth protection.

Take my colleague Nilus Mattive’s new off-grid investment strategy.

If you were at the Weiss Investment Summit, he was also a speaker.

In his new “Shadow Wealth” strategy, he details ways investors can protect their wealth from a falling dollar and out of control government.

I’m talking about private bank accounts, private trusts and strategies with top gold experts from around the world.

He’ll also detail an off-the-grid asset that beat gold by 39x over the last decade. And other assets he details have extraordinary gains of 928%, 2,341% and 22,427%.

This opportunity won’t be around for long. In fact, it’s set to come offline tonight at midnight. Watch this while you can.

Cheers!

Gavin