|

| By Nilus Mattive |

In the early days, humans formed nomadic tribes of hunters and gatherers.

But the minute they started cultivating crops and domesticating animals, land — specifically dirt rich in nutrients … under abundant sunshine … and located near a steady source of water — became the most valuable thing on planet earth.

That remains true to this very day.

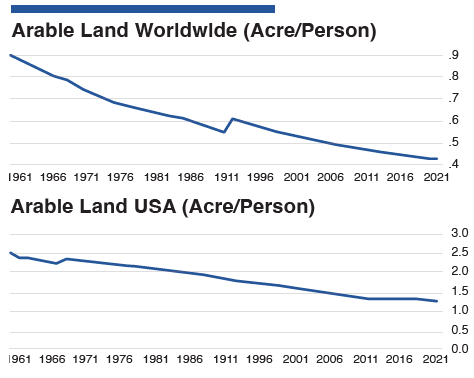

If anything, arable farmland is only becoming scarcer. That’s because the global population keeps growing.

This creates more demand for food … while we increasingly occupy more of the very land needed to produce that food!

This is precisely why farmland is largely considered the most stable asset in the world.

It isn’t correlated to the whims of the stock market …

It couldn’t care less what bond yields are doing …

And it doesn’t react to movements in gold, silver or crypto, either.

Year in and year out, farmland’s rarity steadily increases.

And like feudal lords of the past, today’s uber wealthy are constantly accumulating more of it …

Then reaping the rewards as other people work the land on their behalf.

Warren Buffett wasn’t even out of high school when he bought his first farm in Nebraska. Today, he reportedly owns thousands of acres spread across Illinois, Arizona and South Africa.

His buddy Bill Gates is an even bigger investor in farmland — with more than 270,000 tillable acres to his name.

Gates is actually the largest private farmland owner in the United States.

Famed investor Ray Dalio has more than half a million acres in Australia alone …

Amazon founder Jeff Bezos has more than 400,000 acres mostly in Texas …

And Ted Turner holds more than 2 million acres of personal land. That includes hundreds of thousands of acres of cropland and ranch land.

Even Michael Burry, the guy who made a fortune during the financial crisis and inspired the movie “The Big Short,” has since become quite bullish on farms.

It’s not clear how much he owns, but as Burry told Bloomberg in the wake of the collapse:

“I believe that agricultural land — productive agricultural land with water on site — will be very valuable in the future. I’ve put a good amount of money into that.”

Clearly, the ultra-rich understand that if you own the world’s arable land, you own the world itself.

They also understand that in so doing, they will earn steady returns year in and year out.

To put numbers on it:

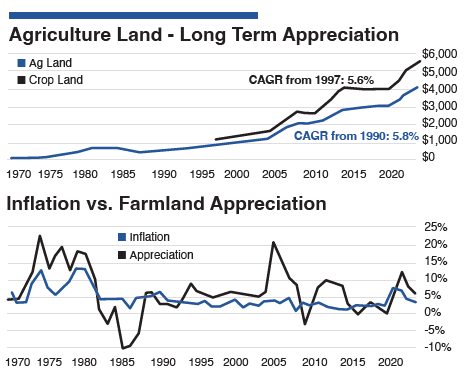

- Over the last 55 years, agricultural land has appreciated at a compound annual growth rate of 5.8%.

- With a compound annual growth rate of 5.6% since 1997, the subset of that category dedicated to growing crops — “cropland” — has largely performed the same way.

- What’s more, based on data from the National Council of Real Estate Investment Fiduciaries (NCREIF) that goes back 33 years, annual cropland has never experienced a losing year!

It’s easy to see why farmland can grow in value through thick and thin. It’s also far less volatile than anything else during economic contractions or outright recessions.

But it’s equally important to point out that farmland also has built-in inflation protection.

Farmland isn’t very correlated to financial markets or broad economic conditions. But it is more correlated to inflation than even the wider category of real estate.

After all, …

Food is the last thing people stop spending money on.

Maybe they’ll switch from steak to chicken or from name-brand corn flakes to generic. But they continue consuming the same number of calories.

Sure, they might complain about higher prices. But they keep paying more because there’s no alternative.

That makes right now a terrific time to get exposure to this time-tested asset class.

On Tuesday, May 20, at 2 p.m. Eastern, you can learn exactly how to do that. It costs nothing to hear our presentation on this and other urgent wealth-protective measures we’ll detail.

I hope to see you there. All you have to do is click this link to save your spot. We’ll send you a reminder so you don’t miss a single detail of how to enter your next season of wealth.

I hope to see you then!

Best wishes,

Nilus Mattive