|

| By Sean Brodrick |

The price of lithium is down 85% from its highs, and this energy metal is roundly detested by investors. But you know what? I believe that’s about to change in a big way.

You know that lithium is essential for battery production. And it’s long been promised that solid-state batteries — the Next Big Thing — could create even more demand.

For multiple reasons, the International Energy Agency (IEA) projects that demand for lithium will increase by nearly 90% over the next two decades.

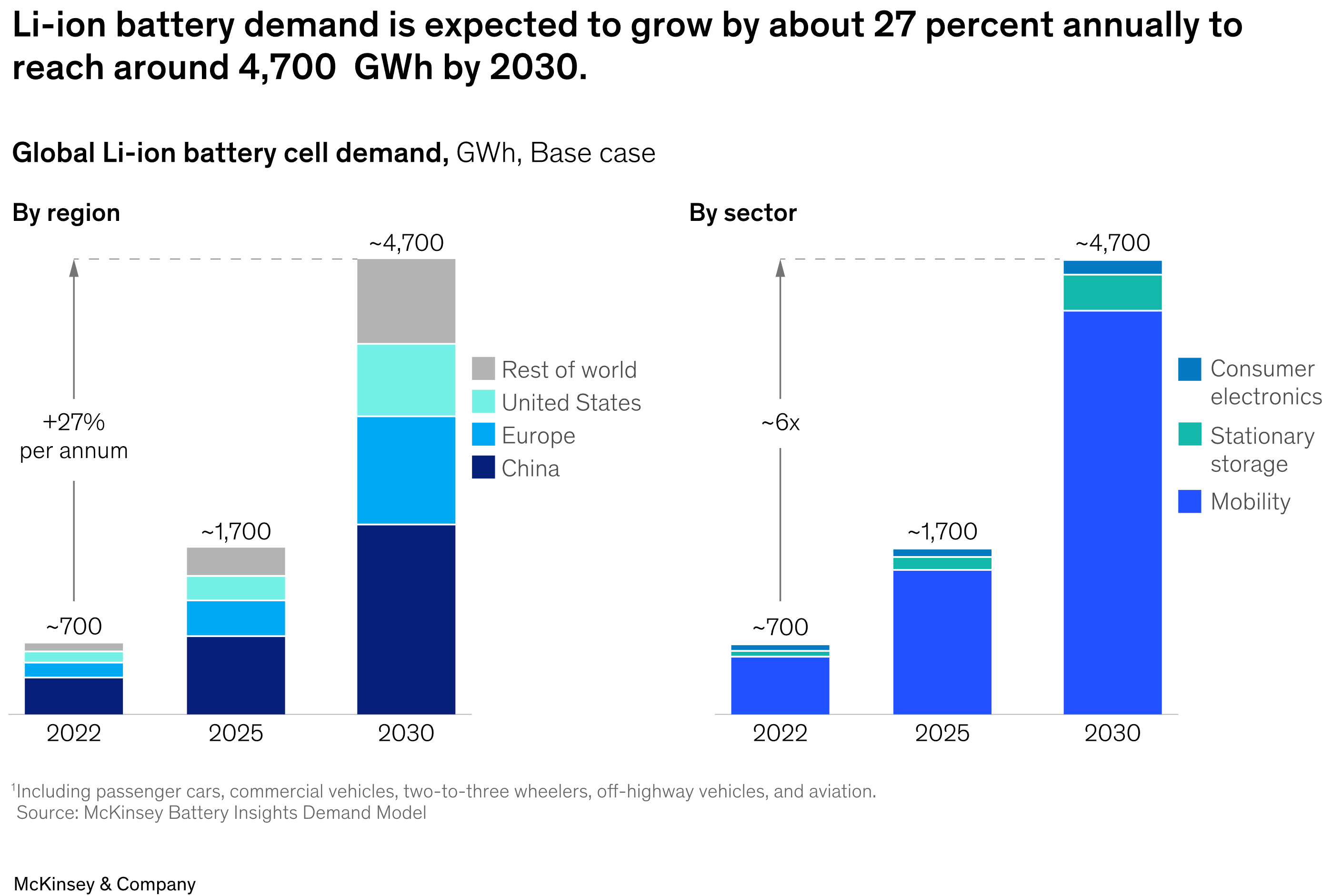

Lithium battery demand is forecasted to grow by about 27% annually and hit 4,700 kWh by 2030. That would see demand for lithium grow by 2.5 times!

And a catalyst right here at home could light a fire under lithium prices.

That’s because 2025 will see 10 new lithium battery plants come online in the U.S., including plants from LG Energy Solutions, SK On, Panasonic and other battery giants.

Collectively, these 10 new plants will grow America's battery manufacturing capacity to 421.5 gigawatt-hours per year. That’s nearly double what it was in 2024.

To be sure, lithium only makes up a small part of the cost of an electric vehicle. There are other metals in a battery — nickel, manganese and cobalt in varying amounts. The battery as a whole makes up a third of an EV’s price.

Sure, President Trump is threatening to kill EV tax credits and slap 25% tariffs on vehicles and parts from Canada and Mexico. So, lithium is in for a turbulent time.

But most of these new plants are in Republican states. I’m thinking the president might change his mind.

Prices Are Already Rising in China

Most of the world’s physical lithium is traded in China. And Deutsche Bank says China’s lithium carbonate spot price should rise from $10.50 per kilogram at the end of last year to $12 per kilo in 2025.

Meanwhile, last year’s rock-bottom prices got low enough to delay lithium mining projects.

Roughly one in 10 new lithium mines originally planned to come on stream this year are on hold.

So, we’re looking at a good old fashioned supply squeeze in lithium. And I know a great way to play it: The Global X Lithium & Battery Tech ETF (LIT).

This fund has an expense ratio of 0.75% and a dividend yield of 0.93%.

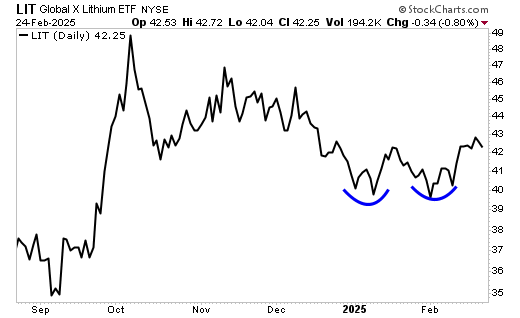

Top holdings include Albemarle (ALB), Sociedad Química Y Minera De Chile (SQM), Tesla (TSLA) and EnerSys (ENS). Let’s take a look at a chart of LIT ….

It sure looks like LIT put in a double bottom and now is zigzagging higher. It should easily revisit its September high and go up from there.

LIT is an easy way to play the next move. Or you can drill down into the fund to find single stocks for potential outperformance.

All the best,

Sean

P.S. Shortly, we’ll be taking down the video that everyone at Weiss Ratings is talking about. You can see it before it disappears right here.