|

| By Sean Brodrick |

Monday brought the S&P 500’s lowest close in three months. The Industrials shed more than 1,000 points. And the Nasdaq saw one of its worst trading days over the past 30 years.

U.S. investors were on edge to start the week. But those 3%-ish drops were nothing compared to Japan's stock market falling more than 25% in three days.

To give you even more context, I believe that was the fastest 25% drop that any major global stock market has seen in history. Ouch!

A Global Margin Call

The only way to label this global selling spree was that it was a global margin call for hedge funds.

After all, just about everything got sold: stocks, value, high-yield, big tech and growth.

It seemed like there was no place to hide outside of U.S. Treasuries and private equity.

Speaking of the latter, my colleague Chris Graebe is hot on the trail of a company that’s behind a secret technology. One that could spark a $1.8 trillion tech disruption and potentially become Elon Musk’s worst nightmare … before it ever IPOs.

Chris is set to release more details as soon as Tuesday, Aug. 13. I know I’ll be listening in, and I urge you to get on the list to learn about it here, too.

In the meantime, if you’re wondering how to play the recent market face-plant, I have some ideas.

First, we’ll look at my top five reasons why markets sold off.

No. 1: Tech weakness.

Tech has been hit hardest recently. Tech stocks tumbled because investors don’t see the return on investment that was promised with artificial intelligence.

That’s very shortsighted, as AI will deliver, if not right away. But for many, it’s a good reason to sell in the short term.

No. 2: Earnings estimates are coming down.

Q2 earnings growth so far is 11.5% year over year. That’s the best since Q4 2021.

But the market is always pricing in the future. What about next quarter? As of Friday, earnings estimates for Q3 are for growth of 6.1%, with more companies issuing warnings than upward revisions.

In order for stocks to go higher, earnings need to go higher. Now, the market is starting to price in Q3 earnings disappointment.

I would point out that investors are disappointed not because earnings will go down but because they’re not going up as quickly as previously. Again, that’s shortsighted.

No. 3: Political uncertainty.

After June’s presidential debate, the market was starting to price in a Trump victory — with its promise of massive tax cuts for corporations and high-net-worth individuals — as a nearly sure thing.

Now, though, Harris’ odds are surging. That’s politics for you.

Could the odds swing back in Trump’s favor? Sure! But the market isn’t sure of any outcome, and it’s hard to make financial plans when you don’t know what policies will be in place just five months from now.

On the bright side, we’ll have an election in a little over three months, and that uncertainty will be behind us.

No. 4: Fear of recession.

According to a recent CNBC survey, two-thirds of Americans believe the country is approaching a recession or is already in one. That makes investors quicker to hit the “sell” button. And that, in turn, makes more people think a recession is on the way. This feeds into the doom loop of anticipation many investors have.

Now I’ll point out that fears of recession are often overblown. It’s because the media makes its money by shoving bad news into our eyeballs. The economy is weakening. But we’re nowhere near a full-blown recession.

No. 5: The Fed is Behind the Curve

The U.S. Federal Reserve held its benchmark interest rate steady in July despite a parade of weakening economic news. Month after month, America has seen gloomy consumer expectations, weak new orders, negative interest rate spreads and rising jobless claims.

The Federal Reserve is supposed to cut interest rates to balance a weakening economy. Now, the market believes the Fed is way behind the curve on cutting rates.

Traders also think the Fed is finally going to wise up and are pricing in a big Fed rate cut in September and every meeting into early next year.

Okay, that’s a lot of bad news and five powerful reasons for the market's decline. Should you sell?

Heck, no!

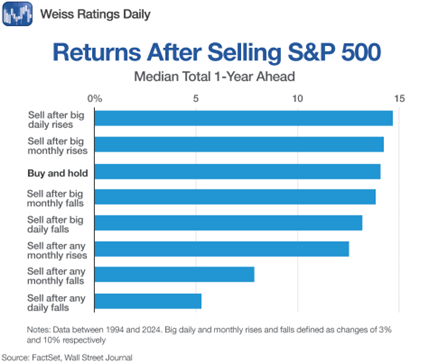

This chart made with FactSet data shows what happens when investors sell after big down days … and under other circumstances.

As you can see, the ONLY strategies that beat “buy and hold” are to sell after a big daily or monthly rise. And those who sell after big falls do particularly badly! It’s a case of closing the barn door after the horse is out.

And remember, the market ALWAYS has corrections. History shows that, on average …

- 5%+ pullbacks occur more than three times a year.

- 10%+ pullbacks occur once per year.

- 15%+ corrections occur every other year.

- 20%+ pullbacks occur every three to four years.

So, my recommendation is, Don’t Panic. Instead, here are three actions you should consider …

Action No. 1: Look Closely at Your Portfolio

If your positions are getting hammered, is it just because the broad market is going down? Or have circumstances changed for that stock?

One thing we know is interest rates will likely go down. Will that help or hurt the stocks in your portfolio?

If you conclude the drawdown in any particular stock is just temporary, then keep holding it. Only sell a stock IF you think you can make more money investing in something else.

And that brings me to the second action.

Action No. 2: Make a Shopping List

In the short term, stocks could go lower. But if your eye is on the longer term — and it should be — lower prices would be a buying opportunity.

So, make a list of stocks you want to buy. And raise cash to buy them by selling underperformers you don’t think will bounce.

Action No. 3: Sit Tight, You’ll Be Right

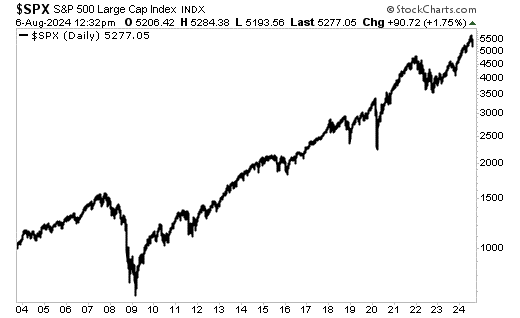

Over the longer term, the market goes up. Here’s a chart of the last 21 years of S&P 500 activity.

The only pullback of real significance is the Great Financial Crisis of 2007-2008. And NO ONE of any repute thinks this current sell-off is anything like the Great Financial Crisis.

Even the pandemic pullback looks like a bump in retrospect. And this most recent sell-off barely registers.

Your goal should be to own enough quality stocks that you outperform the broad market. That’s certainly possible. Heck, in Supercycle Investor, in July alone, we took bunches of gains: 15%, 47%, 105%, 138.36% and more. The portfolio is light now. And I’m going to recommend subscribers reload with high-powered names … when the time is right.

We may not have seen the bottom of this current sell-off yet. But this, too, shall pass. And the next rally will likely be a doozy.

All the best,

Sean