|

| By Nilus Mattive |

On Tuesday, I told you why Warren Buffett has built his entire empire on the backs of insurance companies.

One of the reasons was that he hates taking big risks.

As Buffett once famously said,

“The first rule of an investment is: Don't lose [money]. And the second rule of an investment is: Don't forget the first rule. And that's all the rules there are.”

Another rule, it seems, is that most people will tell you options are risky.

In fact, Buffett famously called them — and other types of derivatives — “weapons of financial mass destruction.”

So, you might be surprised to find out that Buffett has actually used options to make massive windfalls, too.

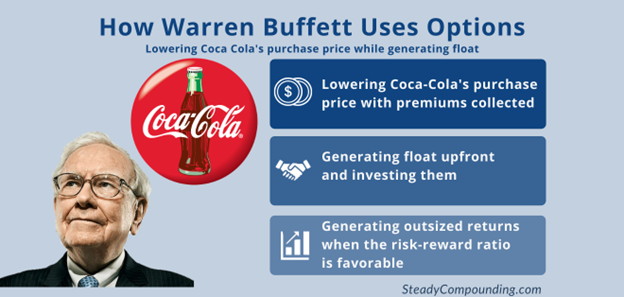

For example, he once made $7.5 million on 50,000 Coca-Cola put options.

Think that’s a lot?

Well, before the financial crisis hit, Buffett generated more than $37 BILLION with options on several different stock market indexes.

On the surface, this doesn’t add up.

But the important thing to know is that Buffett wasn’t buying options in these cases.

He was SELLING them.

Before I go any further, it makes sense to back up and review what options are and how they work.

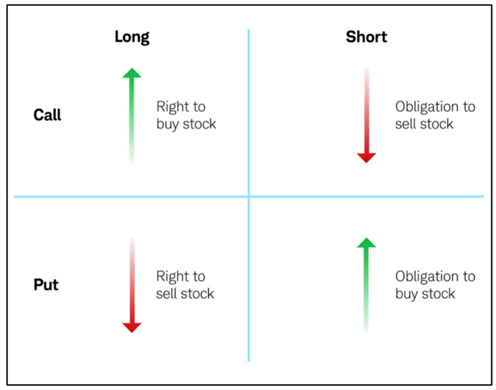

In plain English, an option gives its holder the right to buy or sell some other security — typically a stock or an ETF — at a specified price over a specified time frame.

Put options give you the right to sell an investment.

Call options give you the right to buy an investment ...

… Both at an agreed-upon price on an agreed-upon date.

So, for example, if you’re worried about another bank going under, you can buy a put option on that bank’s stock.

It’s like an insurance contract for the stock.

That way, if the stock drops a lot, you can unload it on someone else at whatever price your contract says.

Traders also use them to speculate — mostly on investments they don’t even own.

When option buyers are right, they can make a lot of money.

But that’s not what usually happens.

Countless studies — including one from the Chicago Board of Options Exchange itself — show that a majority of individual options end up either not being used and/or expiring worthless.

This makes sense.

Just consider how many people pay for homeowners insurance each and every year.

Now think about how many people end up filing claims, let alone experiencing a huge catastrophe like a fire that completely destroys the entire property.

Yet the insurance companies are raking in all that money from every single policyholder each and every year … sometimes for many decades!

It’s the same idea with options. Most of the big moves people expect don’t end up happening so their investment insurance goes unused.

Meanwhile, for every option that someone is buying … there’s someone else on the other end collecting the money they paid.

Most people never really consider that, and Wall Street is glad they don’t.

Because Wall Street trading firms LOVE to keep that part of the business all to themselves.

It’s a niche insurance business, where millions of investors are paying premiums month in and month out and in the vast majority of cases, not even using the insurance they’re buying.

And now you understand why Warren Buffett has happily used options in this way as well.

In the case of Coca-Cola, he sold someone else insurance against the stock dropping.

Keep in mind, not only did they have to be right about the investments dropping. They also had to pick the prices they were going to fall to … and the timeframes involved.

Meanwhile, what was Buffett’s “worst case” scenario?

Being forced to buy more shares of Coca-Cola at a price he considered favorable!

So, here’s the reality …

Yes, options TRADING is risky … especially when you’re buying them and hoping for big moves in short periods of time.

But if you stick to selling options — essentially taking the other side of those kinds of bets — you can collect big payments on a regular basis with minimal risk.

This Strategy Can Easily Get You

4x More Income Than CDs or Bonds

Although the Fed has already begun cutting rates, it’s still possible to lock in 4% from fixed-income investments like CDs and bonds right now.

Yet, I consider options selling to be a far better way to generate consistent income than any traditional stock, bond, money market or other investment you can think of.

After all, even using this strategy conservatively, you can easily get annualized yields of 16%.

That’s FOUR TIMES the income from a CD or Treasury bond even with rates at higher levels than they have been in ages.

Heck, the S&P 500’s yield is only 1.2% right now … so options selling can easily give you 13 times the income you’d get from the broad stock market.

What about the risk?

Sure, there’s more risk than simply holding a CD.

But is there more risk than holding stocks?

No. Broadly speaking, there’s actually LESS risk.

Here’s why:

If you only sell put options on investments you’d like to own … at prices you’d be happy to pay … then the “worst” thing that happens is you end up owning them at those prices.

Think of it as getting paid to make below-market offers on investments you like.

What’s more, since you collect money for making those offers, your possible entry cost is lowered even further if you end up owning the investment.

Obviously,you could still end up owning the investment with a paper loss. You could even end up taking an actual loss at some point.

But that’s no more risk than you would have just owning the same investments anyway. And since you got in at a lower price, this is why I say you actually have less risk than you would without using the strategy at all.

If you’re interested in doing this, then I recommend you watch this special video that Martin Weiss and I did before it goes offline at Midnight Eastern tonight.

In it, we talk about how I’ve personally used this strategy … how I taught my dad to do it … and how a small group of readers have been using it to collect $1,000 or more most weeks out of the year.

That last part is important.

Because, in addition to providing far more income potential than CDs or bonds, this strategy also has another critical difference …

You can get the income IMMEDIATELY AND ON DEMAND.

With a CD or a bond, you only get paid on a fixed schedule. Oftentimes, after a year or more of holding on and waiting.

Sound like something you’d like to try?

Well, I’m actually going to send out a specific recommendation tomorrow and I expect it to produce at least $1,000 in immediate income based on my specific instructions.

However, the only way to get that alert is by watching my video before it goes offline for good tonight at Midnight Eastern.

All you have to do is click here right now.

Best wishes,

Nilus Mattive