How to Navigate Inflation, Invasion & Rising Interest Rates

|

| By Mike Larson |

Inflation. Invasion. Rising interest rates.

All three are coming for YOUR wealth. And if you're not prepared for the consequences of these threats, you're going to have a rough couple of years.

Today, I'll survey all three of them before telling you about an opportunity that will help investors like you prepare for these ongoing supercycles.

Inflation

Let's start with inflation, which is raging through the U.S. economy like an out-of-control conflagaration.

- Officially up 7.9% year over year in February, the consumer price index (CPI) is hotter now than at any time since 1982.

And that doesn't even include the impact of the second "I" threat I'll talk about in a minute — just the impact of too much cheap printed money chasing too few goods and services.

Things are getting so bad, a Bloomberg opinion columnist recently suggested meat eaters switch to lentils to save money, while car owners should sell and take the bus.

Oh, and if you own a pet who's really sick? Let it die instead of taking aggressive (and costly) action to keep it alive.

The author was absolutely roasted on Twitter and elsewhere ... and for good reason. Average Americans are mad as heck about this mess — and they want relief rather than lousy advice!

Invasion

Unfortunately, the second "I" — invasion — isn't going to provide any.

Russian President Vladimir Putin may be getting bogged down in Ukraine thanks to stiff resistance from Ukriane's military units and citziens who have bravely taken up arms. But he's showing no sign of backing down or pulling his troops out.

Worldwide sanctions enacted in response — plus the war itself — are helping drive multiple commodities through the roof. Crude oil is a clear example, as is wheat.

In fact, U.S. wheat futures recently hit a record $13.63 per bushel … more than double its year-earlier level thanks to concern about supply shortfalls from key wheat producers in Ukraine and Russia.

Fertilizer? It's through the roof, too. A benchmark index of North American fertilizer prices surged 10% in the last week and 40% in the last month. The reason: Russia is one of the world's largest suppliers of fertilizer and fertilizer components.

Diesel fuel used by truckers who keep the supply chain operating? That also just hit a record high of $4.88 per gallon.

I could go on, but you get the picture. Putin's war is a very real human tragedy ... and also one with significant economic repercussions.

Rising Interest Rates

As for interest rates, even the Federal Reserve has been forced to abandon its long-maintained (and incorrect) narrative that inflation is "transitory." Not only did Fed Chairman Jerome Powell just hike rates for the first time since December 2018, he also indicated many more hikes are coming this year.

Some may even be of the 50 basis points (bps) variety, rather than the customary 25-point moves we've seen in the last couple of hiking cycles. The Fed's next policy meeting is set for May 3–4.

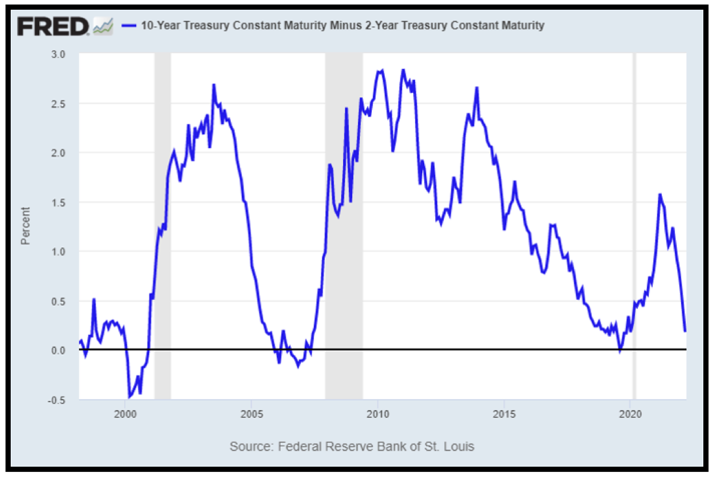

- The problem for the Fed is that its forecast of aggressive action is flattening the yield curve dramatically.

The difference between the yield on the 2-year Treasury Note and 10-year Treasury Note just shrank to 17 bps, as you can see in this chart.

The curve hasn't yet inverted. That's when the 10-year yield falls below the two-year yield. But it certainly looks to be headed that way.

Notice anything interesting about the last few times this happened? Here's a hint:

- Those vertical gray bars on the chart represent economic recessions.

You can see that after the curve flattened and then inverted in 2000, the dot-com bust soon followed. And you can see that after the curve flattened and then inverted in 2006, the housing bust soon followed.

Some will argue the most recent occurrence doesn't count because it was COVID-19 that caused the economy and markets to collapse.

But if you were following my work from 2019, you know I was expecting trouble in 2020 for reasons that had nothing to do with COVID-19 (a bursting of the corporate debt bubble, etc.).

- The pandemic just accelerated and amplified the downturn that I believe was headed our way regardless.

Suffice it to say that the interest rate action we're seeing is yet another reason to worry about more volatility … more migration to "Safe Money" stocks and sectors … and more pain for those not properly positioned.

What Investors Can Do About It

So, if you want to avoid being in that boat — and investors should — I highly recommend you check out Dr. Martin Weiss and Senior Analyst Sean Brodrick's stunning predictions for 2022–2024.

They disucss how the convergence of economic and war supercycles indicate how everything is about to change.

Click here now to learn more.

Until next time,

Mike Larson