|

| By Nilus Mattive |

“There are no bad assets, only bad prices.”

The saying comes from Howard Marks.

As the co-founder of Oaktree Capital Management, a company that specializes in distressed securities, Marks has literally made billions using that concept as his North Star.

Now, the world might be slightly more nuanced than the quote lets on.

There are some assets that aren’t worth a darn thing and end up going to zero.

But the point is both powerful and universal.

For example, let’s say you’re looking at a house.

It’s in a great location with room for expansion. But there’s termite damage, overgrown bushes and a woefully outdated kitchen.

If the seller is asking the same price as much better homes on the block, it’s a pass.

But if they eventually knock off more than enough money to make all those corrections, it becomes a solid deal.

As your realtor might say, “price fixes everything.”

This is common sense, right?

Well, certainly not right now … especially in the riskier parts of the financial markets.

Take today’s stock market.

You can have a stable business with modest sales growth, decent profits and maybe a few shorter-term operational problems trading at a big discount after a substantial selloff.

Yet very few people want to touch it.

Meanwhile, almost EVERYONE has been chasing the polar opposite — a really sexy business … that has many things going its way … but is continually trading at a large premium to what people have historically paid for such a business.

To make matters worse, these businesses have taken over the major market indexes.

That means millions of investors are getting “deworsification” rather than diversification.

So, No I Don’t Hate Stocks. I Hate the Prices!

I was raised on stocks.

I bought my first one when I was still in elementary school.

I spent all my time on Wall Street covering them.

And when I started writing a newsletter for Dr. Martin Weiss way back in 2007, it was completely devoted to them.

I still spend a lot of time analyzing stocks and thinking about new ones to buy.

However, like any other asset, you do NOT want to overpay for them.

And that’s exactly the big danger today — with broad stock indexes trading at some of their richest valuations in history and some individual names priced for completely unrealistic growth expectations.

But here’s something else to note …

Even as stocks continue to grab the headlines, they haven’t even been the best-performing asset class so far this year …

As you can see, gold — often derided as an antiquated “do nothing” asset — has absolutely trounced the most talked about class of stocks in 2025.

That’s not to say a 20.6% gain for the Nasdaq is anything to sneeze at. It’s much better than the long-term historical average.

But how much more juice can be squeezed out of the market as we move into 2026?

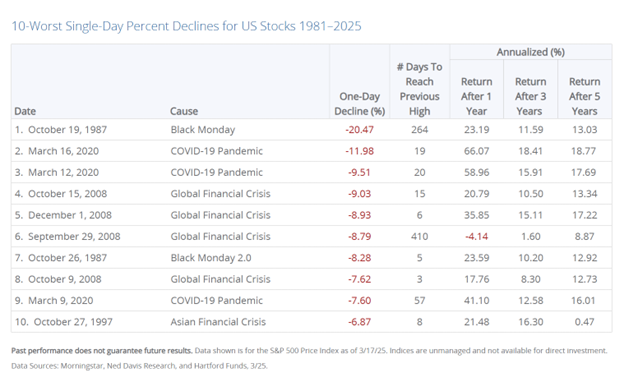

Not a whole lot, in my opinion … certainly not enough to compensate you for the very high probability of a major crash happening at any point.

Yes, I have been saying that for a very long time already. That doesn’t mean I’m wrong.

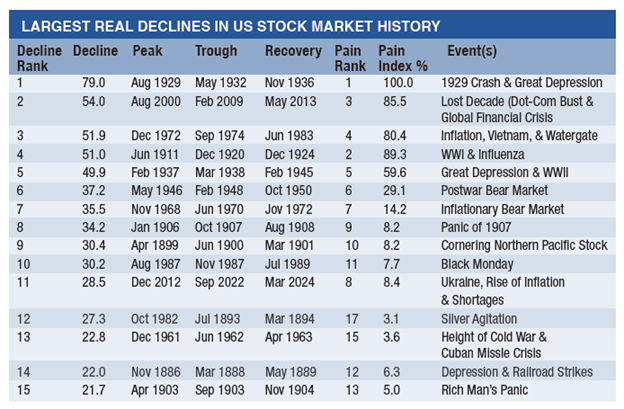

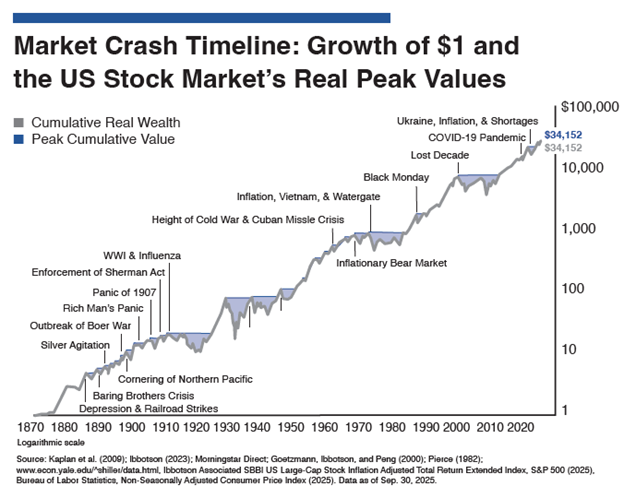

The market’s long-term history is littered with drops of 20%, 30%, 40% or more.

The 1920s crash saw the market lose a full 79% of its value!

My primary job is keeping you (and your money) safe.

Given the data, I think reduced exposure to U.S. equities continues to make sense.

It’s quite easy to be wrong for several years and still end up being right eventually.

Because the truth is, very few investors are taking profits as they accumulate.

Instead, they’re letting everything ride … continuing to accumulate … or even using leverage to load up beyond their actual financial ability.

This doesn’t mean I’m avoiding stocks entirely.

I’ve given my Safe Money readers plenty of new buys over the past year — everything from gold and silver plays to dividend-paying companies that will do well in any type of market environment.

I also told them to buy a special dividend-focused INTERNATIONAL stock fund back in March.

And it has been outpacing the Dow ever since we added it.

So, yes, stocks remain great assets … but only the ones you buy at good prices.

Best wishes,

Nilus Mattive

P.S. If there’s one takeaway, it’s that you need all the tools at your disposal to avoid the wrong stocks. I recommend you take this warning … and avoid the worst of the equities in the market.