|

| By Sean Brodrick |

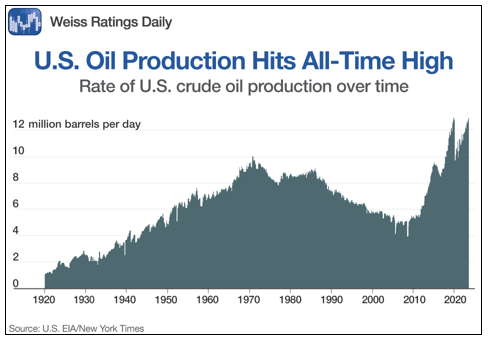

The United States is now the world’s No. 1 producer of crude, as well as the leading producer of natural gas.

So, that SHOULD be good for the stocks of U.S. oil producers, right? Well, it’s more complicated than that.

This production surge is happening against a backdrop of an oil price roller coaster that leaves many investors confused. Strap on your seatbelts because there is a wild ride ahead.

There is plenty of oil on the global market now, and a lot of it is coming from American oil fields. Sure, average U.S. crude oil production dipped slightly from 13.252 million barrels per day in September to 13.248 million bpd in October.

That’s the first monthly decline in average daily production rates since April, but it’s still the second highest ever. And yes, that’s more than Saudi Arabia or Russia produce.

The flow of oil has grown by roughly 800,000 barrels per day since early 2022, and analysts expect the industry to add another 500,000 barrels per day in 2024.

This is happening even as the U.S. sheds drill rigs. The number of rigs is down by about 170 rigs across various basins.

So, how is America producing more oil with fewer rigs? Rigs are incredibly more efficient — about six times more efficient than they were a decade ago. The new rigs that are doing this are super smart — utilizing advanced electronics, robotics and artificial intelligence.

So, we can expect pressure on oil prices at least in the short term.

But the changing nature of how oil is produced — using tech to get more bang for the buck — means investment in oil services companies, both onshore and offshore, could be very profitable. In fact, backlogs are rising for the best oil field services companies.

Raoul LeBlanc, vice president at S&P Global Commodity Insights, recently predicted that American production could rise to 13.7 million barrels per day by the end of 2024, unless there is a deep recession and prices drop around $10 to below $65 per barrel.

This affects gasoline prices, too. Prices at the pump should stay low for most of 2023, due to a jump in global refining capacity. That, in turn, should boost economic activity and consumer confidence.

But as for confidence in the oil fields? Well, it could be scarce in many oil producers limited by prices ranging between $65 to $75.

Coming back to my point, do you know who should be helped by this price range? Oil field services companies.

That’s counterintuitive because conventional Wall Street wisdom is that oil producers will cut back on drilling as prices pull back.

That’s true if prices plunge. But as long as prices stay above $60 a barrel, most producers have positive cash flow. And oil producers will be under the gun to keep their cash flows up. When prices are lower, the only way to do that is to pump more oil.

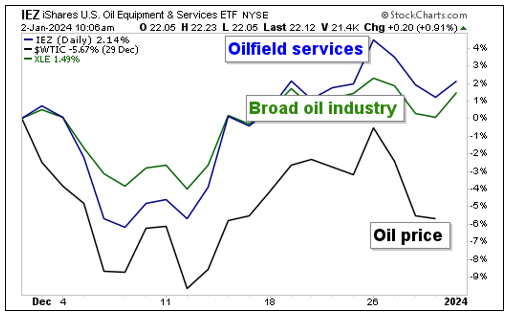

And that’s good news for the stocks in the oil field services industry. The group as a whole is already outperforming since oil and oil stocks bottomed in December. Here’s a performance chart to show you what I’m talking about …

On this chart, I’ve tracked the performance of the price of oil, the broad oil industry as tracked by the Energy Select Sector SPDR Fund (XLE), and the iShares U.S. Oil Equipment & Services ETF (IEZ), a leading oil services ETF. You can see that both exchange-traded funds are outperforming the price of oil since the bottom, and IEZ is ahead. I believe that lead will grow.

Now, will you get a chance to buy IEZ cheaper? Maybe. I’d say in the short term the market is overbought. Heck, the S&P 500 has gone up for NINE WEEKS IN A ROW! Odds favor a pullback sooner than later.

But when that pullback comes, you can buy it. And if you like the oil complex, oil field services is the place to be.

That’s all for today. I’ll have more for you soon.

All the best,

Sean