|

| By Nilus Mattive |

I’m standing in the dairy section of my local Trader Joe’s. It’s five o’clock on a Monday and the egg shelves are completely empty.

But wait, here comes one of the associates in her Hawaiian shirt. And she’s wheeling a trolly stacked with sweet, precious, Grade A huevos.

Amazing!

Because I’m now on a protein-heavy “Brad Pitt in Fight Club” type diet — he reportedly ate seven eggs for breakfast — my shopping list calls for three dozen.

I reach to grab an armful as the crew member gingerly places them down. Then, I notice a new handwritten sign that limits customers to one single dozen.

My starving muscles let out a collective sigh.

If toilet paper was the grocery store staple most associated with the COVID pandemic, eggs have been the poster child for our nation’s inflation.

To me, they are that and even more. They show us just how fragile the markets really are right now.

Which Comes First: The Chicken or the Egg?

I had a triple major in philosophy, theology and English, so I’m prone to asking these types of metaphysical questions.

In fact, I think that background is why I view the markets from a slightly different vantage point than the typical economics or finance major.

There are absolutely always numbers at work. But there are also human emotions, moods and maybe even existential forces in play at all times.

Take the subject of inflation.

On the numbers side …

The massive uptick we’ve seen in the wake of COVID was clearly driven by massive money printing and, to a lesser extent, supply chain disruptions and other fundamental factors.

Yet it is also driven by psychology.

If we expect prices to go higher, we have more reason to buy things now.

If we buy things now, the demand sends prices higher.

Isn’t life weird?

It’s the same with stocks and other investments.

Most of the buying is based on future expectations.

Good price action begets more buying.

And we get to a place like right now … where people are happily paying very large premiums for what they expect will be even larger future returns.

The interesting part is selling rarely seems to work the same way.

The good times roll … the markets are continually climbing that proverbial wall of worry … until, bang, one or more of the worries actually metastasizes from a benign lump into stage four cancer.

Which brings me …

Back to the Eggs

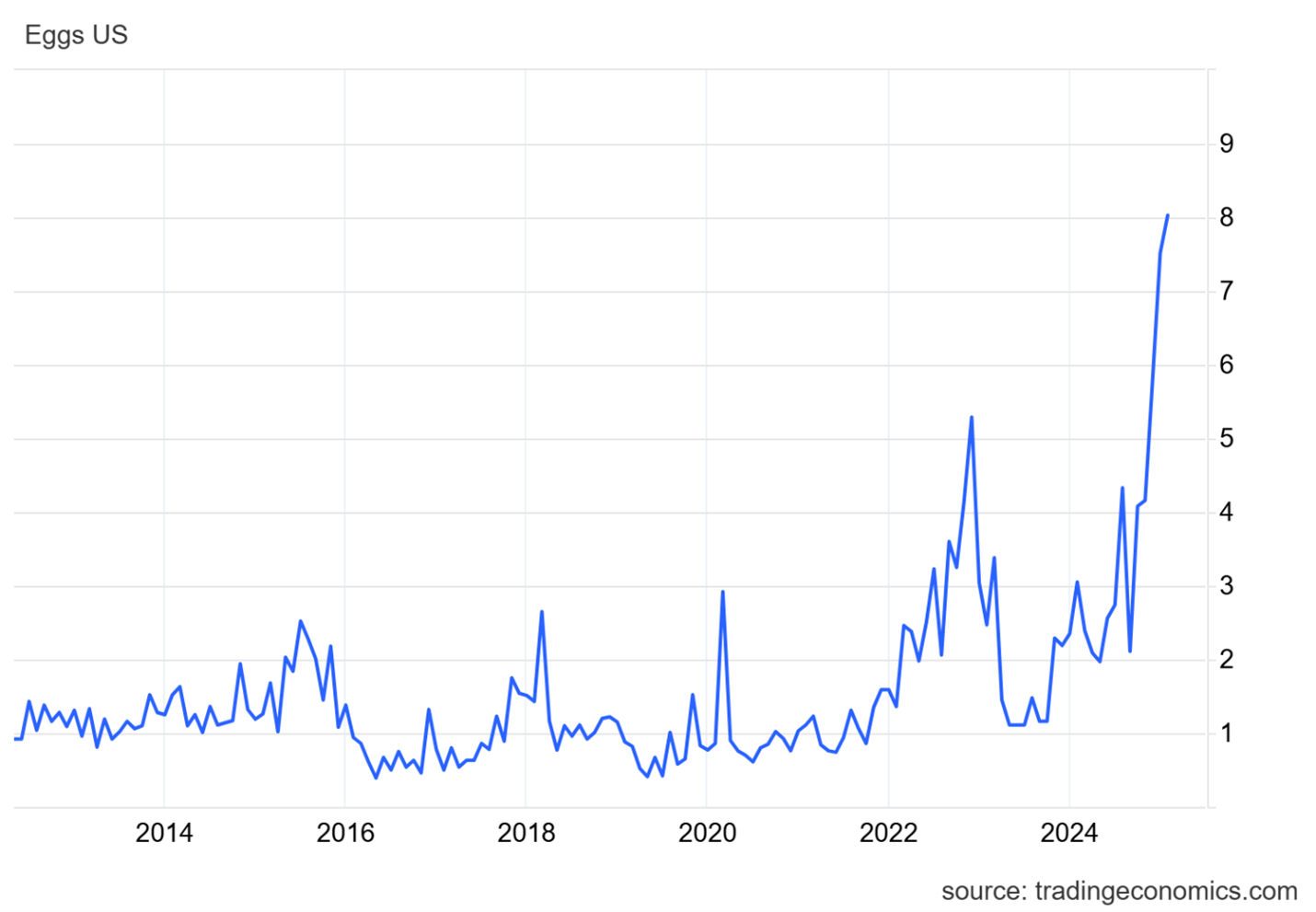

According to the latest Consumer Price Index data, a dozen Grade A eggs recently hit a new all-time national high of $4.95 in January.

That is largely because of a burgeoning avian flu crisis — one of the four biggest risks for 2025 I warned Safe Money Report readers about in my recent annual forecast issue.

Indeed, I think this situation is still not getting enough attention even as it starts to spread into the nation’s dairy cattle and select humans as well.

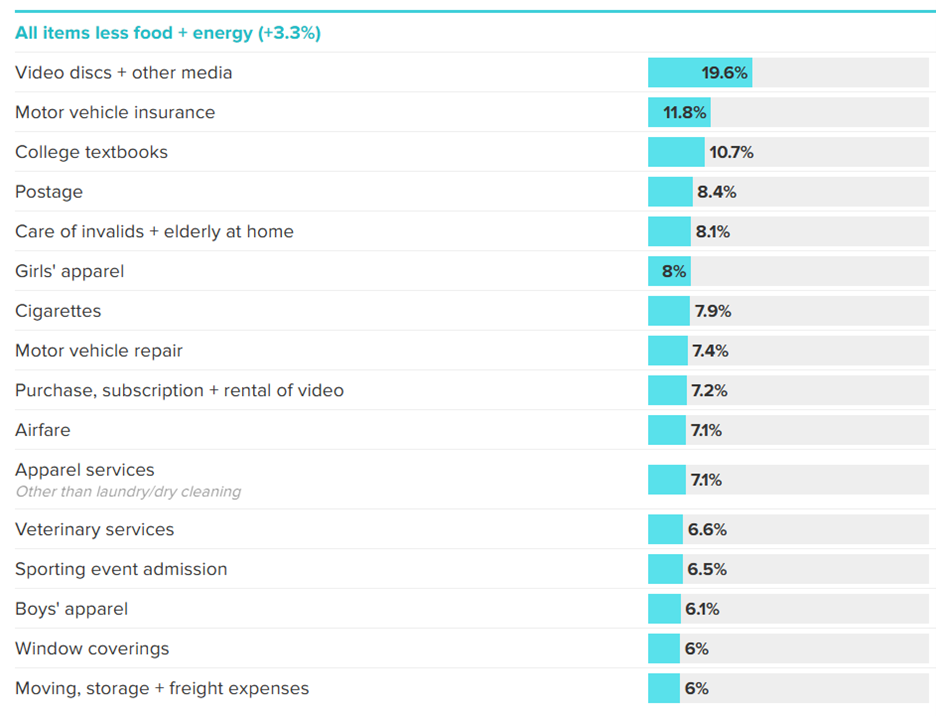

Resurging inflation was another of those risks.

And lo and behold, the January CPI wasn’t just about eggs (up a staggering 53% year over year).

We saw big increases in many other items beyond food and energy — everything from car insurance (+11.8%) to postage (+8.4%) and cigarettes (+7.9%).

With some new tariffs already in place … and many more threatened … there is little reason to expect this trend to reverse in the short term.

Yet in the wake of the data — which serially underreports inflation as regular Americans experience it — everyone from President Trump to Elizabeth Warren called for more monetarily stimulus in the way of rate cuts.

I understand why.

At a time when the latest numbers also show that consumers are increasingly taking on new debt … struggling to service that debt … while simultaneously starting to spend less … a little financial lubrication would be good for the economic wheels.

Indeed, easy money has been making the world go round for at least a quarter century now.

However, it has also created several massive financial bubbles over that same period.

And there are good reasons to believe we are in the biggest one yet.

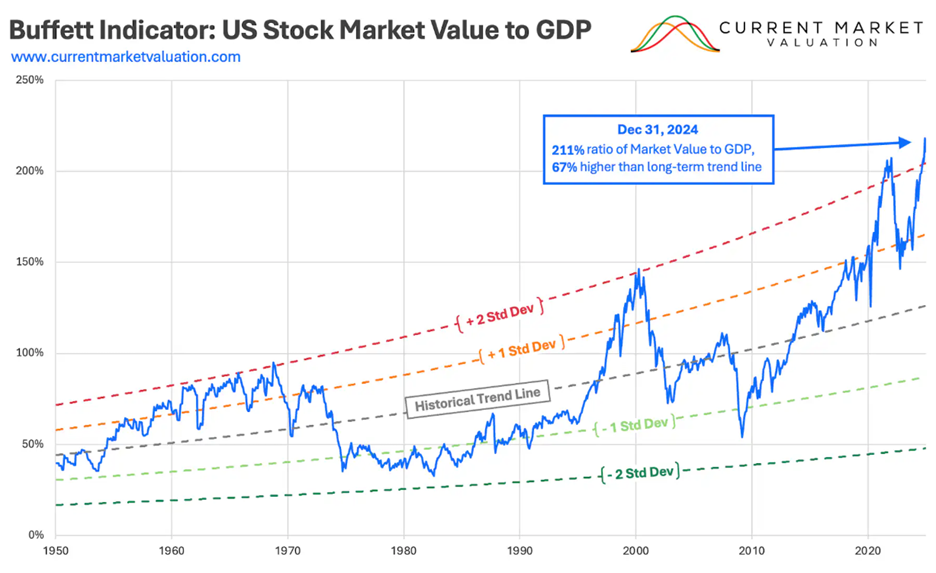

Simply look at this chart of the so-called Buffett Indicator. It divides the Wilshire 5,000 index by U.S. GDP to give us a sense of how much of a premium investors are willing to pay for the broad economy …

I have written about this plenty of times before.

But as you can see, the ratio is now at its highest level ever.

I repeat, EVER.

It is now substantially higher than the last highest peak reached during the turn-of-the-century Dot-Com Bubble.

From my perspective, it’s no coincidence that high watermark was first breached in the wake of the COVID pandemic when easy money really started flowing and a whole new crop of investors flooded the markets.

Again, it’s all about the place where numbers and feelings intersect.

Maybe it doesn’t matter which came first.

An old market adage tells us that bulls and bears both make money while pigs get slaughtered.

It says nothing about the chickens but I recommend keeping your eggs in as many different baskets as possible right now.

Best wishes,

Nilus Mattive

P.S. One basket for your eggs should be New Crypto Wonders. During the last superboom, the average one rose hundreds of times higher than Bitcoin.

So, to diversify AND take advantage of the superboom that just started, I urge you to check this out.