|

| By Sean Brodrick |

Gold has soared to record highs in 2025!

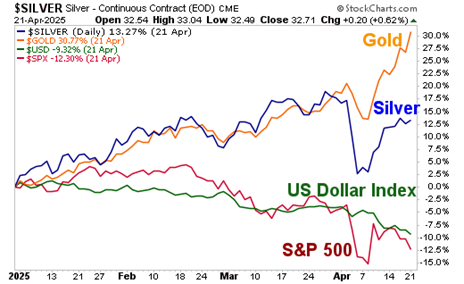

Prices touched $3,500 an ounce recently, and gold has gained a whopping 30.7% so far this year.

And considering that the S&P 500 has lost 12.3% so far this year, many investors are starting to get a touch of metal mania!

But what about silver?

It’s often considered the emotional little sister of gold. Because when gold is down, silver falls on the floor. And when gold is up, silver usually jumps for the stars.

Not this year. Silver has lagged. It’s not making new highs, though it is handily outperforming the S&P.

Gold rises as the U.S. dollar falls. That’s no coincidence. Gold is priced in dollars. They usually move in opposite directions.

And right now, with American exceptionalism under threat, investors are exiting dollars and moving to gold.

Not silver, though. This precious metal hasn’t shone so far this year … yet.

But can that change? Is silver the secret bargain in precious metals?

I’ll get to that. Let’s talk about why silver is underperforming gold. Here are the three biggest:

Why Silver Is Lagging

Gold Is the Safest of Safe Harbors — President Trump’s “Against All Flags” approach to international trade is sending investors scurrying for safety.

Throughout history, gold has shown it’s a safe harbor, holding its value even as empires fall.

Silver doesn’t have that safety cache.

Central Banks Buy Gold — To protect themselves from geopolitical risk and U.S. dollar hegemony, central banks around the world are loading up on gold.

The world’s central banks have bought gold for 15 years in a row — and last year was the third in a row that they collectively bought more than 1,000 metric tonnes.

However, central banks don’t buy silver. So, this is a big reason why silver is underperforming.

Fear of a Global Recession — Recession fears have risen sharply in the past month. JPMorgan puts the odds of a worldwide recession at 60% this year.

This impacts silver because it’s more of an industrial metal than a precious metal.

About 59% of silver demand is industrial. Silver has the highest electrical and thermal conductivity of any metal, along with excellent reflectivity and antimicrobial characteristics.

It’s used for electronics, solar power, EVs, power storage systems, chemical catalysts — all things that could get hit as a trade war intensifies.

So that’s why silver is underperforming.

On the other hand, I believe it could play catchup in a hurry. Here’s why …

4 Reasons Silver Should Soar

The Green Energy Transition Remains Intact — In April of this year, “green” energy sources passed 51% of total U.S. utility power generation. Globally, it’s even better as countries race to replace coal with solar and wind power.

That tells me that industrial demand for silver isn’t as vulnerable to recession as many think.

Silver Is Also a Monetary Metal — Many people forget that silver has played an economic role for thousands of years.

Today, it’s not officially used as a currency. But it’s money — and hard money at that — because, like gold, you can’t print silver. And mints around the world make silver coins. Demand for those is booming!

In a real financial crisis — and we could have one of those — silver will shine as a monetary metal.

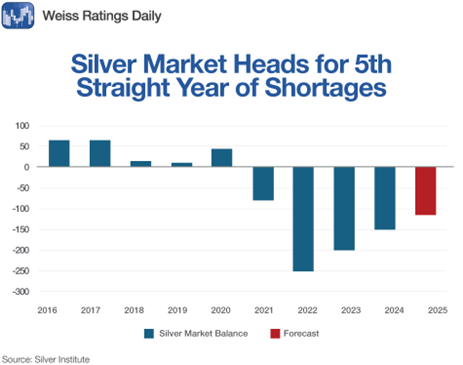

Silver Production Keeps Falling Short — Unlike gold, most silver mined worldwide does not come from primary silver mines. Instead, 80% of silver produced comes as a byproduct of other metal mining … like that of lead and zinc.

That means the silver supply is fairly inelastic, no matter how much demand increases. And 2025 is the fifth year in a row that silver production is going to be less than demand.

Above-ground stockpiles will make up the difference, at least for a while. But those can only last so long.

Add increased demand to less supply, and it sure looks like we have the potential for a squeeze in silver prices.

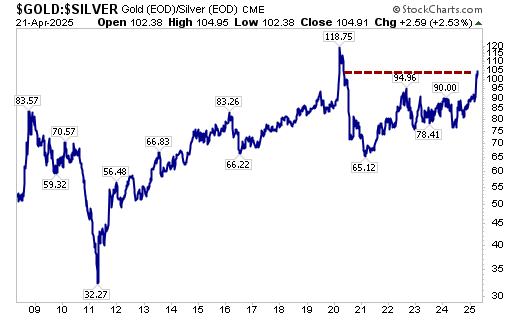

Silver is Dirt Cheap — The gold/silver ratio is how many ounces of silver it takes to buy an ounce of gold. It just hit a five-year high.

It now takes nearly 105 ounces of silver to buy one ounce of gold. The historical gold/silver ratio is around 60. A more recent average is around 75.

However you slice it, silver looks like a bargain compared to gold.

We are in a precious metals bull market, but it has barely started.

I’m old enough to have seen a few of them. When the metal mania really starts, we will see investors snatch up silver out of the bargain basement.

I fully expect silver to hit $48 by the end of this year, and $100 an ounce longer term.

So, is it a buy now? Heck, yeah!

How You Can Play It

It’s easy enough to buy silver coins, rounds or ingots online or at your friendly neighborhood precious metals dealer.

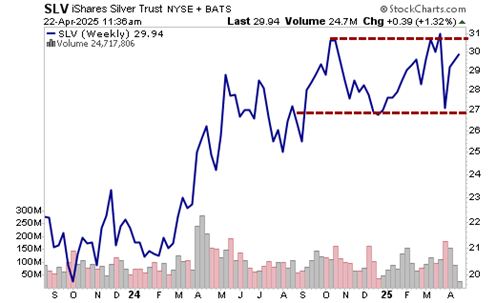

If you want to add it to an investment portfolio, consider the iShares Silver Trust (SLV).

It holds physical silver and closely tracks percentage moves in the metal.

The SLV has an expense ratio of 0.5% and is plenty liquid. Let’s look at a weekly chart …

You can see that silver and the SLV have consolidated in a band since October. I call this an “energy band” — it’s storing energy for a big move up or down.

Considering the fundamentals, I believe that the next big move is up … way, way up!

The next move could leave silver’s critics slack-jawed with disbelief.

I recommend you get a ticket on this silver rocket. It’s a bargain, and blastoff is coming.

All the best,

Sean

P.S. Did you see yesterday’s MAJOR announcement? Dr. Martin Weiss shared what he calls the “crowning achievement” of his 54-year career. But if you watch to the end, he shares an even bigger surprise.