|

| By Nilus Mattive |

I was recently scrolling through social media when I came upon a post from a financial influencer that said, “Now is one of the best entry points the stock market’s seen in 15 years. If you wished you could go back in time and invest in 2009, now would be that opportunity.”

After a little digging, I discovered that this person has half a million followers on Instagram and 4 million YouTube subscribers. But their real business is selling a line of coffee. They post financial advice stating that the money you save not buying things like Starbucks can make you rich if invested wisely.

This is the state of the stock market in 2023: coffee-selling Instagram stars telling millions of Americans now is the time to buy stocks with both hands.

Here’s the truth: Yes, we just saw the worst annual return for the S&P 500 since 2008. But we are nowhere near a 2009-esque buying opportunity.

I was working with Martin back in 2009, pointing readers to the very best investments and buying for my own family’s accounts as well. I was also sitting in a Lower Manhattan office tower the minute the markets reopened after Sept. 11. This isn’t yet the type of market we had then. Sure, there might be some bargains. That’s always the case.

But don’t believe anyone who tells you the broad stock market is rife with historic opportunities right now. The fact that coffee-selling Instagram personalities are touting this as an opportunity is reason enough for caution.

The raw data is worse. Warren Buffett’s favorite market metric shows stocks are still well above previous high-water valuation marks.

That’s Just the Beginning

Consider forward price-to-earnings ratios on the broad S&P 500. This simple measure takes the index’s value and divides it by expected profits over the coming 12 months.

That number is currently 19.03. Other major indexes, like the Dow Industrials, Nasdaq and Russell 2000, were all trading at higher multiples.

That might be a lot better than we’ve seen recently, but it’s hardly a reason to be bullish at the start of 2023. In fact, over the past 20 years, the S&P 500’ average forward P/E ratio was just 15.5!

And what does it look like at a true bottom? Going back to the middle of the 1990s, we have typically seen the forward P/E fall somewhere between 13–14 before the carnage was really over. During the 2008 collapse, it went even lower!

To boil this down: The broad stock market would have to fall another 23% just to reach the average valuation we’ve seen during other market bottoms since I began my career on Wall Street more than 20 years ago. For this to be “like going back in time and investing in 2009,” the market would have to crash even more.

It’s the same thing when you look at other valuation metrics, too, including the Shiller P/E ratio, which has a perfect track record of predicting bear markets. Created by Yale economist Robert Shiller, this cyclically adjusted price-to-earnings ratio takes the basic market P/E and adjusts it for inflation, as well as the volatility associated with regular business cycles.

Using data dating back to 1870, the CAPE ratio has only exceeded a level of 30 on five different occasions: 1929, 1997–2001, 2018, 2019–2020 and 2022. In every instance, the market dropped at least 20%.

Of course, I’d argue that the last three occurrences — from 2018 through 2022 — are part of one big financial market bubble that was never allowed to fully deflate. That gives us two major periods to look at more closely. In 1929, the market dropped as much as 89%, and in 2001 the S&P 500 fell 49%. Right now, it is only down about 24% since the CAPE peaked at 40 last January.

So again, I think it’s completely reasonable to expect another major leg down before we reach a real broad-based buying opportunity in the stock market. If anything, the current environment still feels more like the dot-com bubble than the ‘08 collapse.

Take a company like Tesla (TSLA), the most widely watched stock on Wall Street and one of the poster children of the post-2020 market boom. TSLA dropped 65% in 2022 but is still trading at 35x its 12-month trailing earnings and is worth more than Ford (F), General Motors (GM) and Toyota (TM) combined.

Looked at another way, Tesla is currently trading at 24x its expected earnings over the next year. Companies like GM and Ford are trading at 5x or 6x their expected earnings. This suggests investors think TSLA will continue growing 4x faster than its rivals, which reeks of irrational optimism to me. This is hardly what we see during real market bottoms.

Bottom line: Both historical measures and my real-world experience are still flashing warning signs for stocks at this point.

Therefore, I’m telling Safe Money Members to continue treading lightly in the stock market for the time being.

Does that mean there aren’t any good buys?

Of course not. As I said a moment ago, there will be always some good buys … in any type of market environment.

And that’s where the Weiss Ratings Model comes into play: because it can help us uncover those rare companies that will continue thriving no matter what happens next.

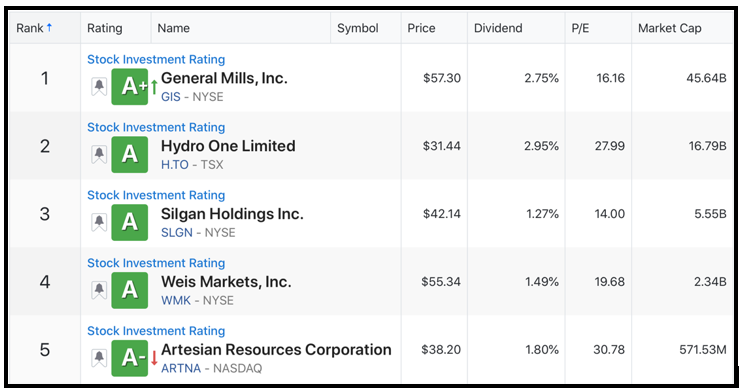

For example, I just ran a quick screen to identify the system’s highest-rated stocks right now, and here’s what it came back with:

Click here to view full-sized image.

According to our system, all of these firms have solid financials and a host of other positive fundamentals.

Plus, the Weiss Ratings Model also considers additional stock-related criteria, too — everything from dividends to current valuation metrics.

Yet, this is still just a starting point for further research and human oversight, which is precisely what I do every time our team pulls a new list like this.

Before any investment becomes a new Safe Money Report recommendation, I look at other factors beyond our model’s scope. And I also consider things like how a new recommendation might complement existing positions in our model portfolios.

The end goal is giving members the very best combination of safety, ongoing income and upside potential.

So, based on both historical measures and my own personal experience … no, the stock market is not a cornucopia of deep values right now.

However, you can still find individual names to buy if your decisions are based on hard data and real-world experience rather than Instagram hype.

Best wishes,

Nilus

P.S. The Safe Money Report goes far beyond the stock market. In fact, I just issued a brand-new recommendation for the start of the year … a special income investment that has nothing to do with equities at all. I consider it one of the safest, best-yielding places to put some money right now.

You can get all the details on that new idea, plus access to a complete list of our other recommendations, immediately. Just click here.