How to Legally Avoid Estate & Inheritance Taxes

|

| By Nilus Mattive |

Editor’s note: Join us in welcoming income expert Nilus Mattive back to Weiss Ratings as co-editor of Safe Money Report, Weiss Crypto Investor and Weekend Windfalls and as a contributor to Weiss Ratings Daily. With the royal family’s vast fortune changing hands tax-free, Nilus has an idea that can help your heirs give less to the tax man.

Death and taxes. As the saying reminds us, those two things are unavoidable.

Of course, there are some ways to avoid “death taxes” — also commonly known as inheritance and estate taxes.

Take King Charles III.

He just inherited the majority of a portfolio of assets worth roughly $28 billion.

However, because of a 1993 agreement with the British government, all of that is exempt from U.K. inheritance tax.

Most everyone else? If they inherit more than $377,000, they owe the British government a full 40% of the take.

Here in the U.S., federal estate taxes go as high as 40%, too.

The good news is it can be avoided this year as long as the estate is valued at less than $12,060,000.

Have more than that?

There are legal ways to avoid, or at least mitigate, the sting.

For example, plenty of U.S. politicians — even the ones who publicly advocate for estate taxes — use trusts and other strategies to avoid paying. I’ll just leave one solid example right here.

All that hypocrisy aside, I’m totally in favor of using current law to maximize personal wealth, including legally avoiding estate taxes through whatever means are available.

I recommend talking to a good estate planner or a well-versed attorney.

Of course, that’s just the beginning of the story on this side of the pond.

In fact, your heirs could end up paying taxes on every single thing you leave behind, no matter how much your estate is worth.

So far, we’ve only been talking about federal-level estate taxes. However, in many instances, there are also …

State Inheritance/Estate Taxes

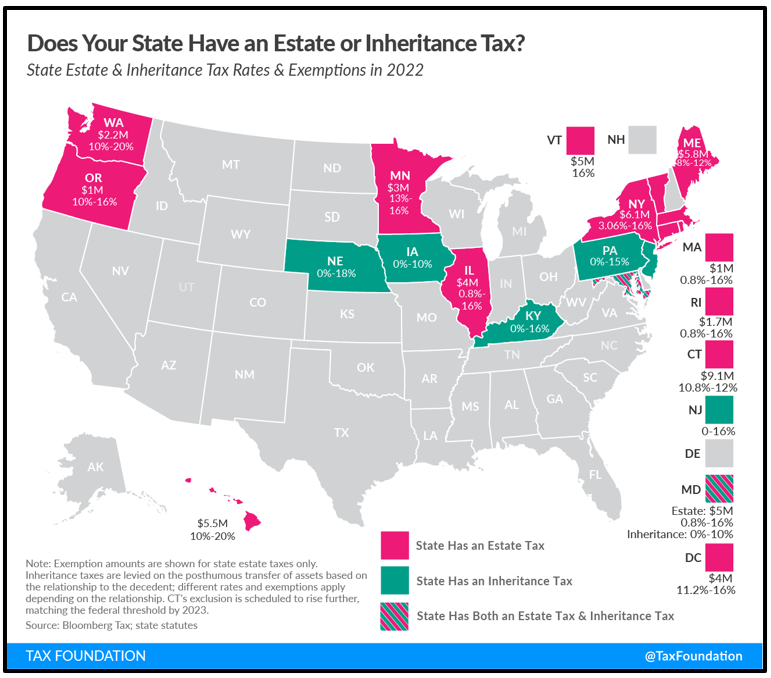

What a lot of people don’t realize is that 12 states and the District of Columbia have estate taxes of their own. Yes, in addition to any federal estate taxes you might already owe.

Five more states have inheritance taxes instead.

And Maryland currently has both!

The Tax Foundation put together this handy graphic that outlines the current situation very nicely:

Click here to see full-sized image.

What exactly is the difference between an estate tax and an inheritance tax?

Estate taxes are paid based on the value of everything someone leaves behind. Inheritance taxes are based on everything a person receives from an estate.

And how much are we talking? Rates vary, of course.

But on the high end, Washington and Hawaii both take as much as 20% of an estate.

Most states have much lower thresholds than the current federal one, too.

For example, in Oregon, any estate worth more than $1 million gets hit with a minimum estate tax of 10%. That will easily ensnare many people leaving behind fairly average homes in places like Portland.

Meanwhile, inheritance taxes can be worse, hitting even the poorest citizens.

Take my old home state of Pennsylvania, where inheritance taxes generally apply to everything you receive.

The only real exceptions are inheritances from spouses, children who die before age 21 or serving military members who die from injuries or illnesses while on active duty.

If I still lived there and my wife and I both kicked the bucket, my daughter would owe Harrisburg 4.5% of everything we left her — right down to the value of my cars, guitars and surfboards.

And that’s actually a good deal. Siblings pay 12% and others pay as much as 15%.

I consider this criminal.

Of course, I moved. Which is a relatively easy way to avoid paying.

Just be aware that it’s sometimes a bit more complicated than that, especially if you still maintain a home in your old state.

Again, it pays to speak to an attorney or estate planner before you do anything.

Also, you should realize that these laws change over time.

The recent trend has mostly been favorable, with some states repealing or phasing out their death taxes in recent years.

The bottom Line is, you should look more closely at …

Where You Live & Die

Look, I think death taxes are ridiculous.

- You’re taxed when you make your money ...

- You’re taxed if you successfully invest it ...

- You’re taxed on it every year you live in your state …

- And most people are taxed whenever they buy other goods and services, too.

So, there’s simply no reason to tax whatever’s left AGAIN upon a person’s death.

Wherever the money goes next, it’ll be used to generate plenty more future tax revenue anyway.

If you agree, now might be a very good time to look at all the possible estate and inheritance taxes that could apply to you and other people you care about.

You won’t be able to get the King Charles III deal, but there are plenty of other possible steps to lessen liabilities down the line.

Best wishes,

Nilus

P.S. If you enjoyed this issue, check out Safe Money Report to help guide you in not only making money but protecting it. Members of this service are currently sitting on open gains of 22%, 18% and 13% while receiving substantial dividends during a brutal bear market.