|

| By Sean Brodrick |

Many traders and investors are as nervous as 9-tailed cats in a roomful of rocking chairs right now.

The funny thing is that most of the financial talking heads I see on Bloomberg TV are NOT nervous. They say they are bullish on the economy and that you should be buying.

These people represent some of Wall Street’s biggest firms. So, maybe we shouldn’t be so nervous. Except here’s the funny thing: Wall Street is selling every rally in the broad market.

We see hedge funds and institutions rotating into safety stocks, gold and cash. So, if the talking heads are so bullish, why are their companies selling?

I’ll show you three charts that explain why …

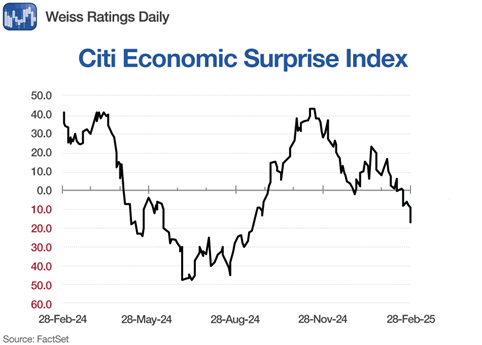

Economic Surprises, and Not the Good Kind

The U.S. Citi Economic Surprise Index, which tracks the difference between what economists expect and what the data shows, has fallen to its lowest level in almost six months. And it’s likely to go lower as data continues to disappoint.

Poor economic news is a harbinger of what could affect corporate earnings.

Orders Down, Prices Up

Let me give you an example of the bad news. Here’s the Institute for Supply Management data that came out on Monday. It shows new orders and manufacturing prices.

New orders fell off a cliff from January to February. There could be plenty of reasons for this, but President Trump’s tariff-thumping is having an impact because it raises uncertainty.

Companies are unsure of the economic environment in the future, so they take fewer financial risks.

Meanwhile, prices paid continue to surge, rising to the highest level in more than two and a half years. That’s the biggest jump since the pandemic. And this is before tariffs hit!

Together these charts add up to more inflation and lower economic activity. And to many on Wall Street, that sounds uncomfortably like stagflation.

And there are other bad economic surprises — in consumer confidence, retail sales, home sales and more.

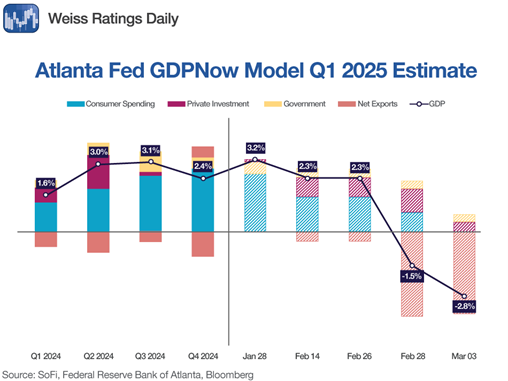

And that leads to the bombshell that the Atlanta Fed dropped on Monday, with its updated GDPNow forecast for Q1 …

The Atlanta Fed’s GDPNow model shows the economy contracting at 2.8% in Q1. Some of these might be special situations. For example, imports jumped ahead of the Trump tariffs, and imports subtract from GDP readings. So, once imports get back to normal, the readings could improve.

However, the Atlanta Fed is also tracking no growth in consumer spending or equipment investment, and there is a contraction in housing.

This week’s GDPNow estimate is the worst number in the history of the series except for Covid!

So, you can see why the institutions and hedge funds are selling rallies.

That makes all the happy talk we’re hearing from analysts on CNBC and Bloomberg even more grating.

It sure looks like they’re talking up the markets so their bosses can get better prices as they sell into rallies.

Now, this all seems gloomy. But there are ports in this storm.

What to Buy When the Market is Tariff-Fied!

Here’s one …

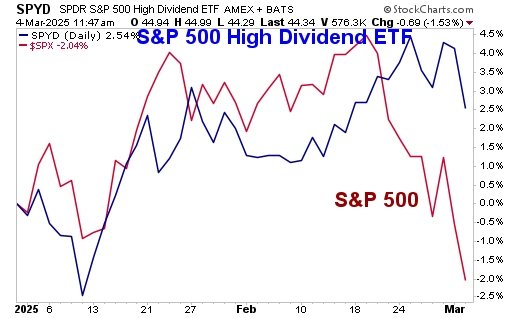

If you have an S&P 500 fund, consider shifting to the S&P 500 High Dividend ETF (SPYD).

It has an expense ratio of just 0.07% (cheap!), a fat dividend yield of 4.23% and a Weiss Rating of “C.”

It is also plenty liquid, with average volume of more than 900,000 shares per day.

What’s so good about the SPYD? Well, since the start of the year, its performance has kicked the S&P’s butt.

You can see when the market shifted, as traders began to find dividend-paying stocks much more attractive than the regular S&P 500.

As of Tuesday, the S&P 500 was negative since the start of the year (so far), but the SYPD is managing a decent gain.

While the market works through the trauma of the new tariffs, the SPYD might be a good place to hide out.

All the best,

Sean

P.S. There’s another way to profit in an even bigger way when markets are terrified — private equity.

Pre-IPO companies aren’t as restrained by fast-shifting market prices. Instead, they keep their heads down and push forward with their growth plans.

And my colleague, Chris Graebe, is the expert at finding the right ones. In fact, on Tuesday, he’s going to unveil his latest pre-IPO opportunity. Click here to reserve your spot.