|

| By Gavin Magor |

Few things are more horrifying than being in a major hurricane. I can say that firsthand, as I’ve been in a few. And I am a Florida resident.

Our hearts go out to anyone impacted by Hurricane Helene. It heavily impacted Florida, Georgia, Tennessee, North Carolina and South Carolina.

I know we have many Weiss Ratings readers in those states. We are thinking of you and are with you in our hearts and minds.

Hurricane Helene will surely go down in the history books as one of the worst hurricanes in modern times … and one of the most expensive.

What made this storm unique was its high winds in Florida’s Big Bend and its intense rain that hit already-storm-drenched areas throughout the South.

The storm also produced a record storm surge along the coast here in Florida of 16 feet in some areas. As of this writing, there are 161 fatalities that are attributed to the storm.

In addition to the truly awful loss of life, there is the very critical financial side of hurricanes that I am particularly well aware of as Director of Research & Ratings here at Weiss Ratings.

With Helene-related damages now in the $34 billion range, by some estimates, this is a good time to talk about what happens next.

In other words, people are going to need money … and can their insurers afford to pay it?

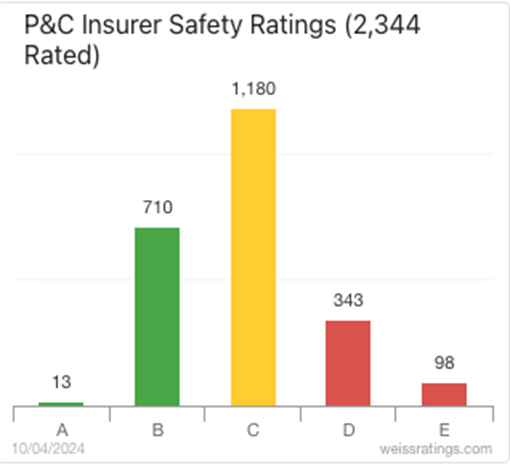

Here’s a look at our ratings of property and casualty insurers:

Currently, we rate 2,407 property and casualty insurers (including our “F” ratings). You can find all our ratings on our ratings screener page.

Florida currently has a major homeowners insurance policy issue. It has become a very costly state with expensive storms.

That is a big reason why we recently released a report on large insurers not paying out claims. We are 100% unbiased and here for you, the consumer. I urge you to check it out here.

Unfortunately, hurricanes provide a very real connection between Mother Nature and financial impacts.

At the moment, it looks like Hurricane Helene could have been much costlier for insurers because most flood claims are not covered and will be denied.

Certainly, insurers will be paying out claims where there was wind damage, and I’m sure there was plenty. But the true devastation appears to be in areas like Ashville, N.C., where vicious flooding from nearby mountains destroyed most of the city.

Most homeowners’ policies do not cover flooding. So, unfortunately, many people in the worst hit areas will have to rebuild on their own.

And a major rebuild it will be. Here is an image in Ashville, NC from the Rolling Stone:

I have some friends in Ashville. They were heavily impacted by Hurricane Helene.

The bubbly and up-and-coming city of Ashville will have a long rebuild. And that goes for many other areas throughout the Southeast.

That leads me to my last two major points. I urge you to make …

2 Financial Moves for Sanity

Step 1: Check Your Insurer

The first move I recommend you make right away, which I already mentioned above, is to check your homeowners insurance rating.

Even if you’re not in a hurricane-prone area, it’s very important to do so. Sadly, no area of the United States is exempt from extreme weather events.

Our insurance page clearly provides you with key financial metrics like risk adjusted capital ratios, loss ratio, total assets, capital, net premiums and net income among other important metrics.

I urge you to check your insurer by clicking here now.

Step 2: Attend The Great Income Solution Summit

Next week, Weiss Ratings founder Dr. Martin Weiss will be sitting down with income expert Nilus Mattive to detail a breakthrough “instant income” strategy.

This strategy boasts a 100% win-rate since May of 2022 … and you could be collected instant income of $1,000 or more, nearly weekly.

I’ve seen the power and success of this strategy. And I truly hope you don’t miss this opportunity to learn more. Be sure to click here now to reserve your seat.

While storms may continue to test our character and resilience, our great can-do spirit and resilient mindsets will make the best of any challenge.

Sincerest Regards and Cheers,

Gavin Magor