|

| By Gavin Magor |

In a market dominated by high-priced tech and mega-cap stocks, a few forgotten micro-caps and nano-caps are quietly outperforming — including some flashing “Buy” on the Weiss Ratings system.

Micro-caps fall between $50M and $300M in market value.

Nano-caps? Even smaller — under $50M.

Both can be volatile investments — which is why it is crucial they have a Weiss safety rating of “B-” or above.

Despite inherent risks that come with small stocks, they do offer strong upside potential.

Consider that Monster Beverage (MNST) had a market cap of a mere $42M in April of 2003 — along with a Weiss “Buy” rating.

Today, the stock is worth $62B — a total return of over 147,000%. And, during that period, MNST never dropped below a “Hold” rating.

Another “unstoppable” example is HEICO (HEI),which wasworth ~$160M in 2003. Now, HEICO’s market cap is $36B, a return of nearly 18,000%.

HEI, it is worth mentioning, is currently one of the highest performers in the Weiss Ultimate Portfolio.

Now, let’s look under the hood of our best-rated micro- and nano-caps!

How to Find Rock-Solid Microcap & Nanocap Gems

Weiss Ratings Plus users looking to find these stocks can go to Weiss’ Stock Ratings page, then click the hourglass to filter on scores of fields.

We screened for “buy”-rated, U.S.-listed, microcap and nanocap stocks with solid momentum by selecting the following fields and criteria:

- Investment rating: “A+” to “B-”

- Market Cap Category: Micro Cap or Nano Cap

- 30-Day Total Return: >=5%

- Exchange: Common U.S. Exchanges

Here are the 13 tiny stocks that passed our screen.

The stocks on the list have a +25% average 30-day return and market caps ranging from ~$30M to $230M.

When it comes to micro and nano-caps, it is especially critical to ensure the stocks are financially sound, relatively stable and have solid liquidity, like the three stocks we highlight next.

Rock-Solid Micro Gems

The three stocks we selected to highlight are up by about 40% on average in the past 30 days, fast-growing and have surprisingly strong balance sheets.

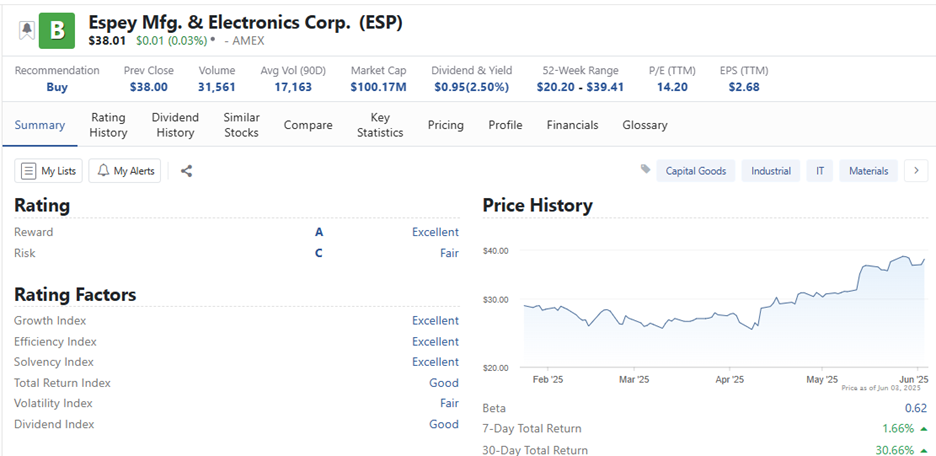

Topping our list is Espey Manufacturing & Electronics (ESP), amaker of electronic equipment for military and industrial applications, with a market cap of ~$100M.

Up about 30% in the past month and 90% in the last year, Espey’s solid rating is driven by “Excellent” scores in the Growth, Efficiency and Solvency Indexes, which can be found on the stock’s Summary page.

A few salient observations on what is driving Espey’s excellent index scores:

- Growth: Earnings grew by nearly 40% in the past year.

- Value: Price-to-earnings ratio of 14.2x represents a substantial discount to the sector.

- Solvency: Zero debt and $38M in cash on the balance sheet is impressive for a fast-growing micro-cap.

- Profitability: 16% return on equity highlights efficient use of shareholder funds.

Espey’s beta of 0.62 indicates the stock is also substantially less volatile than the market.

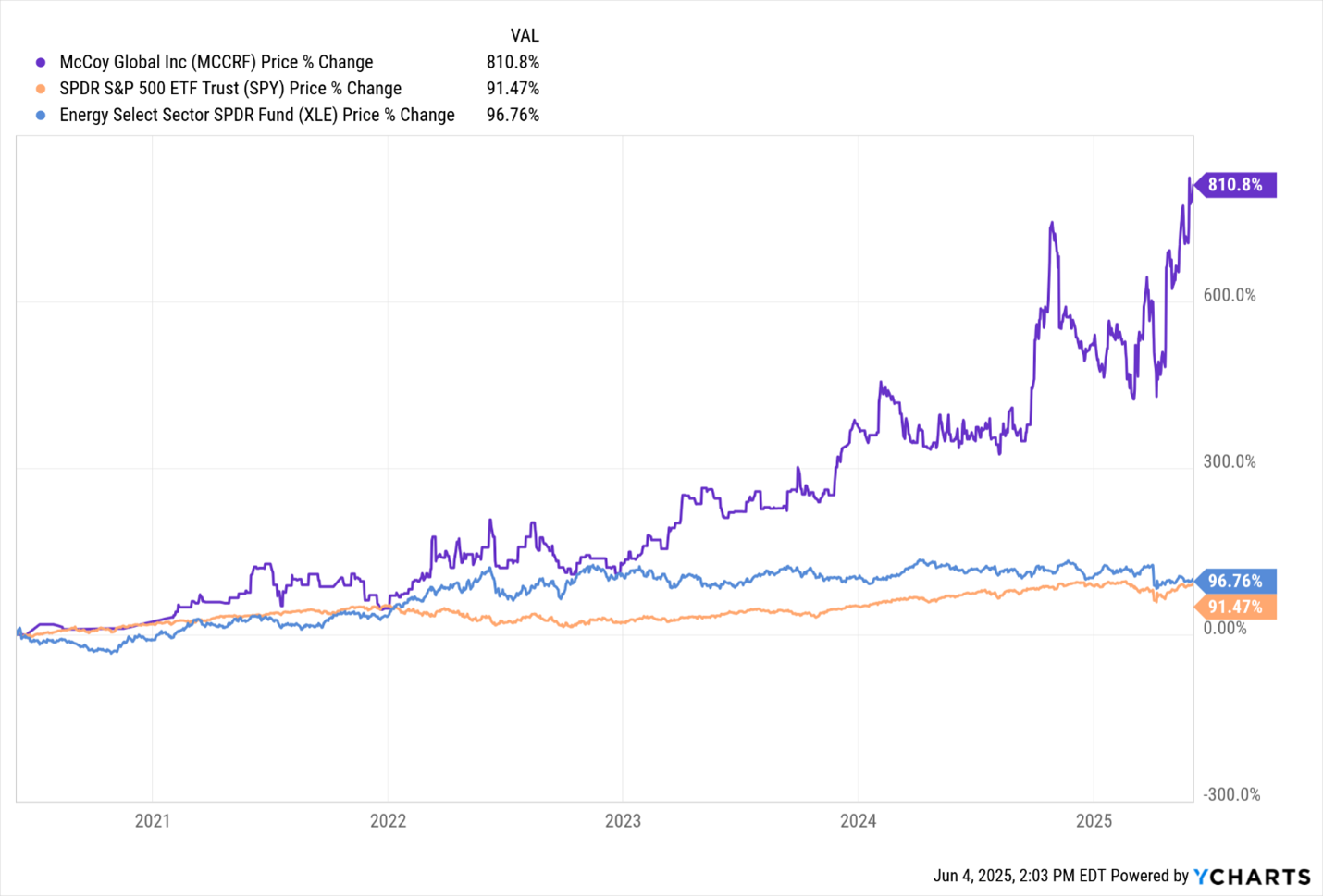

McCoy Global (MCCRF), a Canadian-based energy tech provider,has a market cap just over $75M, is up nearly 50% in the past 30 days and +810% in the past five years.

McCoy is another micro-cap with a strong balance sheet: $7M in cash and $2.92M in debt.

McCoy’s earnings grew 18% in the past 12 months. Its top line grew by a CAGR of 32% over the past three years.

No. 3 on our list, Westell Technologies (WSTL), is a nano-cap stock valued at $30M.

The telecom technology manufacturer is up over 40% in the past month and more than 100% in the past year.

WSTL earnings grew 696% in the trailing twelve months, the stock remains stable with a beta of 0.28 and has a strong net cash position.

WSTL has a P/E TTM ratio of only 2.5x, which is incredible in a sector where stocks are trading at about 30x earnings.

Higher Risk, Higher Reward

Microcap stocks can be risky investments, but have huge upside potential — if you pick the winners.

Subscribers can use our screening tools to find the best microcap or nanocap stocks to invest in.

Each of the three stocks we highlighted have reward ratings high enough to offset risks, according to our models.

These aren’t speculative penny stocks.

They’re “Buy”-rated microcaps with real growth, strong balance sheets and solid momentum.

In short, based on our risk/reward-driven ratings system, these rock-solid micro gems are attractive investments with good prospects for outperforming the market.

Cheers!

Gavin

P.S. For full access to all the tools above, you’ll need to check out Weiss Ratings Plus. This upgrade gives you far more than just some stock screening filters.

In fact, it helps members set alerts for any number of stocks they choose, quickly see the freshest “buy” upgrades and “sell” downgrades, as well as several exclusive special reports.

I urge you to check it out here.