|

| By Nilus Mattive |

Which asset class has typically been among the best ways to combat periods of high inflation?

Which one has been a favorite for the wealthy to protect and grow their wealth for centuries?

And what asset outperformed all traditional choices not just last year but from 1995 to 2021?

Fine art.

Perhaps the biggest irony is that, although fine art exists outside the traditional financial system, it has always been a favored asset for the very people running the traditional financial system!

The reasons are myriad:

- Great works of art are visually and intellectually stimulating.

- They’re easily recognized status symbols.

- They’re inherently unique and non-fungible.

- They’re relatively portable.

- And they’re not easily tracked, taxed or even recognized by financial authorities.

In fact, a masterpiece can be handed down from generation to generation, while its value can potentially compound at astronomical rates.

This megatrend dates back to Florence’s Medici family during the Italian Renaissance. The Medici’s essentially created the modern global banking system and then funneled a good portion of their growing wealth into the art world.

Just consider “The Birth of Venus,” one of the most famous paintings commissioned by the Medici family roughly 550 years ago. The artwork, by Alessandro “Sandro” Botticelli, was possibly created as a wedding gift.

Today, it’s valued at roughly $500 million! And this isn’t just an outlier.

Last year, for example:

- Bitcoin crashed 65%.

- The Nasdaq fell 33%.

- The Dow Jones U.S. Select Real Estate Investment Trust Index dropped 25.9%.

- The S&P 500 stock index lost 18.1%.

- And the Bloomberg Aggregate U.S. Bond Market Index fell 13%.

In contrast, a study published in the Knight Frank’s Wealth Report shows that blue-chip artworks rose 29% on average, also last year — trouncing U.S. inflation and beating all other asset classes in the process.

Other studies show that art has outperformed other asset classes over much longer periods of time, too.

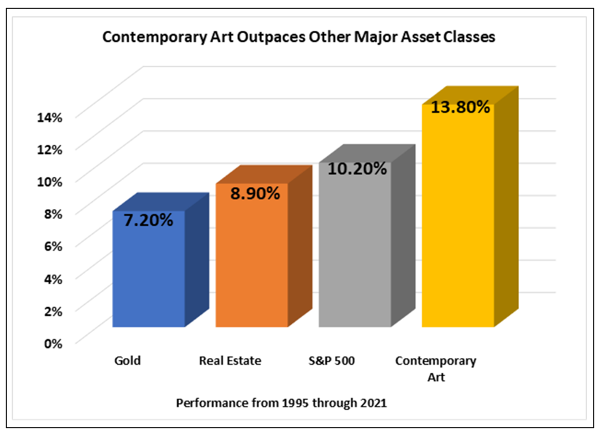

Contemporary works have proven especially lucrative, rising an average of 13.8% annually from 1995 through 2021 … almost twice as fast as gold and substantially better than real estate or the broad stock market.

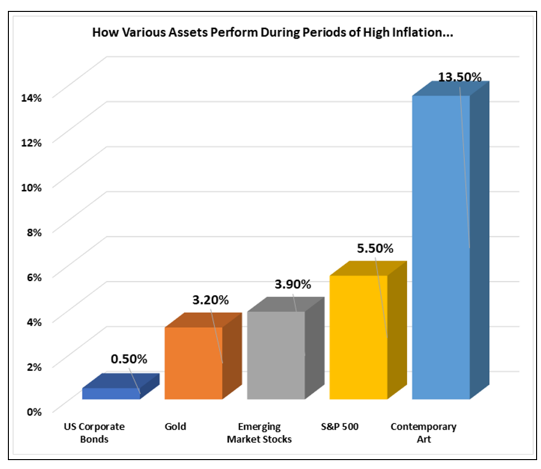

When inflation is running above average, like it is now, the outperformance is even better:

Is it any wonder that wealthy families have invested so much of their fortune in art?

Or that today’s hedge fund titans, venture capitalists and banking elites — including Marc Andreessen (Andreessen Horowitz), Larry Fink (BlackRock), Jeffrey Gundlach (DoubleLine Capital) and Dan Loeb (Third Point) — are doing the same?

Indeed, many of the names on Artnet’s annual list of the top 200 art collectors come from the world of finance.

Just to be clear: This doesn’t mean art is foolproof or always goes up. The art market can also occasionally be subject to a temporary bust.

However, the very best blue-chip artworks have continued on to new, all-time highs with every subsequent bull market.

More importantly, art can zig even when many other assets are zagging. As I mentioned, it rose last year when almost everything else lost money.

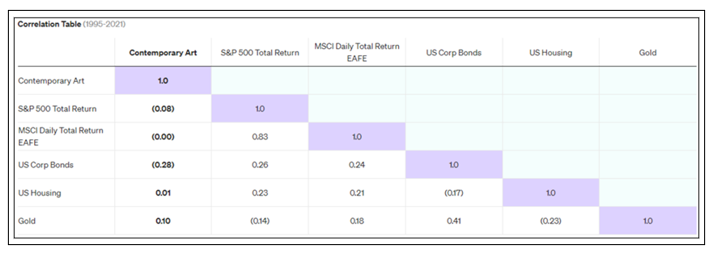

Contemporary art did the same thing during the 2008 recession, rising 6.3% while the S&P 500 fell 37%.

In fact, as the following table demonstrates, art is actually negatively correlated to both U.S. stocks and U.S. corporate bonds. It’s very common for it to rise when nearly all else is falling:

When you put all this together, it’s easy to see why adding some exposure to art is a smart idea for anyone interested in:

- Privacy.

- Safety.

- And outsized profit potential.

The Obstacles of Investing

in Fine Art and How to Overcome Them

The single biggest obstacle to investing in fine art has always been affordability.

Reason: The best art to buy is not a cheap, unknown piece hanging at your local gallery.

Truth be told, most cheap art does not appreciate in value, no matter how much you might like a certain piece or the person who created it.

And the odds of randomly stumbling upon the next Andy Warhol are slim to none. Even well-informed buyers with solid art world connections strike out plenty of times.

It’s a lot easier to make $1 million on a painting that already costs $1 million — the blue-chip artworks with well-established markets and plenty of collector cachet.

And it’s that high cost per piece that creates a high barrier to entry.

It also creates an obstacle to diversification. Even if you have hundreds of thousands of dollars, it would be hard to spread the money around adequately. Only an investor with an oversized appetite for risk — or someone solely buying because of passion — would bet a fortune on one single painting and hope for the best.

A sound investing strategy includes putting money into five, 10 or even 20 different high-quality art pieces, other collectibles and other tangible assets. This is the main reason why the high-end art world has remained the exclusive domain of the wealthy up until very recently.

Luckily, the JOBS Act changed things.

The Jumpstart Our Business Startups Act (JOBS) tore down the wall that had prevented non-accredited investors from putting their money into pre-IPO companies … the types of investments that have increased by as much as thousands of percentage points before they ever hit Wall Street exchanges.

Already, there are two platforms that allow you to invest in fine art through fractional ownership: Yieldstreet and Masterworks. Fractional ownership means you buy shares in a piece or a few pieces, much like owning shares gives you a very small percentage of ownership in the underlying company.

I’ll continue to monitor this space. As startups have more time to develop this alternative asset investment space post-JOBS, the number of opportunities is certain to grow.

Best wishes,

Nilus