There’s a big supply-demand squeeze with lithium and lucrative investments that play to it.

And lithium isn’t the only energy metal on a soaring price path.

In this segment, I interview commodities specialist and Senior Analyst Sean Brodrick about new mining companies getting in on the action, the electric vehicle boom and why there’s tremendous profit potential for gold and silver in 2023.

You can watch the video here or continue reading for the full transcript.

JB (narration): The market for metals is heating up.

JB: Sean, lithium is one of the big trends right now. It has so much life, now and moving forward.

Sean Brodrick: The way lithium prices are going, these companies aren’t just mining lithium, they’re mining money.

There’s just tremendous profit potential there. Demand is so strong that the average forecast is that we’re about to go into a serious lithium deficit.

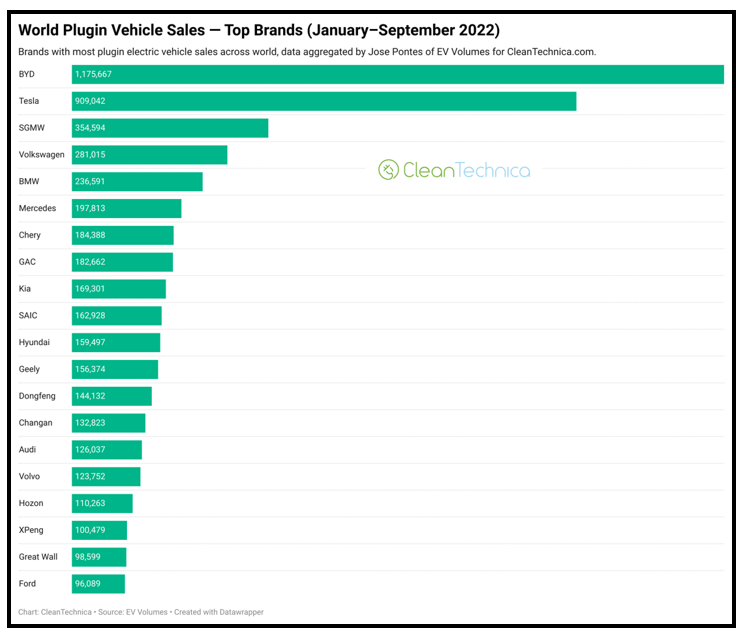

JB (narration): Lithium is one of the key components in EV batteries. And EV sales continue to rev up.

SB: We’re seeing a faster pace of EV sales and so that is what is really driving the lithium supply-demand squeeze.

It’s just going higher and higher, especially in China. China is the leader in all of this. Europe is No. 2.

Thanks to some incentives that were put into the most recent U.S. tax plan, there are all sorts of incentives not only to buy EVs now, but to buy used EVs, which we never had before.

So, that’s probably going to keep things booming here in the U.S.

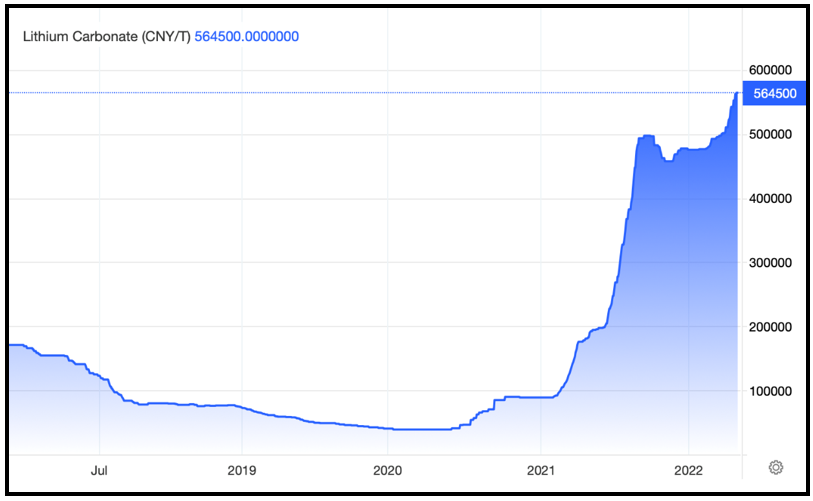

JB (narration): The price that’s watched is the price of lithium carbonate in China, which is essentially the global benchmark.

This chart shows how much the price is on the rise.

Click here to see full-sized image.

Sean’s trading services, Wealth Megatrends, Supercycle Investor and Resource Trader play to its strength.

SB: All forecasts are that, going forward, even with high lithium costs, the price of batteries will come down.

And so, within a few years anyway, the cost of buying an EV will be about the same as buying an internal combustion vehicle.

That’s one of the things that’s probably going to accelerate demand.

JB (narration): And so will new tech that makes recharging batteries more efficient. NASA says it may have the answer to ultra-fast EV charging.

SB: NASA says it can use the same technologies that it uses in spaceships to cut the amount of time that it takes to charge your EV down to about five minutes.

Even though we’re seeing fast EV adoption now, we’re going to see faster EV adoption in the future.

So, it’s a really exciting world and there are lots of investment opportunities.

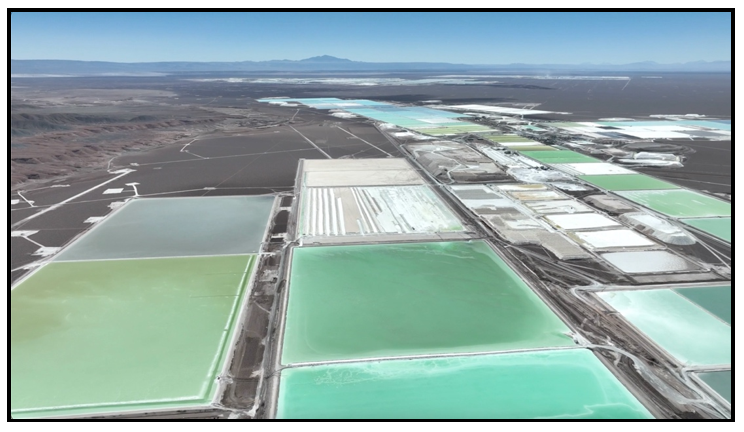

JB (narration): You can’t invest in lithium futures — like you can with oil, for example — mainly because it’s such a new market. But you can invest in the companies that produce lithium.

Click here to see full-sized image.

The exchange-traded fund, Sociedad Química y Minera de Chile (SQM), has a Weiss Safety Rating of “B.”

SB: They not only produce lithium, but they also produce agricultural chemicals. Guess what? We need a lot of those, too.

It also pays a heck of a dividend with a yield of 4.86%.

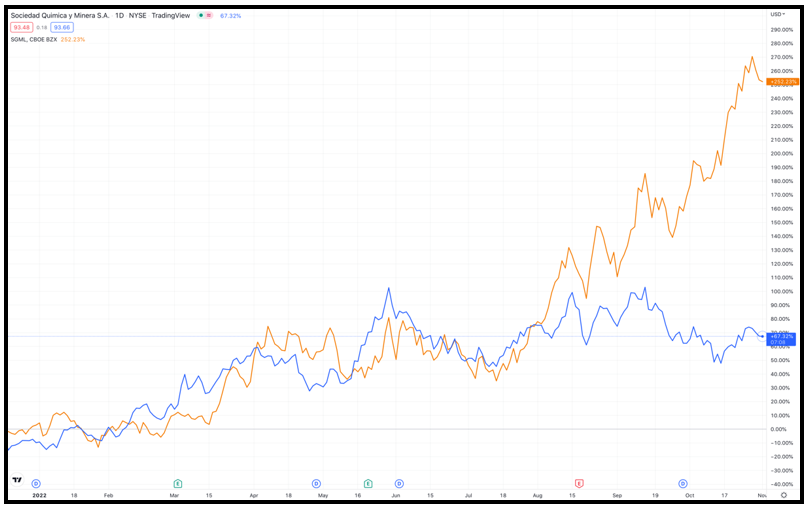

JB (narration): Sigma Lithium Corporation (SGML) has done well in Sean’s model portfolio. It has a new mine coming online in Brazil and possibly the U.S., down the pike.

Click here to see full-sized image.

SB: We already made 200% gains, and last week, we sold the remaining shares for a gain of nearly 300%.

There are also some junior mining companies that are going to be involved in new mines. I have a group of five that will be bringing new projects online in the next two years.

I’m watching those very closely and making recommendations because those are the ones that are probably going to blast off.

JB (narration): There’s not just energy metals to watch, but precious metals, too.

JB: What are you seeing in the precious metals market that has you quite bullish on it?

SB: You see cycles in all sorts of things and all sorts of markets, but especially in precious metals. They are very cyclical beasts.

There seems to be a silver squeeze coming on. I recently recommended a new silver junior position.

Silver production will be up this year. Nobody knows how much.

And it’s true that the last two years were incredibly difficult because we had the pandemic going on and mines shut down for a period of time.

Silver is one of the most useful industrial metals we have because it really conducts electricity very, very well.

It’s used so much in solar power, for example. It does all the little connections that you have in a solar panel.

Click here to see full-sized image.

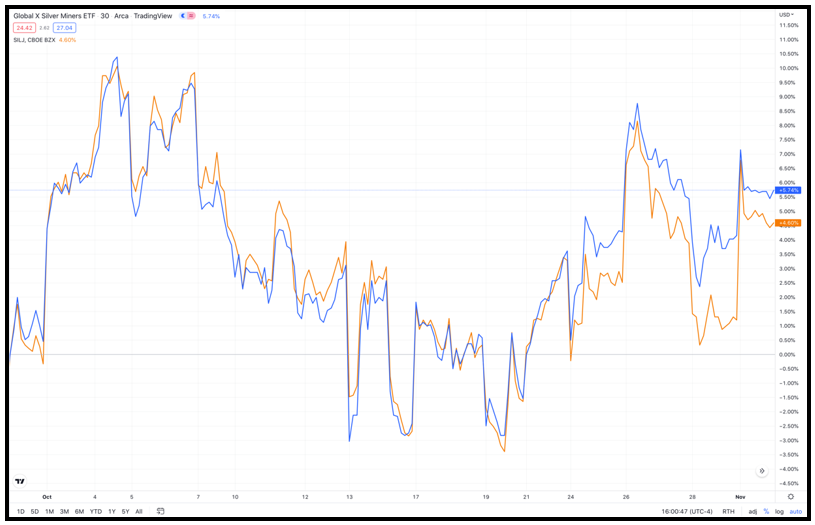

JB (narration): There are a few ways to get in on the trend. One way is through the Global X Silver Miners EFT (SIL).

SB: If you want to ride silver stocks, SIL holds the biggest silver miners in the world.

There’s also the junior miner version of it, which is ETFMG Prime Junior Silvers Minters ETF (SILJ).

Click here to see full-sized image.

Frankly, some of the miners in there aren’t so junior anymore because they keep growing! They hold the best miners … that’s the nice thing about an ETF.

Those companies leveraged to silver could do extraordinarily well.

JB (narration): Sean says gold is at the bottom of a two-year cycle.

SB: I think we’ll be looking at much higher gold prices next year. That will probably come with a weaker U.S. dollar.

That doesn’t mean that the dollar is going to become worthless. It’s just that it’s been on a rampage this year.

As the dollar gets weaker, precious metals will look much more attractive and cyclically speaking, this next year is going to be great time for those metals.

JB (narration): So, now’s the time to target investments along for the ride.

JB: Senior Analyst Sean Brodrick, it is always a pleasure to get your insights. Thank you so much for making time for me today.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings