|

| By Sean Brodrick |

America is getting older, quickly.

We’re not alone, however.

Europe, China and Japan are in even worse shape on this trend.

In Japan, its “super-aged” society is the oldest in the world: 28.7% of the population is 65 or older, with women forming the majority.

The country is also home to a record 80,000 centenarians. By 2036, people aged 65 and over will represent a third of Japan’s population.

As birth rates fall, life expectancies worldwide are increasing by one year every five years — and will reach an average of 77 years by 2050, up from 48 in 1950.

By 2050, 2.1 billion people will be 60 or older, more than double 2015’s count.

Focusing solely on the U.S., according to the U.S. Census Bureau, it is expected that we will have:

• Seventy-seven million adults over 65 by 2034.

• More older adults than children by 2035.

• And nearly one in four Americans over the age of 65 by 2060.

People are living much longer, which is why I’m labeling this trend “the revenge of the old coots.” And because that demographic is growing at such a rapid clip, there are handfuls of …

Stocks That

Cater to Them

I’m not going to dive into all of them. But some — especially given the sectors they’re in — are obvious.

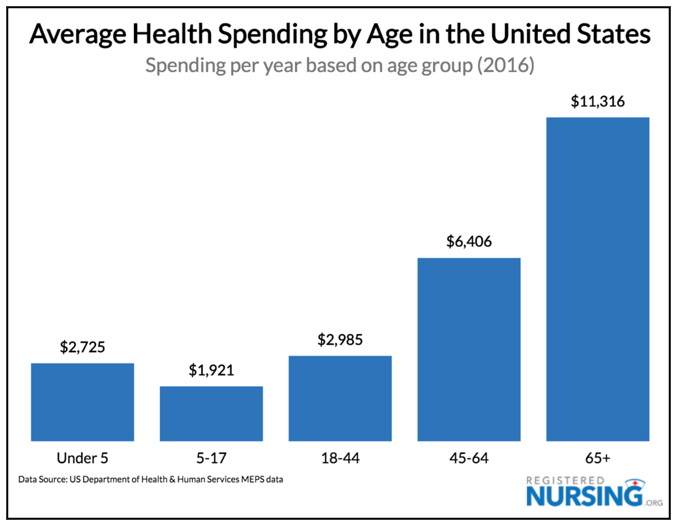

As people age, they require more healthcare. A lot more.

Click here to see full-sized image.

In fact, health spending in the U.S. nearly doubles from ages 45-64 to ages 65+, and health spending increases faster than inflation.

And who profits from that increased spending? Companies that develop …

Medical Devices, Pharmaceuticals

& Consumer Goods

Companies like Johnson & Johnson (JNJ), which have been providing healthcare products of all sorts since 1886.

JNJ has three core divisions — (1) consumer health, (2) pharmaceuticals and (3) medical technology — and the company is planning to soon spin off its consumer health division into a separate business.

And since consumer health has grown at a slower pace than pharmaceuticals and medical technology, by spinning it off into a new business, JNJ can focus its resources on growing its two most productive divisions.

This should ultimately result in stronger growth for the company moving forward.

Click here to see full-sized image.

Shares are down over 8% this year, but they’re testing JNJ’s 200-day moving average.

The stock pays a dividend with a market-beating yield of 2.78%, and its sector — healthcare — is recession-resistant given how demand for healthcare is inelastic.

Another place to look?

Senior Housing

Nursing homes and longer-term care facilities are big business in the U.S.

According to the National Institute on Aging:

“There are about 4.7 million senior citizens utilizing home-health care, 730,000 in assisted living facilities and 1.4 million in skilled nursing facilities (nursing homes). There are about 16,000 nursing homes nationwide with 1.8 million beds.”

For a strong example, look no further than Florida, my home state and one that’s often referred to as God’s waiting room.

In Florida, 73,000 residents live in nursing homes, and facilities in this state have an occupancy rate of 87%.

There’s profit potential in that industry if you know where to look, and real estate investment trusts are a good place to start.

One particular REIT I like is Ventas (VTR), which specializes in homing aging populations in America, Canada and the U.K.

Ventas owns and manages healthcare facilities, with a portfolio that consists of 1,200 properties including nursing homes, medical office buildings, rehabilitation and acute care centers, as well as labs, research centers and medical-surgical centers.

Shares are down less than 1% this year but are up over 20% in the past six months, and at the time of writing, it’s challenging both its 50-day and 200-day moving averages as overhead resistance.

Click here to see full-sized image.

There’s more to like about VTR. Like all REITs, it must pay 90% of its taxable profits to shareholders in the form of dividends.

Ventas pays a whopping 4% yield!

I’m not telling you to buy either of these stocks ...

What I am telling you is that the global population is aging rapidly, and savvy investors who know where to look can set themselves up for enormous profit potential as demand for certain goods and services is bound to skyrocket along with the age of the general populace.

As always, remember to conduct your own due diligence, but keep in mind sectors and stocks that are leveraged to an ever-expanding senior citizenry.

Best wishes,

Sean

P.S. Mark your calendar for Sept. 10–12, for the 2023 Weiss Investment Summit. We’ve chosen The Boca Raton, a tropical resort surrounded by lush palm trees, our Weiss Ratings experts’ travel plans are in motion and Dr. Martin Weiss’ busy schedule is cleared for two full days. Now, there’s only one thing left to secure … your RSVP to our second annual, live, in-person event! Click here to sign up before April 30, to take advantage of the $200 Early Bird Special discount. I’ll be there, and I’m looking forward to shaking your hand.