|

| By Tony Sagami |

Dubai is best known for the Burj Khalifa, the tallest building in the world and Palm Jumeirah, the manmade island shaped like a palm tree that has some of the most expensive real estate on the planet.

Last week, I told you how sky-high oil prices are enriching the United Arab Emirates and what it means for the future of oil prices and oil stocks.

This week, I’m going to tell you how the nation’s tied to the world’s favorite precious metal … gold.

Souk is an Arabic word meaning open-air marketplace. At the gold souk in Dubai, over 400 gold merchants clamor for the attention of gold buyers.

The Dubai gold souk opened in the early 1900s but was a sleepy marketplace of only a handful of gold vendors … until the oil boom of the 1970s.

Suddenly, the Middle East was awash in cash, and the Dubai gold souk transformed into the largest gold marketplace in the world.

Dubai: The City of Gold

On any given day, there are over 10 tons of glittering gold jewelry on display among the 400+ merchants.

There’s even an ATM that pays in gold bars and coins.

What’s offered is scrupulously regulated by the UAE government, ensuring authenticity.

All merchandise sold by jewelers is regulated by the Dubai Municipality, which conducts regular inspections of items sold. Every jewelry store across the city must carry a gold purity hallmark on items they sell … and they’re obliged to provide it to their customers upon request.

The gold purity hallmark is a certificate that specifies details, such as the karats and weight of actual gold and stones in the jewelry, as well as the cost of the labor. It ensures that each purchase is authenticated and can be valued anywhere in the world.

Prices aren’t regulated by the government, which means that haggling is an integral part of the gold-buying experience. If you’re good at haggling, you can find the best gold deals in the world.

And let me tell you … there was a lot of haggling going on the day that I visited. Thanks to $100/barrel oil, the oil-rich Middle East is swimming in money. Arabs, dressed in a traditional white kandūrah and headscarf, were buying small mountains of gold.

Middle Eastern nations have traditionally valued gold, whether in the form of jewelry or bullion, because of the stability it provides against political and economic upheaval.

Two-thirds of the jewelry purchased in the Middle East is stashed away as a storehouse of wealth.

The gold-buying frenzy I witnessed is going to last a long time. According to the World Gold Council, the demand for gold in the UAE reached 12.5 tons in just Q1 of 2022, a 50% year-over-year increase.

According to an Emirates Investment Bank survey of the 100 richest men in the Middle East, gold demand will almost double this year.

The price of gold has been under pressure so far in 2022. However, history has shown gold is about to bounce.

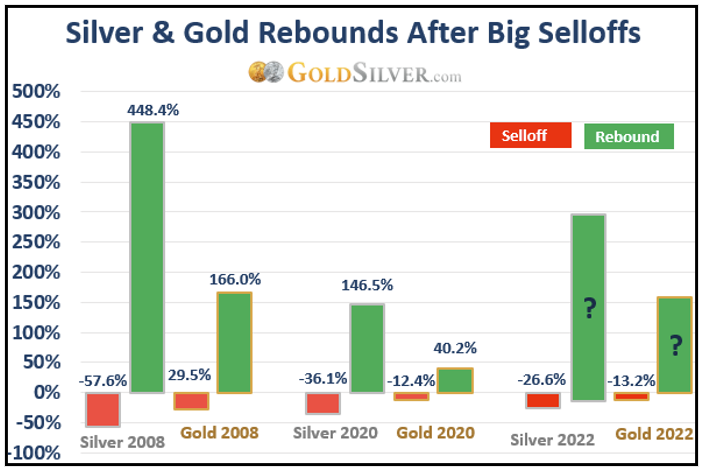

Look at the chart below — the green bars show how big gains come after down periods rebound. I know it doesn't feel like it now, but the bigger the decline … the bigger the rebound.

Gold is poised for a big rebound, and I recommend that you include at least a 10% precious metals weighting in your portfolio, which is what the Weiss Ultimate Portfolio holds.

You can always look into gold miners and gold exchange-traded funds for basket exposure to the industry.

But if you want to know what I’m specifically recommending to Members of the Weiss Ultimate Portfolio, click here now.

Always do your own due diligence, but investors must remember — just like the adage says — make new friends but keep the old; those are silver, these are gold.

Best wishes,

Tony