In this segment, Financial News Anchor Jessica Borg interviews Senior Analyst Tony Sagami, editor of Disruptors & Dominators and Weiss Ultimate Portfolio.

The two discuss current geopolitical instability and the subsequent market volatility. Plus, Tony talks about how to find profitable investments in a time of inflation, war and widespread uncertainty.

You can watch the video segment or continue reading for the full transcript.

Jessica Borg (narration): In the days leading up to Russia invading Ukraine, stocks were reacting.

Tony Sagami: The stock market hates uncertainty. So, all that uncertainty — "will they or won't they" — was removed when they actually went in.

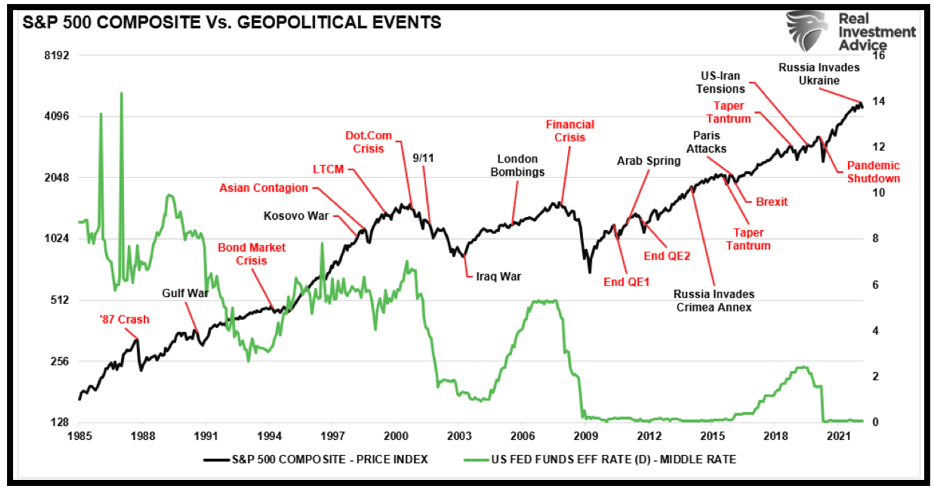

JB (narration): Times are concerning, but Senior Analyst Tony Sagami points to this chart, tracking how the markets generally fare long term, during geopolitical strife.

Tony Sagami: I'm not going to underestimate or downplay the human tragedy, but it does show how geopolitical events don't have that much of an influence on the stock market.

JB (narration): He says to look at the recently released gross domestic product numbers (GDP).

TS: GDPnumbers came in at 7% growth for the fourth quarter. Seven percent is a monster GDP number.

JB (narration): The GDP is considered a scorecard for a country's economic health.

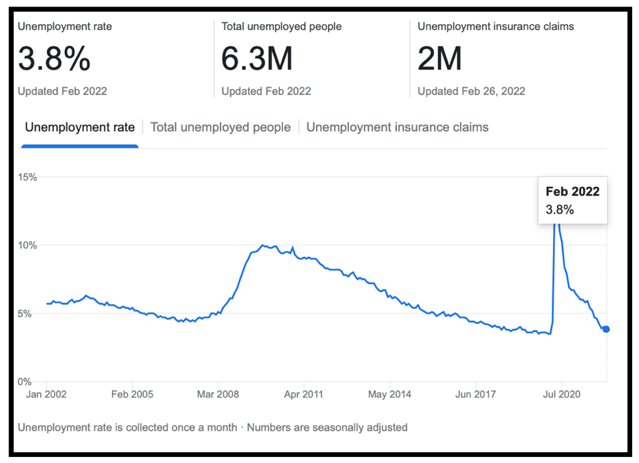

TS: The thing to remember is that the U.S. is nowhere near going into a recession.

Unemployment is at lows and incomes are going up. Things are good, and the stock market, at its roots, is a reflection of the economy, and the economy is doing very well.

JB (narration): And that's despite rising inflation.

Guess how much this Bloody Mary cost. It's a photo that Tony's friend sent him from an airport.

TS: It really looks delicious, but if you look in the right-hand corner, you'll see the price.

JB (narration): $34.

TS: It was 34 bucks for one single Bloody Mary! That's ridiculous, but that's how much prices are going up.

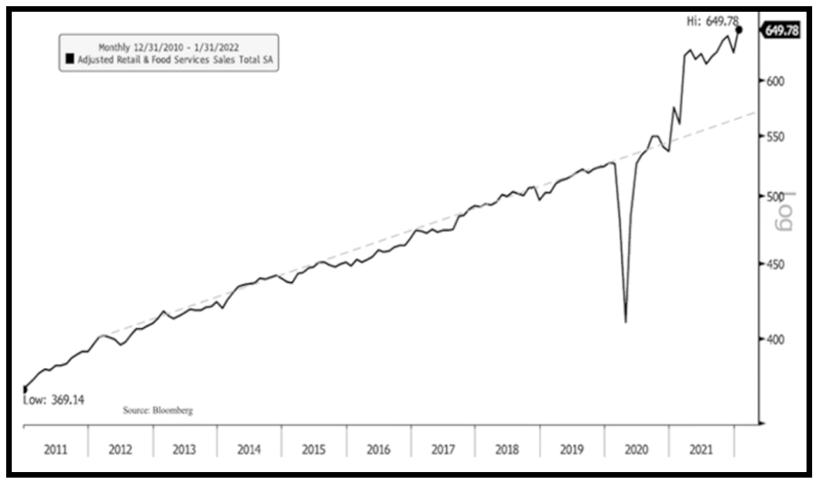

JB: In general, higher prices are not holding consumers back.

TS: Remember, we are a consumer-based economy, and 70% of GDP is consumer spending.

Are Americans still spending money?

Take a look at this chart at retails sales, month by month.

Are we still spending money? Darn right we are. Look, we're at an all-time high.

And those strong sales translate into higher profits and bigger revenues for a very small select group of companies.

JB (narration): Companies that Tony holds in the portfolios of Disruptors and Dominators and Weiss Ultimate Portfolio.

TS: One of the big winners is Amazon.com (AMZN). They're reporting gigantic sales revenues.

If something goes up, people are still buying it, and Amazon gets a little more money each time they sell something.

The same is true at Walmart (WMT).

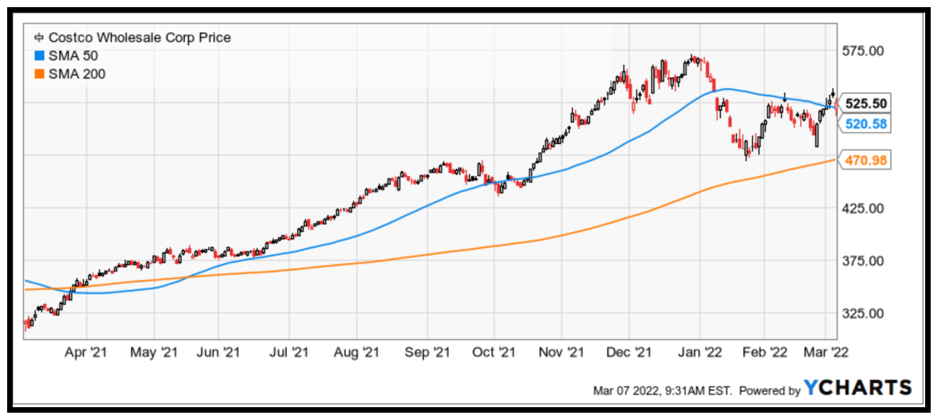

Also, at Costco Wholesale (COST).

Let's just say your profit margin stays the same — you're making 10%. Well, 10% on $200 is better than 10% on $100.

One of the biggest hidden winners, I think, is Mastercard (MA) and Visa (V), because every time you charge, they get a little piece of the action, like a "vig" (vigorish), kind of like a bookie, and their vig went up along with those higher prices.

JB (narration): Higher car prices are also hard to ignore.

TS: Take a look at new car prices. They're up by 12% on a year-over-year (YOY) basis. That's quite a bit, and it's even more shocking for used cars.

JB: You've written about how auto parts companies remain a great investment.

TS: The auto parts business is very steady, very recession resistant and doing especially well now with these higher car prices, because that combination of new car shortages and skyrocketing prices for used cars, as well as the age of the U.S. cars on the road, is a bonanza for people who are making auto parts.

JB (narration): And there are clear winners.

TS: There are four publicly traded auto parts producers.

O'Reilly Automotive (ORLY) is my favorite because it's the one that is showing the strongest growth.

It has the best Weiss safety rating and the best Weiss performance rating.

JB (narration): There are stocks across sectors benefiting from higher prices.

Right now, Tony sees a bull market intact.

TS: That doesn't mean there aren't going to be painful corrections, as we've seen.

Those are normal corrections, and this is not the time to run for the hills. Don't run … buy!

JB (narration): Knowing what to buy is his bread and butter.

JB: Senior Analyst Tony Sagami, always a pleasure to speak with you. Thank you so much for making time for me today.

TS: Let's do it again!

JB: Absolutely.

Best wishes,

The Weiss Ratings Team