|

| By Nilus Mattive |

Back in early February, I made a surprising new recommendation to Safe Money Report readers — Bitcoin (BTC).

I say “surprising” because most people think of Bitcoin as a very risky asset.

But as I explained at the time, the truly risky strategy is keeping all of your money in stocks and bonds.

After all, we’re living in a world of unprecedented money printing and monetary policy manipulation ...

We have the stock market trading at historically high valuations ...

Along with the largest government debts the world has ever seen.

Given all that, it makes more sense to get maximum diversification across the widest range of assets possible.

That includes some that have typically been off limits to regular investors, but are now more accessible through unique online investment platforms — fine art, for example.

And it also includes newly-emerging assets like Bitcoin, which were expressly created to address some of the big problems I mentioned a moment ago — including structural problems in the traditional financial system.

Want proof?

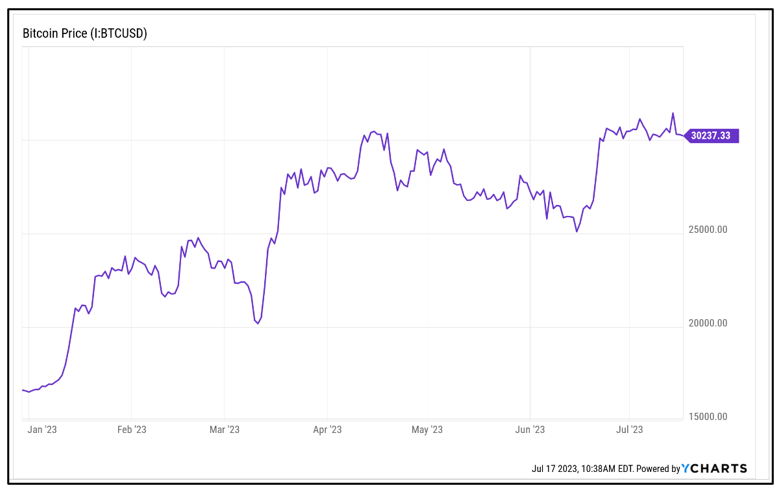

Well, here we are only six months later, and I just told my Safe Money Report Members to take half profits on their existing Bitcoin position after it ran up more than 40% from our tracked entry price ...

Click here to see full-sized image.

As you can see from my chart, the banking crisis back in March was one of the main reasons Bitcoin really started taking off — it went from roughly $20,000 to $30,000 in less than five weeks.

In other words, it did exactly the job it was designed for and exactly the job I recommended it for.

And it has since continued to see substantial follow-through for two very important reasons:

1. Americans realize that Bitcoin is one of the only true ways to get some money out of the traditional financial system.

That is becoming ever more important to people given the aforementioned risks to banks and other institutions, as well as the rollout of the FedNow program this month.

2. In a rather ironic twist, Wall Street itself is looking to find new ways to profit off the back of Bitcoin, as more and more Americans flock to it.

This is precisely why we saw BlackRock (BLK), the world’s largest asset manager, file an application to launch a spot Bitcoin exchange-traded fund a few weeks ago, with other companies quickly following suit.

There have been plenty of attempts in the past already, too. And the SEC has continually rejected those applications.

But you now have BlackRock’s CEO Larry Fink saying Bitcoin is an “international asset” and that crypto is “digitizing gold.” In the past, Fink wrote off Bitcoin as an “index of money laundering.”

That alone is …

A Huge Moment for Bitcoin’s Legitimacy

Plus, the latest rumors suggest that BlackRock, Fidelity and other big Wall Street firms looking to launch Bitcoin ETFs will be meeting with the SEC very shortly, after refiling their applications to address its prior objections.

Any subsequent approval would likely spark an even bigger rally, while new rejections could have the opposite effect.

Because safety is our number one priority... and taking big, fast profits is simply good risk management ... I told my subscribers to take half gains now.

But if we see a dip at any point, I’ll be telling them to load up again.

Meanwhile, I want you to know that all those big risks still remain in place.

Sure, after an aggressive series of 10 successive interest rate hikes, the Federal Reserve decided to take a breather during its June meeting.

But that doesn’t mean inflation is dead nor does it imply the Fed’s work is done.

Last week’s Consumer Price Index came out, and headline CPI rose 3% year over year, slightly under the estimates on Wall Street.

Core CPI, which leaves out food and energy, rose 4.8% year over year, also better than estimates.

A lot of people are celebrating.

However, headline CPI is still 50% above the Fed’s 2% target. Core is still 2.4 times higher than they’d like.

This is why the markets are currently pricing in about a 90% chance that we’ll see another quarter-point increase later this month.

Fed Chairman Jerome Powell himself has reiterated the likelihood of two more quarter-point hikes several times. He’s even suggested those hikes could come back-to-back.

And after several strong economic numbers — including very robust new home sales and an upwardly revised Q1 GDP figure — other Fed members have come out saying similar things.

So, the proverbial tightrope walk continues.

Is it possible that monetary policymakers will maintain perfect balance all the way through?

Sure. But it would be foolish to assume that outcome, especially when they were so woefully clueless when inflation originally started accelerating.

Never forget: Just a few months ago, the financial system was on the verge of another meltdown after the Fed’s 10th rate hike. Nobody knows exactly which straw breaks the camel’s back.

Yet financial markets continue to move higher, completely oblivious to the risk that everything could come crashing down.

Fear among stock investors — as measured by the CBOE’s Volatility Index — is currently sitting near multiyear lows and substantially below its long-term average.

Yet we’ve seen plenty of autumn bloodbaths in the past.

This is precisely why I’d love to have you join me in person at the Weiss Investment Summit in Boca Raton Sept. 10-12.

I’ll be there to address everything happening in the markets live on stage, alongside many of our other analysts and editors ...

I plan on discussing my favorite strategies and investments with everyone in the room ...

And given the intimate nature of the setting, I might even be able to recommend an idea or two that I simply can’t share with larger audiences.

Best wishes,

Nilus