|

| By Gavin Magor |

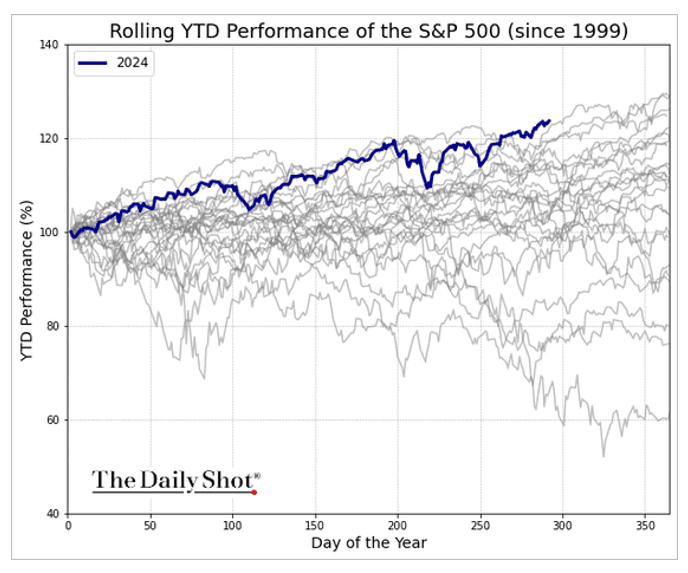

With high inflation, interest rate cut debates and geopolitical concerns, you may be forgetting that this year has been a historically dominant year for the stock market.

Sure, there have been many uncertainties clouding things. But my viewpoint has not changed. I remain cautiously optimistic, and the bulls have won 2024 so far.

Just check out how strong the S&P 500 has been compared to years since 1999:

As of writing, the S&P 500 is up 21.9% in 2024. That’s quite impressive.

And while my premium Weiss Intelligence Portfolio Members are trouncing that return this year, I believe you can aim for outperformance as well with both our Stock Ratings and Crypto Ratings.

Heck, even many professional traders can’t outperform the market when it’s performing so strongly.

But we do things differently here at Weiss Ratings. And it’s why I’m confident our ratings are superior to most.

Sock it to ‘Em with

the Weiss Stock Ratings

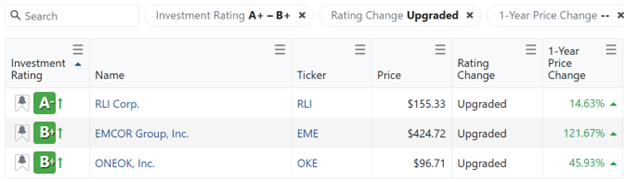

There are many ways I could illustrate just how amazing our Stock Ratings are. But today, I want to show you how to check which “Buy”-rated stocks have recently been upgraded.

This way, you may be able to get ahead of the trend for potential gains on these positions.

After heading over to the Weiss Stock Ratings page, I entered these easy filters:

- Investment rating of “A+” to “B+”

- Rating Change, Upgraded

Here’s the results:

Three stocks populated. And they all look like strong names with solid one-year returns … especially EMCOR Group (EME) and ONEOK (OKE), up 122% and 46%, respectively.

EMCOR has been within our “Buy” territory since Oct. 2022. Since it landed there, shares have gone up 204%.

ONEOK has been within our “Buy” territory since May of 2023. And shares are up 69% since.

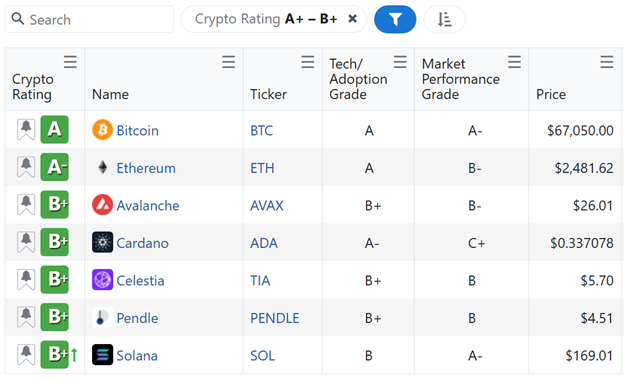

Of course, we don’t just have stellar stock ratings here at Weiss Ratings. I encourage you to check out our Crypto Ratings as well, especially since we are in more of a “risk on” Bull Market.

Crypto Ratings to

Ridiculously Revere

After an easy filter for crypto ratings within our “A” to “B+” range, here’s what populated:

Here, you can see Bitcoin and Ethereum. But other highly rated names like Solana and Cardano may be less familiar.

We have amazing tools such as the Tech/Adoption Grade and Market Performance.

I encourage you to explore these as well, especially as cryptocurrencies rapidly become further mainstream.

And no matter where you are on your investing journey, there’s a very time sensitive profit-packed opportunity that my colleague Juan Villaverde has. In fact, he calls it a …

Golden Window

About to Open

According to Juan, this window will promptly open up on Nov. 5. And boy, we don’t want you to miss it!

It’s a rare opportunity that only blossoms once every 1,460 days.

Juan will be hosting an urgent event tomorrow, Oct. 29, at 2 p.m. Eastern, where he will detail opportunities that have led to gains of 19X, 23X and even 93X!

The founder and head honcho at Weiss, Dr. Martin Weiss, even invested a whopping $100,000 into this same strategy, and his return is already up to a very impressive $407,000.

So, do not wait, click here for your spot.

And no matter what you do, I’m confident you can outperform any market environment … even this charging bull market we’re currently in.

With the Weiss Ratings, I’m quite confident that your best investing self is just clicks away.

Cheers!

Gavin