|

| By Gavin Magor |

Whether we’re talking about socks or stocks, I always want the best value I can get.

That doesn’t mean I’m out buying Aston Martins or $30 smoothies everyday … but it does mean I am trying to get the most out of every dollar I spend.

And you better believe that perception of value applies to my stock selection as well.

Just think about how you judge a movie …

You may use Rotten Tomatoes to see its score. If you are deciding where to eat dinner, you may use Yelp. The examples are endless.

And when you’re thinking about stock selection, I truly hope you are using the accurate, unbiased and wonderful Weiss Ratings.

Certain selection processes, such as the Oscars or Grammys, are a look into some highly crafted pieces of art.

In a sense, it’s very much apples and oranges in terms of what’s better than the other. Beauty is in the eye of the beholder so to speak.

But this is not the case when it comes to picking stocks.

Yes, our stock ratings do have a bias toward safety. And if you’re looking for the next GameStop (GME) with a 200% gain in a matter of days, you’ve come to the wrong spot.

Because that is neither data-driven, nor safe investing.

But if you want safety … if you want sanity … if you want stocks that have been put through a rigorous test … the Weiss Stock Ratings may be for you.

The Best of Our Current ‘Buys’

During my career, we’ve seen a transition from a time when there was a limited amount of data to a mountain of daily data thanks to things like the internet and AI.

That’s why our stock ratings are updated daily, and the numbers always paint a picture.

With many of the companies I recommend to my premium subscribers, there are often fascinating histories behind the stocks.

When it comes to newer stocks, the story matters so much more than a mature company, where the numbers matter more.

For example, in today’s market, a newer successful stock like Meta Platforms (META) is being driven up more because of its future growth and the story behind the Metaverse.

But for older names, like IBM (IBM), which IPOed in 1962, its price is being driven far more by its financial numbers.

Granted, both are solid stocks. But they just have a much different situation.

Let’s check in with our current “A”-range stocks in the Weiss Ratings, because we’re …

$eeing a Lot of Green

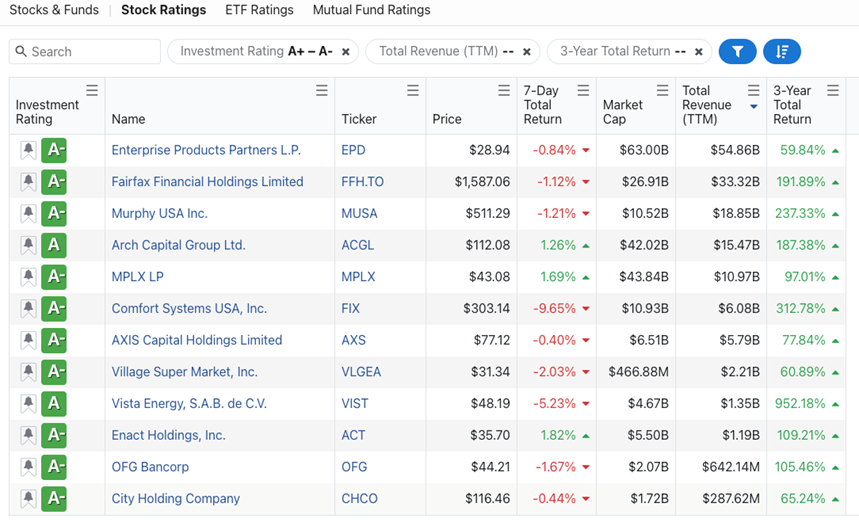

After a few easy clicks, I was able to load our newest “A”-rated list of stocks from the Weiss Ratings site.

Here’s what populated:

Keep in mind, these are all stocks that have been put under a massive microscope. And as you can see, only 12 stocks out of 12,645 we rate made this cut.

One thing you’ll notice on the right-hand side of the image above is that they’re all up pretty nicely over the past three years.

I’m seeing some nice gains such as 237% on Murphy USA (MUSA) and a blistering 952% on Vista Energy (VIST).

If your portfolio needs a jolt, perhaps you should consider adding some of these names.

Of course, it doesn’t hurt to have a helping hand above and beyond the data too.

In fact, I know just how to help with that too.

Our team has been on the hunt for what comes after the AI gains we’ve already seen the past year and a half. What’s the next Nvidia?

We even teamed up with one of America’s top tech minds to uncover it. And he did.

Tomorrow, we’ll share all the details. Click here to reserve your spot to see the results of this search.

Cheers!

Gavin