|

| By Gavin Magor |

While fear-mongering investors reduced Nvidia’s (NVDA) value by $600 billion last Monday, sending shares lower by 17%, I beefed up my position in the chipmaker.

I’ve been around the block a few times. So, I know that an unsubstantiated report from China about the development of a cheaper, more efficient AI model (by Chinese lab DeepSeek) isn’t going to derail a company with the caliber of Nvidia.

So, when its share price plummets for “silly” reasons — like competition or sideways-moving interest rates — I don’t ask myself why I should buy more shares. I ask, why not?

That’s even the case as NVDA becomes pricier.

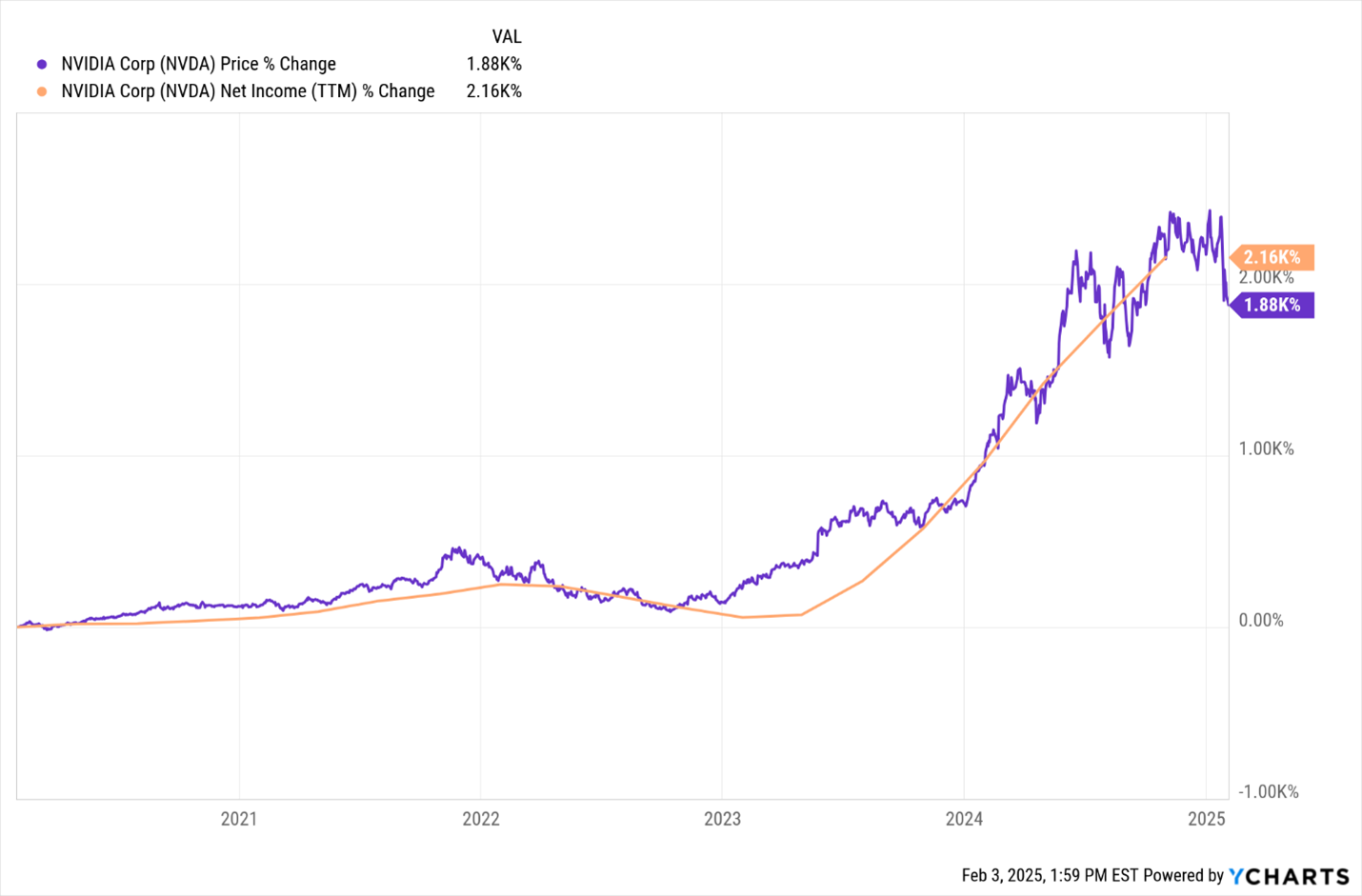

Shares may be up close to 2,000% in the past five years, but earnings are up by about 2,100% during the same timeframe.

I also know from experience that fundamentally sound companies may bend when external forces rattle shareholders’ nerves, but they don’t break.

I mean, here’s a company about to report its Q4 2024 earnings on Feb. 16 and is expected to outperform on top and bottom lines for the fifth consecutive quarter.

All of the same factors that lifted Nvidia during the first wave of growth from AI still remain — especially demand for its GPUs and chips.

Shoot, even DeepSeek uses tens of thousands of Nvidia H100 AI GPUs.

The extent of demand was in full display last week as many of the AI-focused companies and cloud providers that reported mixed earnings still revealed plans for massive spending on the technology moving forward.

Taiwan Semi (TSM), Nvidia's chip manufacturer, forecasted that AI-related chips would double its revenue in 2025.

Now, you can peruse all the earnings announcements and fine print in financial reports …

You can try to distinguish between truth and hope when CEOs paint a picture of the future …

You can dig as deeply and take as long as you want to determine a company’s strength …

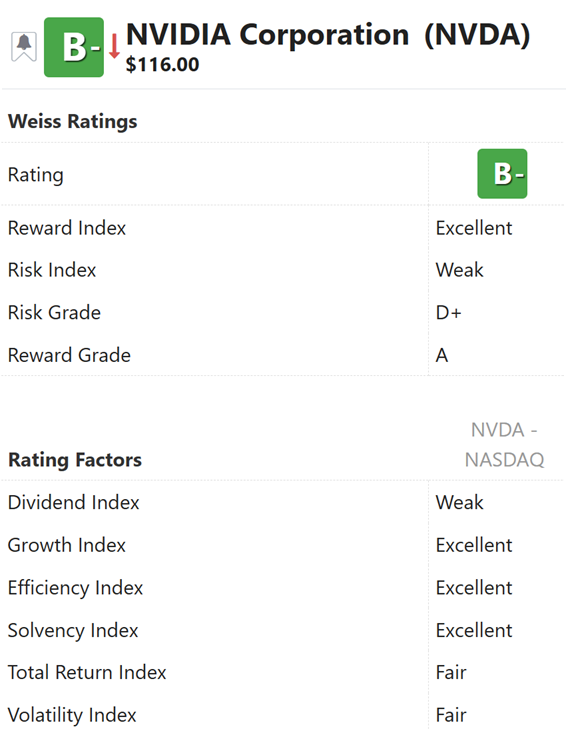

Or you can turn to Weiss Stock Ratings. It doesn’t take much digging or time to get answers there.

It just takes a few keystrokes to find a company’s stock rating and investment recommendation (Buy, Sell or Hold).

I know the cliché most people are familiar with is, “a picture is worth a thousand words.” But so is a Weiss stock rating.

That “A” or “B” or “E” says more than you can imagine. And so does a rating upgrade or downgrade on a stock. You can find a great tutorial here.

Our ratings include our “Reward Index,” which is a representation of potential profit in relation to the risk taken.

It is a look at the positive attributes of a stock's financials, like growth in stock price and a look at valuation versus volatility, solvency and risk metrics.

Here’s how Nvidia fares:

By combining these metrics, our stock model creates a comprehensive rating for each company. This allows us to:

- Highlight companies with strong growth, performance and valuation potential.

- Identify risks, such as high volatility or solvency concerns.

- Ultimately help you make informed decisions based on data, trends and benchmarks.

Here’s an example of what we’re looking for with respect to growth. We answer questions such as:

- Is a company increasing its revenue by selling its goods or services year-over-year, in the last quarter or in the last few years?

- Are minimizing costs and maximizing output driving profitability?

- Are profits after all costs, including rent, salaries, debt costs, taxes, etc., rising consistently?

- And finally, is the company generating enough cash to pay obligations and reinvest in growth, such as acquiring inventory or expanding operations through property, plant, equipment … or even through acquisition, mergers, etc.?

Nvidia checks all those boxes … and some.

It paints a beautiful picture of a stock poised for growth and why I’d still be a buyer of Nvidia.

Cheers!

Gavin

P.S. In just a few hours, my colleague, Michael A. Robinson, is going to go even deeper into Nvidia and the plethora of other tech companies on his radar.

The event — called “The $35 Trillion Trump/Musk Tech Alliance Summit” — will show you exactly how to participate in one of the largest innovation revolutions in history. Click here before it starts at 2 p.m. Eastern today.